[Tech50] Fintech startup OneCode is doing for its users what Uber did for taxi drivers: helping them earn money

YourStory’s Tech50 2021 startup OneCode taps into the trust deficit in the financial services sector, which has been historically defined by agents and paperwork. Here’s a look at how the startup is mobilising the sales agent network

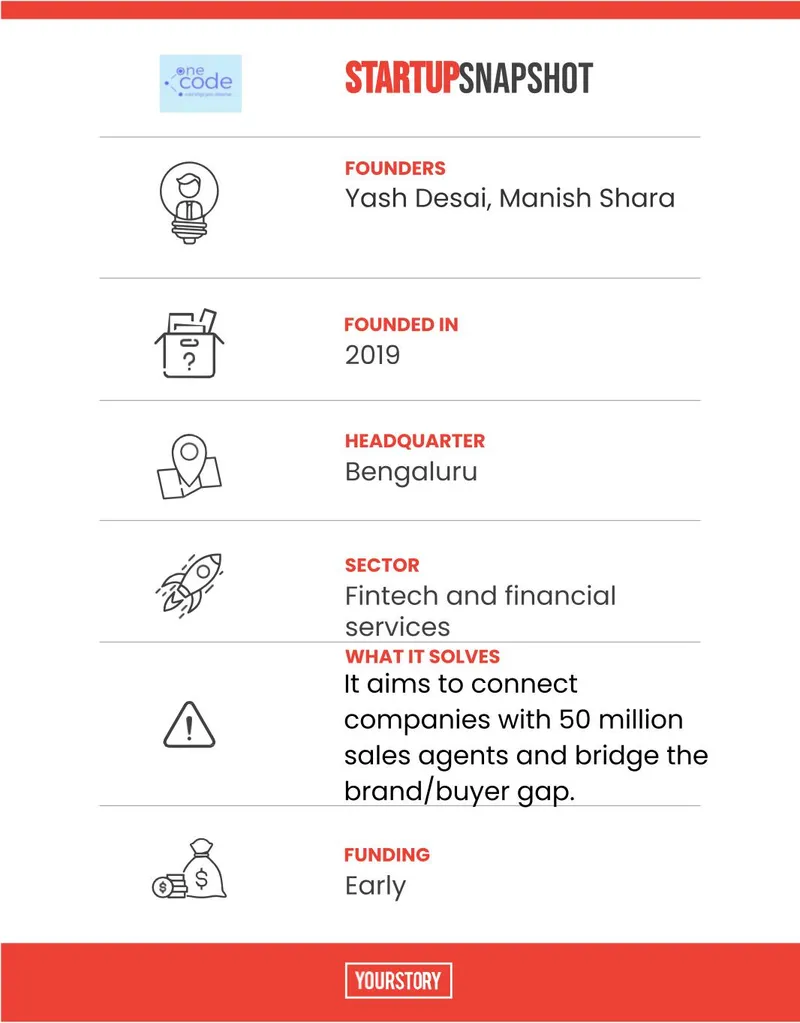

Bengaluru-based B2C fintech and financial services startup , which is among YourStory’s Tech50 list of 50 most promising early stage startups from India, is on a mission to disrupt the agent-driven financial sector.

While some may view OneCode as the fintech version of Meesho — a commission-based distribution model that allows users to recommend and sell financial products to their network to earn commissions — co-founders Yash Desai and Manish Shara say OneCode is doing for its users and agents, what ride-sharing platform Uber did for taxi drivers: help them make money.

“What we are telling our users is: 'hey, you have the customer, I will recommend the best products for you to give and delight your end customer',” says Yash, who adds that the widest gap in India is between opportunity and opportunity seekers, which OneCode is trying to bridge.

The genesis of OneCode

But how did it all begin before Yash and Manish started OneCode in 2019?

Yash who along with Manish worked at Dineout — a restaurant tech solutions company catering to individuals and businesses — recalls that when Dineout was launched in Tier II and Tier III markets, the only distribution channels for digital advertising were Facebook and Google.

"This was during early 2018 when we realised that the digital budgets were not getting consumed because people were not clicking or availing digital transactions to pay their restaurant bills,” adds Yash, who has an MBA from San Francisco’s Hult International Business School and was the business head at the time, while Manish led product department.

Yash recalls how deep diving into consumer behaviour in Tier II and III towns revealed that people still had reservations about making digital payments. Some preferred personal contacts for support versus reaching out on chat. This signalled a trust deficit in customers. And that’s why Yash and Manish started looking at social commerce models that could help them bridge this trust deficit.

Bridging the gap between brands and buyers

“The initial challenge was not in convincing agents about the product. That was actually the easiest part once they knew about the availability of the product. The challenge lay in getting them to leave their inefficient ways and move on to an efficient platform where they could reach out to their customers better, do better sales, and make more money,” explains Yash.

In effect, it meant abandoning the age-old paperwork model that involved tonnes of files and physically maintained data and visiting a branch every time one needed a signature.

Initially, OneCode started with the plan of enabling commerce across sectors from D2C brands to healthtech, edtech, and fintech. However, in December last year when the co-founders found that maximum agents were adapting to fintech than any other category, they took a conscious decision to deep dive into fintech and stick to it.

“So, that was our first milestone and after that, we grew 100 percent month-on-month for six months in a row and that really changed the business for us,” recalls Yash.

Owned and operated by Vistas TechnoLabs Private Limited, OneCode is a tech-enabled distribution platform for products that require education and training. It aims to connect companies with over 50 million sales agents across India, enabling them to sell products and services to less tech-savvy buyers.

By digitising 50 million sales agents across India, the startup wants to bridge the gap between brands and potential buyers who may need in-person interactions and physical touchpoints before committing to a purchase.

Mobilising the agent network

India’s population and demographic distribution have often meant that up to 95 percent of businesses in the country rely on an agent network to raise awareness of a product and get it in the hands of consumers.

OneCode works with a variety of financial institutions such as banks, discount brokers, and credit card companies, including ICICI Bank, Axis Bank, and RedCarpet.

Using technology to mobilise the agent network, these companies can increase their distribution in Tier II and III cities. On top of providing sales agents with access to relevant products and services and a chance to earn a commission through these sales, OneCode also gives them visibility over their earnings on the app, where they can also track how much money is owed to them.

OneCode uses 18 technologies for its website, including Viewport Meta, iPhone/Mobile Compatible, and Google Font API.

The startup generates revenue from commission on each transaction. It has 23 clients, 3,50,00 customers, and according to the startup, an ARR of $5 million.

At present, the startup is valued at $20 million and has 25,000 monthly active agents on the app and has generated income of more than $3 million. It has raised a total funding of $5.7 million from Sequoia Capital India’s Surge, Nexus Venture Partners, and WaterBridge Ventures, among others.

Quality over quantity

The startup is working with a long-term goal of digitising 50 million sales agents in India, improving their lives by enabling them to make money. By the end of 2022, it aims to digitise two million agents.

Since it’s not like a traditional ecommerce business where one is relentlessly pursuing millions of users, the key, Yash says, is to have quality users instead of big numbers.

“So, even if we have 50,000 quality users, we can still be a $100 million revenue company with people using us as a product,” points out Yash.

Edited by Anju Narayanan

![[Tech50] Fintech startup OneCode is doing for its users what Uber did for taxi drivers: helping them earn money](https://images.yourstory.com/cs/2/0e302530227f11ec9e19b7c38d296967/OneCodeFounder-1638863549569.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)