Can fabless be the next SaaS for India?

India, over the past two decades, has made considerable progress in the fabless segment. India has deep design, verification, firmware talent – the necessary ingredients for the success of a fabless startup.

The ongoing global semiconductor crisis has adversely impacted over 170 manufacturing industries – from personal computers and smartphones to dishwashers and automobiles.

As the COVID-19 pandemic pushed economies into multiple lockdowns, chip production facilities had to remain shut, consequently running global stocks dry.

The demand for chips, however, did not decline. Rather, the worldwide shift to remote work led to a surge in demand for smartphones, personal computers, smart home devices, gaming consoles, and myriad home appliances. Even the demand for automobiles bounced back quickly as lockdowns gradually eased across countries. The crisis, which is tipped to continue into the next year, is expected to vastly alter the dynamics and the scale of the global chip manufacturing industry.

In September, technology research firm IDC forecasted that the semiconductor market would grow

by 17.3 percent in 2021, compared to 10.8 percent last year when the worldwide revenues stood at $464 billion.

The firm noted in its report that there was a potential for overcapacity in 2023 as larger scale capacity expansions start to kick in late next year. “5G semiconductor revenues will increase by 128 percent, with total mobile phone semiconductors expected to grow by 28.5 percent.

Game consoles, smart home, and wearables will grow +34 percent, 20 percent, and 21 percent respectively. Automotive semiconductor revenues will also increase by 22.8 percent as shortages are mitigated by the year end.

Notebook semiconductor revenues will grow by 11.8 percent, while X86 Server semiconductor revenues will increase by 24.6 percent,” it said in its report.

The global chip shortage and geopolitical developments involving the United States and China may present India with opportunities to accelerate growth.

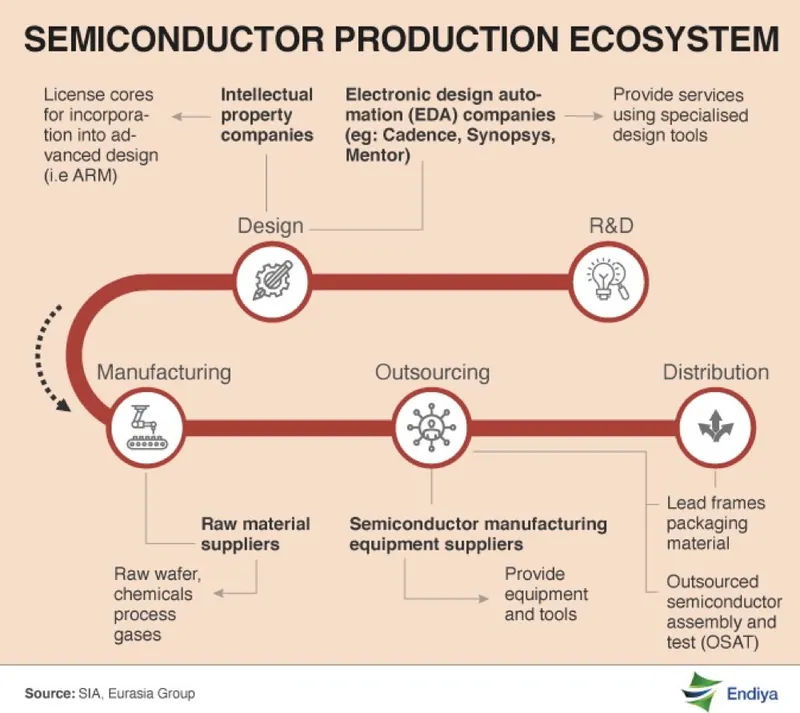

Global semiconductor ecosystem

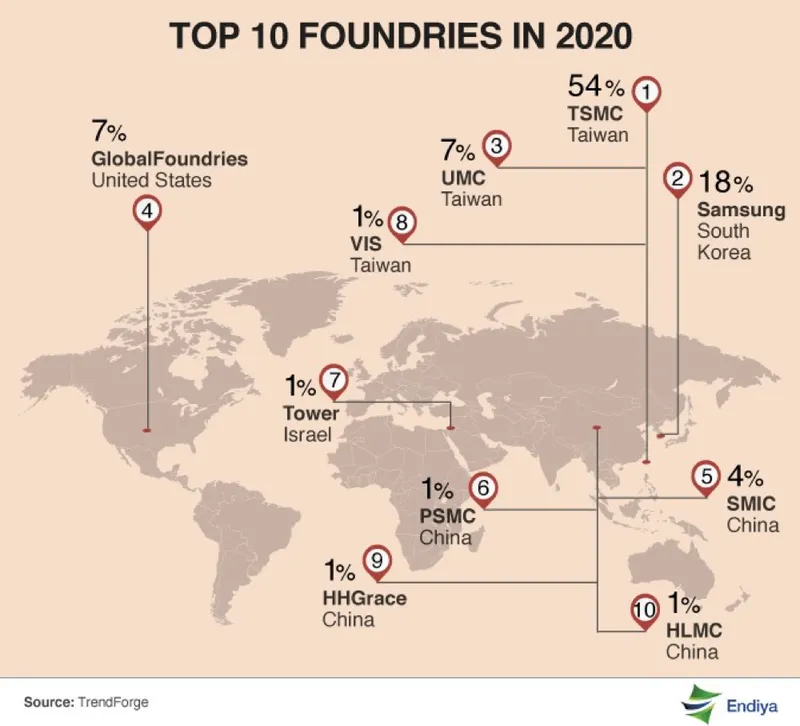

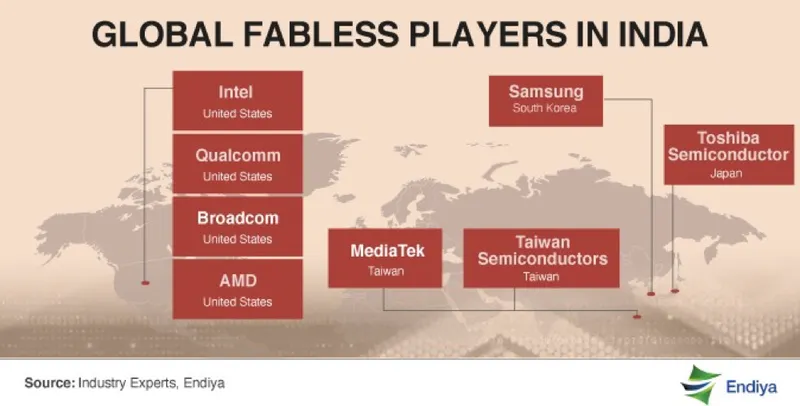

The most prevalent business model in semiconductor manufacturing is the foundry model which consists of a semiconductor fabrication plant and an integrated circuit design operation (eg: GlobalFoundries, TSMC, UMC). Then there are fabless companies that design chips and outsource production (eg: AMD, Nvidia, Qualcomm). IDMs (integrated device manufacturers) design and manufacture integrated circuits (eg: Intel, Samsung, Texas Instruments).

The semiconductor ecosystem also consists of EDA (Electronic Design Automation) companies that assist in the design, planning, implementation, verification and manufacture of chips.

Major players in this segment include Cadence Design and Synopsys, both based in the United States, and German multinational, Siemens. There are also third-party providers of semiconductor assembly and testing (OSATs). Well-known players include ASE, Amcor, and JCET.

As per Moore’s Law, semiconductors would double the circuit density every two years. The leading companies in the space are in a race to create more dense and powerful ICs (Integrated Circuits).

South Korea’s Samsung and Taiwan’s TSMC are at present the only two companies that manufacture chips at the most advanced process nodes (under 7 nm) at scale. The leading producers are currently looking to transition into the 5nm and 3nm processing nodes.

China - US Spat

While the pandemic triggered the ongoing chip crisis, the trade war between the United States and China further complicated matters. In a series of developments, the US restricted the supply of cutting-edge chips from TSMC to Huawei in order to block the Chinese company’s 5G rollouts. The moves by Washington have been effective to convince European allies to ban Chinese 5G supplies.

China has been trying to parry the American attack with a bunch of fixes. In one of its most significant attempts, it has pumped over $200 billion into its massive National IC Investment fund. Also, as a workaround for the Huawei-TSMC strictures, talks are ongoing with Taiwan’s smartphone chip supplier MediaTek and with UNISOC, a leading domestic chipmaker backed by Tsinghua Unigroup. Both rely on TSMC for their less than 10 nm fabrication.

The Huawei restriction situation has been causing global disruption in the telecom sector. The UK government, for example, is concerned about having to remove Huawei equipment from the networks of their mobile operators. The ban would reportedly delay the arrival of 5G in the UK by two years costing the operators at least £2 billion.

India’s fabless future

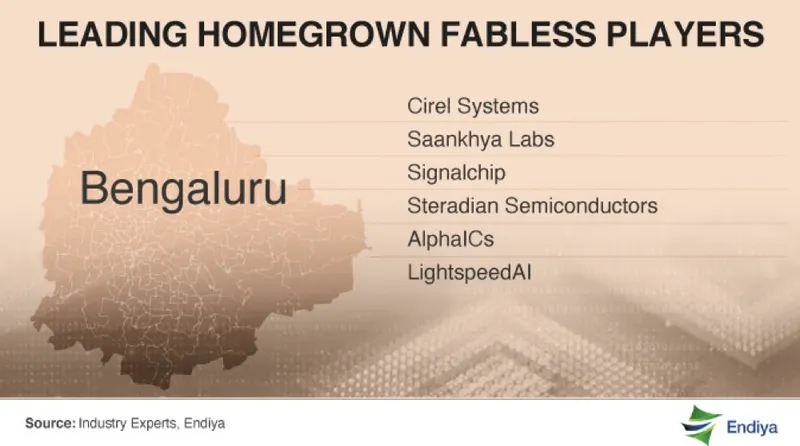

India, over the past two decades, has made considerable progress in the fabless segment. In terms of size, it is still relatively nascent, with cumulative annual revenues estimated at a little over $50 million.

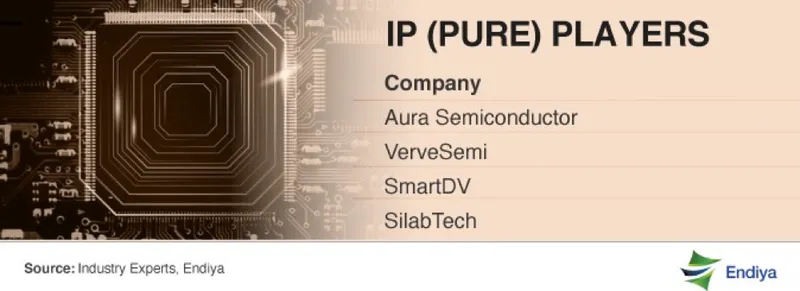

In recent years, companies such as Steradian Semiconductors, AlphaICs, Cirel Systems, Saankhya Labs, LightspeedAI and Aura Semiconductors have been successful at designing and building competitive circuit enhancements.

In the past, India has struggled to adequately incentivise the creation of a fabless hub. The government, in 2017, invited foreign companies to set up facilities in India by waiving customs duties for relevant imports. The offer had no takers.

Subsequently, it sent out an expression of interest (EOI) inviting companies interested in setting up fabs. The EOI’s deadline was April 2021. India also tried to woo semiconductor giant Intel to set up a facility in India, only to lose the bid to Vietnam.

For emerging companies and startups, the lack of availability of risk capital presents yet another challenge. While fail fast, fail cheap is possible in a space like SaaS, thanks to AWS, Azure and Google Cloud startup programmes.

It costs $8 million to $10 million and a couple of years to produce quality chips. It would make a big difference if EDA vendors like Cadence, Synopsys and Siemens EDA, and fabs such as TSMC and GlobalFoundries partner and aggressively offer credits to fabless startups to ensure venture capital money flow to the sector.

India has deep design, verification, firmware talent – the necessary ingredients for the success of a fabless startup. With the right government incentives and access to adequate capital at the critical moment, homegrown talent could be harnessed for the growth of the fabless industry.

Edited by Kanishk Singh

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)