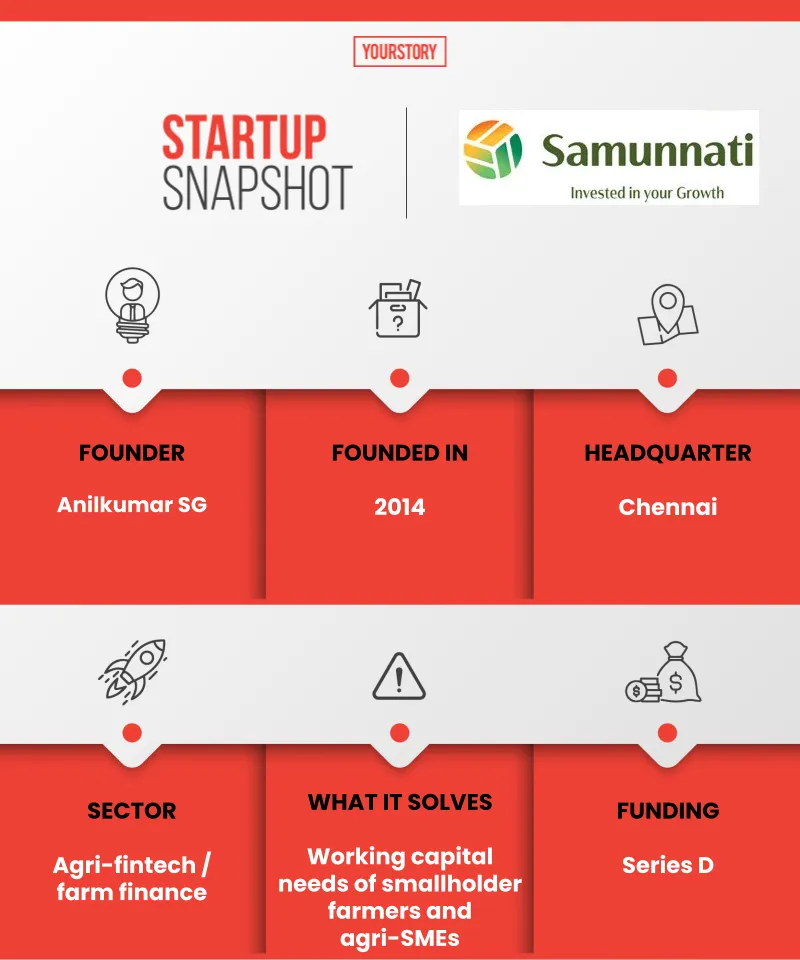

This ex-banker’s agri-fintech startup has disbursed loans worth Rs 6,000 Cr to 4M farmers

Chennai-based agri-fintech startup Samunnati solves the working capital needs of smallholder farmers and agri-SMEs. It has impacted 54 agri value chains in 20 Indian states.

Veteran banker Anilkumar SG’s initiation into rural finance happened in 2007, when he joined IFMR Trust, and was tasked with developing a micro-finance solution known as Kshetriya Gramin Financial Services (KGFS).

As part of the role, he and his team had to profile India’s low-income households and track their assets and liabilities.

“That’s when we realised that a household was not operating in a vacuum, but was a part of an ecosystem. So, it was important to engage with the entire value chain,” he tells .

Amilkumar SG, Founder & CEO, Samunnati | Photo: Medium

Seven years on, in 2014, Anilkumar would take that value-chain approach to embark on his entrepreneurial journey.

He founded — an agri-fintech startup that works towards improving market linkages for India’s smallholder farmers, makes credit more accessible at every step of the agri value chain, and eventually, helps agriculture “operate at a higher equilibrium” i.e. become more efficient.

The problem it solves

The Chennai-based startup’s goal was to differentiate itself from India’s existing agri financiers and farmer welfare policies.

“The problem with agri lenders in India is their definition of farmers. Most smallholders farmers are not landowners. They are just tenants. But, they are made accountable for the entire loan amount whether crop cultivation happens or not,” Anilkumar explains.

As a result, farmers in India are not only perennially in debt, but also left with limited access to formal credit. Studies suggest that only 11 percent of the farming population has access to organised lenders and farm loans.

Samunnati has impacted 54 agri value chains in 20 states of India

This is the problem Samunnati wanted to solve with its agri-finance products.

Unlike traditional lenders who dole out crop loans or agricultural input loans, it focuses on specific needs of smallholder farmers and designs financial products that are not collateralised.

It also solves working capital needs of FPOs and agri-SMEs to make an impact on the entire agri value chain. “Nothing much has changed in terms of the reach [of formal credit], but what has changed is our ability to reach farmers,” says the founder.

Growth and measurable impact

Using tech, Samunnati has expanded its reach to more than 700 FPOs (on the supply side) and 1,500+ agri enterprises (on the demand side) across 20 states.

Over six years, it has disbursed loans worth Rs 6,000 crore and impacted the lives of four million farmers across 54 agri value chains in India. The current net worth of the startup stands at Rs 505 crore.

It has also reduced the cost of production for FPOs by 7-15 percent, and improved farm productivity depending on seasons, crops, and climate.

Sammunati customers can avail working capital for one to 100 days, with the average loan size at about Rs 70 lakh, and individual transactions pegged at Rs 5-10 lakh. “Our goal is to make the throughput more, and remove working capital constraints for everyone in the value chain,” says the founder.

The startup operates on a B2B2C model, and currently has a monthly run rate (MRR) of Rs 250 crore. Samunnati’s primary revenue stream is the interest income (13-18 percent) it earns on loans, and market linkage fees when transactions happen.

“We double our MRR every year,” Anilkumar shares.

Infographic: YS Design

Platforms to connect the ecosystem

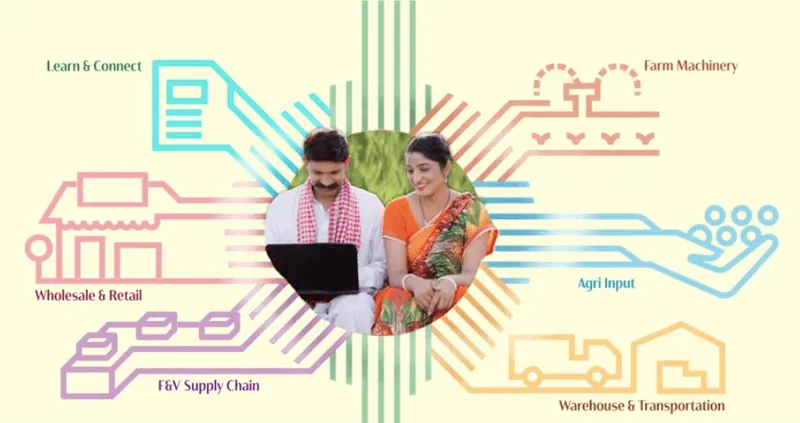

Last August, Sammunati rolled out its proprietary ‘Samaarambh’ platform to improve engagement and foster innovation among agritech startups.

These startups can avail customised working capital, seek advisory and mentoring, and tap into wider distribution networks through the platform. Over 230 startups have registered on Samaarambh until now.

Later in December, Sammunati also launched Agri Elevate, which the founder calls a “virtual directory of all service providers in agriculture”. The platform is non-transactional for now, and aims to solve the information asymmetry that exists in the agri ecosystem.

Anilkumar elaborates, “The FPOs are unaware of ecosystem players who can address their issues from farm machinery to agri inputs. Agritech startups do not have easy access to farmers who are customers of their services.”

Hence, Agri Elevate serves as a search engine for agricultural service providers of all kinds to discover and interact with each other.

Agri Elevate serves as a search engine for agricultural service providers

Funding rounds and market landscape

Samunnati is a well-funded startup, having raised both debt and equity finance from 40-odd investors since 2016.

In its last funding round in January 2021, it raised Rs 89.6 crore in debt from FMO: Entrepreneurial Development Bank and Triodos Investment Management. It will use the funds to expand its low-income farmer network.

Huib-Jan de Ruijter, Chief Investment Officer at FMO, said at the time of funding,

“The loan to Samunnati achieves our goals of improving access to finance in this sector, which is in great need of more finance.”

Prior to this, the startup had raised a debt financing round of $20 million led by the US International Development Finance Corporation (DFC) in September 2020. And before that, it raised a Series D round from , Accel, , , and debt finance from other social impact investors.

Only 11% of India's farming population has access to formal credit

Ajay Rao, Managing Director – South Asia Region, DFC, said, “We are impressed with Samunnati’s pioneering work in agriculture value chain finance in India, which contributes to making agriculture value chains more efficient, enables more produce to flow through the value chain, lowers food waste, and provides for higher and stable incomes for smallholder farmers.”

The larger rounds Sammunati has been able to raise from local and global investors point towards significant tailwinds in the agritech sector.

The founder states,

“Nobody needs convincing about agritech anymore. There is an abundance of potential and opportunity if you collaborate. Smallholder farmers and agribusinesses put together, it is a $245 billion market.”

Agritech has seen “ecosystem-level vibrancy” in the last two to three years, and is poised for exponential growth in this decade.

“This is the Silicon Valley moment for Indian agriculture,” Anilkumar says.

Edited by Teja Lele