How Cropin honed its focus on large enterprises in the global agriculture industry

During the onset of COVID-19 in 2020, Cropin CEO Krishna Kumar took a tough call -- to focus on the large and mid-market enterprises. And it paid off.

When Krishna Kumar, CEO and Co-founder of Cropin Technology Solutions, began to raise capital for its Series C round in 2020, the conditions were hardly ideal.

Until then, the agritech venture headquartered in Bengaluru had raised $15.7 million over seven years. clocked Rs 17 crore in revenue in FY 2020, growing 40 percent over the previous year, according to its filings with the Registrar of Companies.

But Krishna had taken a couple of tough strategic calls in mid-2018, which would begin to show in the financial results. Losses shot up by 75 percent to Rs 34 crore in FY 2020. And the COVID-19 pandemic had just taken root in India, leading to a nationwide lockdown for more than three months in 2020.

Against that backdrop, Krishna set out to raise capital, but remained optimistic about his two decisions in 2019.

His first call had been to invest in its predictive-intelligence product called SmartRisk, which would help Cropin's clients in the agriculture and foods business analyse yield patterns in farms, and get historical trends related to crops by area.

By May 2020, SmartRisk had nearly 20 signups, even as the startup's flagship product SmartFarm had 130 clients. "While SmartFarm will grow by three times, SmartRisk can grow five to 10 times," Krishna said at the time.

Why was he gung-ho about SmartRisk? The lockdowns and restrictions worldwide were pushing Cropin's existing clients and prospects to use software for remote monitoring of their farm assets.

"We are buying a lot of satellite and weather images to get data on farms," Krishna explained in May 2020. "The demand for SmartRisk will surge because enterprises can remotely monitor their assets. That demand will pick up," he said.

SmartRisk's contribution to revenue was 4 percent in April 2019, and as Krishna had anticipated, the next-gen agri intelligent solution saw a significant uptick in the next three years. As of February 2022, SmartRisk contributes 65 percent of its annualised revenue, according to the company.

Revenue from SmartRisk has grown by 113 times in dollar terms over three years, the company states.

"Cropin’s earth observation and AI-led intelligent ag cloud platform empowers our B2B customers to reimagine agriculture with data," Krishna tells YourStory, referring to the industry shift from ‘digitisation of farming’ to ‘intelligent agriculture'.

(L) Krishna Kumar Co-founder and CEO, (R) Kunal Prasad Co-founder and COO

Krishna's second decision in FY 2019 was more brutal. "We decided to work with large enterprises and the mid-segment because they will bring a larger number of farmers onto the Cropin platform," Krishna said.

If Cropin worked with small customers, it would have to devote more internal resources to cover and analyse smaller tracts of lands and cropping patterns.

In effect, the startup pruned its client base from 185 clients in 2018 to 130 enterprises in April 2020. In December that year, Krishna closed the Series C round of $20.4 million led by impact-investor ABC World Asia.

Claiming to be working with more than 100 clients, Krishna has now upped the ante for Cropin to win big-ticket deals with enterprises in the agri-inputs, seeds, food processing, agri-lending and agri-insurance segments.

That said, the startup's year-on-year growth in FY 2021 was the slowest in its 11-year history: 10 percent. "There were some COVID-19-linked delays (that) led to projects crossing over, and being split," says Ritu Verma, Managing Partner in , and the first venture-capital investor in Cropin in 2013.

But Cropin says it will close FY 2022 with revenue of nearly Rs 40 crore, or two times the revenue of the previous year, and annual bookings of Rs 145 crore. Its net revenue retention, which indicates how the contribution from existing deals has improved, is up 120 percent in FY 2022, according to the company.

In the past year, the founders and its board of directors have put in place a management team for the next stage of growth, even as Krishna will drive the startup's focus as CEO to build the world's largest agri intelligence platform. Its products currently cover farms in 56 countries.

When we were doing $200,000 to $300,000 deals, it needed a setup and approach to reach customers," Krishna says. "But when we want to bag $5-million to $10-million orders from clients every year, we needed to build that muscle."

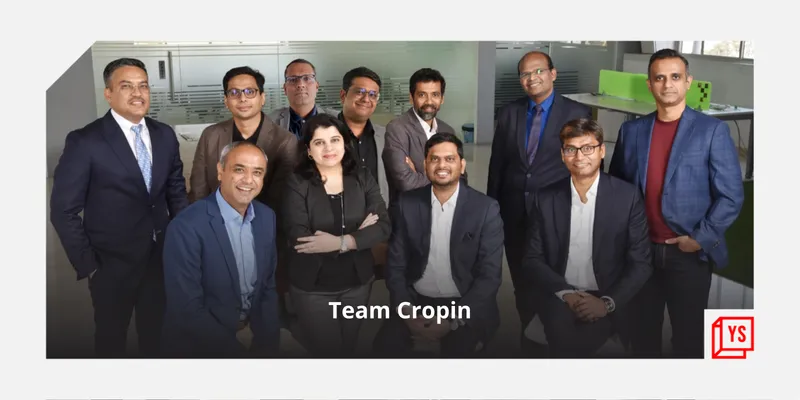

The Cropin management includes (back row, from left) Sharad Kothari, Head - Public Sector, Rahul Singh, CFO, Rajesh Jalan, Chief Technology Officer, Abishek Keerthi Narayan, VP - Customer Success, Praveen Pankajakshan, VP - Data Science & AI, and Vijay Nelson, Chief Product Officer. Front Row (from left): Mohit Pande, Chief Business Officer, Manasi Kelkar, VP - Human Resources, Krishna Kumar, Co-founder and CEO, Kunal Prasad, Co-founder and COO, and Sujit Janardanan, Chief Marketing Officer.

Decentralisation at Cropin

Kunal Prasad, Co-founder and Chief Operating Officer of Cropin, will now focus on the Europe region, apart from steering the company for business from government, civil and development agencies.

In mid-March, it announced three additions to its top leadership. Mohit Pande, a Microsoft and Google veteran, is the Chief Business Officer. Its Chief Product Officer, Vijay Nelson, has also worked with Microsoft, and Sujit Janardanan joined as Chief Marketing Officer after stints at Google Cloud, AWS, and Netmagic.

Rajesh Jalan joined Cropin in April 2021 as Chief Technology Officer and Head of Engineering, after a decade of experience at Microsoft Azure.

Krishna was struck by the blockchain service that Rajesh's team built for Azure, and also the first version of FarmBeats, an agriculture platform on Azure, which helps farmers increase yield and lower inputs. "Vijay has experience in building those products at scale," Krishna says.

"The business, technology, and marketing pillars will help Cropin accelerate the pace of building the first intelligent ag cloud," Krishna says. "If we want to build the world’s largest agtech company, we have to surround ourselves with the right set of people."

"We are becoming a deep-tech company, so we need people who can build and sell deep-tech, who have seen platforms and large-scale systems, who can go and bag multi-million dollar deals with enterprise customers because they have done it before," Krishna explains.

Ritu of Ankur Capital says she has definitely seen Krishna evolve in the past couple of years. "He has built an amazing team and inspired them," she adds.

To date, Cropin has raised $36 million in three fund-raising rounds, and the founders have decentralised key management functions to managers with clarity of the size of big-ticket deals the startup wants.

It could prove to be an important differentiation for an agtech venture that has diversified revenue by geography over the past three years. At least, 50 percent of its revenue is from markets outside India.

Being global matters

The global market for farm management software is expected to be $5.3 billion in size in 2026, according to Research and Markets, at a compounded annual growth rate of 18.6 percent over five years. And North America is the biggest market for software in agriculture.

Among large agtech or agritech companies in India, and have each raised more than $100 million of capital in their quest to provide full-stack agri-commerce solutions in India.

and , which focus on solving the procurement of fresh produce from farmers, have raised $367 million and $152 million respectively. Again, their focus is on the domestic market.

In contrast, Cropin is in a league of nimble ventures from India like Stellapps (software for dairy supply chain) and (B2B marketplace for agricultural commodities) that have raised less than $40 million each, and have a software platform-play that can be relevant for enterprises even outside India.

Krishna is proud of how far the software has come in the past five years. The first five or seven years went in shaping the products, building the IP (intellectual property), frameworks, and ingredients, he recalls.

“Now, it is out of the lab and getting deployed with high accuracy," Krishna says. “We have shipped this AI-computed intelligence to 12 countries on 34 commodities, and got paid. This is proof these models are now commercial — not in the lab anymore.”

While SmartFarm and SmartRisk are software-as-a-service products, Cropin has to invest time in training its clients online on using the products and moving their workflows to the products.

So far, the products have covered 16 million acres of farmland across 56 countries, and 488 crops that cover 80 percent of global farm production. “This is a moat we have created because our data is based on observations over multiple seasons,” Krishna notes.

It puts in perspective his decision to focus on large customers because Cropin's ag platform can cover more crops and farms as more enterprises come on board. It aims to cover one-third of the planet by 2025.

Krishna's immediate objective is to raise a big Series D round. "We are preparing for that now," says the 39-year-old CEO, who previously worked with GE. A product-builder at heart, Krishna has delegated key business functions in the past year, evoking some of the best management lessons from GE.

"Historically, agriculture has not attracted this kind of talent. But now, with the work we are doing, the impact we are creating, the tech stack we are using, and the vision that we have, Cropin is able to attract veterans from the industry," Krishna says.

It might turn out to be the recipe for the startup to be ahead on the road to becoming not just another tech unicorn from India, but possibly the first agtech unicorn in the world.

Edited by Saheli Sen Gupta

![[Product Roadmap] How CropIn developed tech solutions to address challenges faced by farmers](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/CropIn-1633433693111.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)