How fish and poultry startup FreshToHome reached EBITDA profitability in Bengaluru and Delhi

Bengaluru-based FreshToHome is EBITDA profitable in two cities. The startup has also raised $121 million in Series C funding. Here is how the team was able to achieve profitability and revenue growth.

When Shan Kadavil started FreshToHome with Mathew Joseph in 2016, he was focused on a single idea – get fresh fish from Kerala delivered to his doorstep. With 35 years of experience as a fish exporter, Mathew built the chain of users and suppliers, and Shan, with his vast experience in running Zynga’s India operations, focused on operations and technology.

The startup recently raised $121 million in Series C funding led by Investment Corporation of Dubai (ICD). FreshToHome currently fulfils 1.5 million orders per month and are targeting a revenue of Rs 1500 crore in the next 12 months. The online meat delivery startup is also profitable on an EBITDA level in Bengaluru and Delhi.

To achieve profitability, the team ensured gross margins of 20 to 25 percent – higher than most grocery companies. The main reason is that the cuts go to the middlemen – in case of fish, it is much larger – and this is where the margins drop.

Gaurav Sharma, Partner, Head of Private Equity, Investcorp India, tells YourStory,

“With the growing consumer awareness and the need for online shopping, we have seen that the topline of many companies can be high. But the CAC or consumer acquisition cost are also high. So it is important to bring the CAC down so that at least in mature cities, you can get to a scale with the unit economics being positive at city and mature market levels. We saw that with FreshToHome. And that is what made us invest in this current round of funding.”

The startup receives nearly 1.5 million (15 lakh) B2C orders per month and has a Rs 600 annualised sales run-rate on the platform. It is now present across Mumbai, Delhi-NCR, Bengaluru, Hyderabad, Pune, Kerala, and Tamil Nadu, as well as in the UAE.

Building a robust supply chain for higher margins

To get higher gross margins, the dependency on the middlemen had to be removed. For that, the team had to understand the supply chain and operations processes.

This meant building an optimised supply and cold chain. Shan explains that building a supply chain on its own wouldn’t work as the network of fishermen along the coast is vast, and the middlemen have a very strong and powerful influence.

That’s where Mathew stepped in. A fish exporter for 35 years, he has a foot on the street and is acquainted with the fishermen community.

“There is a cost disadvantage in bringing fresh fish from the harbour. Fish trade, for example, employs four middlemen. A place like Kochi has 70-75 harbours, unlike the US, where there are only five main harbours where you can get your truck and collect the material. In India, there are 5,000 harbours, and people and fishermen working there have to deal with fragmentation – which is why you need middlemen,” explains Shan.

Each of the harbours has auctions at four in the morning. Interestingly, the same stock of fish, if being sold for Rs 1,000 a 100 km away, will be sold for Rs 2,000 to Rs 3,000 at the harbour. There is limited visibility as most of the fishing is done by local fishermen and it is highly fragmented.

The next part of the supply chain are the wholesale markets, where the fish is auctioned at four in the evening. Again, middlemen from neighbouring cities participate in the auction. They then take the produce to the wet markets and into the cities. Each part of the chain takes a 10 to 15 percent cut.

However, it just isn’t the marketplace model; the control of the entire supply chain brings the added advantage. Anand Prasanna, Managing Partner, Iron Pillar, says,

“There are many marketplaces with comparatively low margins. But they aren’t selling their own product. This is a big differentiator. What this means is that the customer can go to another marketplace and get the exact same thing. The moat is a larger offering that is unique. In FreshToHome’s case, you have a unique product and brand; if you want a FreshToHome fish you get it there.”

Anand explains that ensuring freshness along with providing a chemical-free product has a difficult value proposition. This is because it requires organising a complete supply chain with technology and manpower, for which there is no alternative. He adds,

“It just isn’t about throwing money at the problem. You need to learn tech, understand the fishermen and poultry farmer base, and building this takes time. Once that is built, you have a unique moat of scalability. And that is where you get the right unit economics.”

The fishermen' app

Technology reduces dependency on middlemen

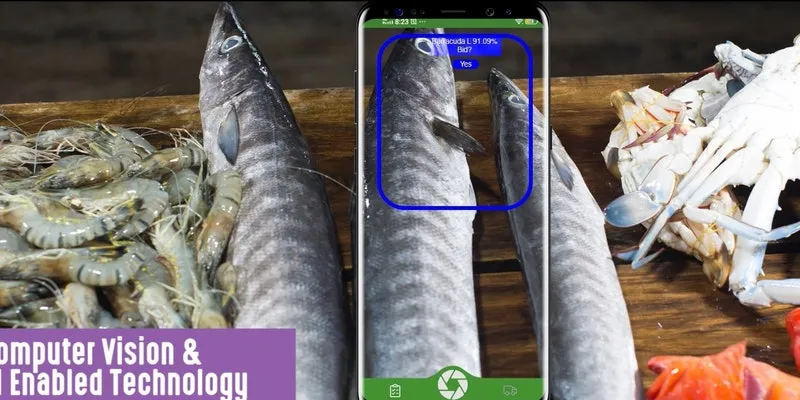

While the team had onboarded the fishermen, they knew the process had to be scaled to make the supply chain more efficient. The team decided to use technology and built a simple app that fishermen and poultry farmers could use.

The app works on a simple and gamified model. Once a fisherman opens the app, the camera “reads” the fish with neural network training, and using an AI-based US-patented technology. It detects the variety and size of the fish – based on which the fishermen place their bid. At the other end, one or two “feet on street” bid at auctions, pick up the catch, and transport it through the cold chain to the respective hubs.

"Across 125 harbours, 1,500 fishermen are bidding with us on the app. They directly tell us about the availability, and price – which is determined on the closeness to the harbour. Even then I get the lowest price, because in Bengaluru, for example, the price in a wet market will be the highest,” explains Shan.

The platform can buy products at a pre-agreed price of Rs 2 lakh for the fish yield, but it wasn’t easy in the early days. Fishermen were reluctant and unwilling to onboard without a demand.

Gaurav adds that the team has been able to bring in the backward integration with fish, and later poultry. This is a moat for FreshToHome and isn’t easy to replicate.

“The support system and connects you need along with hacking the tech stack is a big advantage. This leads to the best gross margins levels in the space, which in turn, translates to higher margins at the city levels,” says Gaurav.

Controlling the farming process

Since 20 percent of the fish produced in Bengaluru is freshwater, the team focused on harvest farming, financing farmers with Rs 2.5 lakh per acre. This enables the fishermen to breed and grow the kind of fish FreshToHome consumers are used to.

The technology the team uses here intensifies the crop. If farmers do six tonnes of farming per acre, the team increases it up to 12 tonnes per acre. The margins here in turn help translate to becoming EBITDA positive.

“In poultry, what we do is allow vertical innovation by allowing seed and feed producers. ‘Seed’ refers to a day old chicks, and there is a backend infrastructure around producing hatcheries. The focus here is on contract farming, like in trading fish from the harbour. Thus, we end up getting higher margins by cutting off the middlemen in the traded products,” explains Shan.

This also helps control the wastage. Shan adds that the typical wastage in a fish supply chain is about 15 percent. The process of taking the fish into the markets is done in trucks with bare amounts of ice, and chemicals.

“We are able to use a lot of algorithmic and AI-based technology, particularly using deep learning, to predict how much we can sell and buy. On its basis, the vertical integration becomes simpler. We can predict this up to nine months,” says Shan.

FreshToHome team

The market size

India consumes meat worth around $30 billion every year. The demand is expected to grow faster, driven by economic growth, rising per capita income, urban trends, and a rise in the awareness of the nutrition provided by meat and related products. However, 90 percent of this demand has been primarily addressed by the unorganised market.

Apart from FreshToHome, Bengaluru-based Licious too is looking to disrupt the unorganised meat market. Gaurav believes the space to be large enough for both the brands to work in the market

Gaurav explains the market for meat and fish in India is big, but this is largely dominated by the wet markets. “As health and hygiene become an important factor for consumers, companies like FreshToHome or even Licious for that matter, come in and educate the consumer and win market share away from the wet markets,” he adds.

He explained that COVID-19 has accelerated the shift and move towards buying online, with a stronger focus on health and hygiene.

“As per most surveys, close to 25 percent of the consumers today are driven by health and hygiene choices,” says Gaurav

Working around the challenges

The entire process took the team three years to complete. “With Mathew, we were able to bring in the understanding of what the farmer needs, and offer a mix of gamification and easy-to-use tech. The product is in their local languages and helps fishermen bid for different kinds of fish,” says Shan.

He adds the team uses a lot of technology to control the cold-chain. FreshToHome has used IoT-based inbuilt sensors to ensure that the temperature is controlled at zero to four degree Celsius.

“We have built cloud-based monitors to track the movement of the products. When we started, people would put in extremely low prices to build the algorithm, and we would give them leeway and they would, in that time, increase the product price. Sometimes, you end up buying at a higher price because the customer wants the product. Also, the cost of the fish varies drastically on the basis of size. They would quote for a one kg price and send a half kg,” adds Shan.

This is when the team added technology to the process, using SMSes and callbacks. They focused on simplicity and bringing a visual product.

Now with the tech and model in place, the team is looking to replicate this across India and Dubai.

Edited by Kanishk Singh

![[Funding alert] Online meat startup FreshToHome raises $121M in Series C led by IDC](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/Image4nsc-1582624654197.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Product roadmap] How FreshToHome brings fish and meat from the coast into your kitchen](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/Product-roadmap-1582623616317.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Behind the Scenes] What Licious needs to organise India’s $30B meat consumption market](https://images.yourstory.com/cs/2/a9efa9c0-2dd9-11e9-adc5-2d913c55075e/Vivek_and_Abhay15552626191231565354176511.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[YS Learn] How FreshTohome was able to raise $152M across three funding rounds](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/Imagexafu-1605780691021.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)