Indian companies rush to list on the bourses

Besides MTAR, a bunch of other Indian firms are also waiting to launch their initial public offerings.

Good morning!

2021 is expected to be a blockbuster year for IPOs in India as homegrown startups, as well as small and medium businesses, look to give its investors valuable ‘exits’.

Cumulatively, IPOs raised around Rs 30,000 crore in capital in 2020, more than double of the Rs 12,362 crore it had raised in 2019. Experts reckon this year is going to be as big or even bigger.

The latest to head the IPO way is Hyderabad-based engineering company MTAR Technologies, which listed on the bourses on Monday at an 85.03 percent premium of its issue price of Rs 575.

In a three-day issue between March 3 and March 5, the Rs 597-crore IPO of the company received strong interest with bids for over 145 crore equity shares against 72.6 lakh stocks on offer.

Established in 1970 by technocrats P Ravindra Reddy and the late K Satyanarayana Reddy, MTAR is a leader in the nuclear, defence, and aerospace equipment space, with domestic clients such as ISRO, DRDO, and NPCI, and overseas ones such as Bloom Energy, Dassault Aviation, and Elbit Systems.

Besides MTAR, a bunch of other Indian firms are also waiting to launch their initial public offerings.

These include Craftsman Automation and Laxmi Organics Industries, (its share price is fixed at a band of Rs 86-87 a share for a Rs 1,175 crore-initial share-sale), Rakesh Jhunjhunwala-backed gaming giant (that plans to sell nearly 5.3 million shares), and Suryoday Small Finance Bank, among others.

Ramesh Kalyanaraman (Left), TS Kalyanaraman (Centre), and Rajesh Kalyanaraman (Right)

Prior to this, Indigo Paints' Rs 1,170-crore initial share-sale had garnered an overwhelming response from investors, with its IPO subscribed 117 times on the final day of bidding on January 22. Indigo Paints received bids for 64.58 crore shares against an offer size of 55.18 lakh shares, translating into a subscription of 117.02 times.

Not only this, serial entrepreneur Naveen Tewari recently shared that India’s first unicorn, , will be issuing guidance on its IPO in the next few quarters. Also waiting in the wings to go public this year are well-known SMEs and MSMEs, including Barbecue Nation, PNB Metlife Insurance, JSW Cements, and Indian Railways’ finance arm, among others.

In fact, homegrown unicorns and ‘soonicorns’ such as , , Delhivery, , Nykaa, and Grofers are also expected to go public soon, in what could be a definitive year for startup listings.

The Interview

Companies that harness new-age technologies such as cloud computing, cognitive computing, AI, and analytics have performed well in recent years. Their next phase of exponential growth could come from a rapid scale-up in a cost-effective manner, Bhawna Agarwal, Senior Director, Growth Segment, Hewlett Packard Enterprise’s India stated at Future of Work 2021.

At the recently concluded event, she detailed the features of HPE GreenLake — a service that brings a modern cloud experience to startups and their apps, product, data, workloads, etc., with a self-served, pay-per-use, scale up and down, and ‘managed-for-you’ model. This blend of a public cloud and a private cloud helps startups be future-ready, and lets them save costs, boost security, and ensure compliance.

Editor’s Pick: PhonePe 2021 expectations

Post the emergence of pandemic-induced “new normal”, , a Bengaluru-based fintech leader then wholly-owned by Flipkart, went through rapid changes. It led the startup to pivot quickly to meet new kinds of demands, sometimes beyond its core verticals.

In a conversation with YourStory, Karthik Raghupathy, PhonePe’s Vice President of Strategy and Business Development, spoke about how things changed across the board at the fintech startup, and how the pandemic shifted some of the goalposts it had set for itself in the past. Read more.

Startup Spotlight

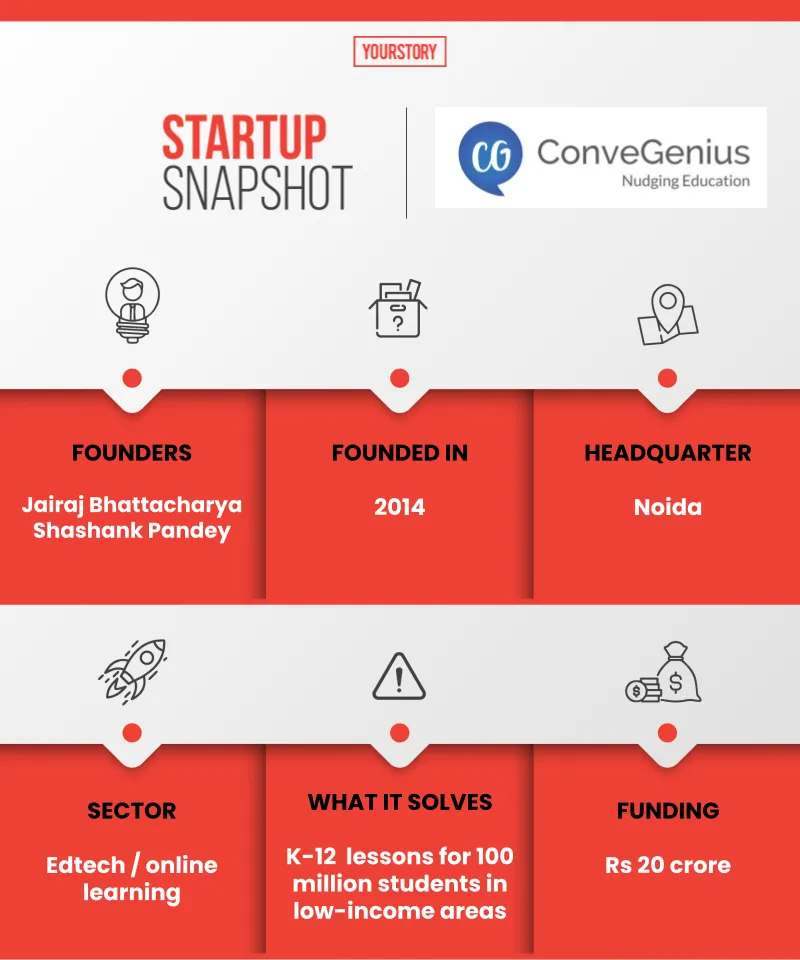

How Dell Foundation-backed ConveGenius delivered learning to 10M rural students

As a project officer at Singapore’s Nanyang Technological University, Jairaj Bhattacharya was leading a cross-country team that was developing a low-cost tablet ($70 apiece) tailored for rural education in India. After “exploring edtech for the bottom of the pyramid from a research lens,” Jairaj realised that companies working in this segment were mostly non-profits like Khan Academy.

In 2014, he returned to India and founded ConveGenius as a social enterprise that looked to offer affordable learning to 100 million students at the bottom of the pyramid. Post the pandemic, the startup pivoted from a school-led model to a B2C WhatsApp-based learning approach that helped it scale rapidly to 10 million users. Read more.

Infographic: YS Design

News & Updates

- Payments Bank Ltd (PPBL) has received approval from SEBI for payment mandate of IPO applications through its UPI handle. PPBL has also entered into a partnership with Paytm Money to enable payment mandates for IPO applications.

- Around 40,000 bank employees and officers in Maharashtra have gone on a two-day strike to protest against the privatisation of two public sector banks as announced by the government in the Union Budget for the next fiscal.

- According to reports, India will propose a ban on cryptocurrencies, criminalising “possession, issuance, mining, trading, and transferring of crypto-assets.” The bill is expected to give cryptocurrency holders six months to liquidate their assets.

- A survey revealed that 49 percent of Indian consumers and their families prefer shopping through ecommerce. The survey received over 1.3 lakh responses, with consumers from metros, Tier II, and beyond locations participating in it.

- Silicon Valley-based fintech startup Stripe has become the second-most unicorn globally at $95 billion after its latest fundraise of $600 million. At present, the world’s most valuable startup is Bytedance at $140 billion, with Elon Musk’s SpaceX pushed to the third spot at $74 billion.

Before you go, stay inspired with…

Rakesh Jhunjhunwala

“When opportunities come, they come through technology, marketing, brands, value protections, capital, etc. You need to be able to spot those.”

— Rakesh Jhunjhunwala, Owner of Rare Enterprises

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!