9Unicorns

View Brand Publisher9Unicorns’ fifth closure at $100 million sets a benchmark as India’s largest accelerator fund for early-stage startups

9Unicorns, India’s leading early-to-growth stage accelerator fund, has announced the fifth closure of its maiden fund at $100 million. The fund has so far invested in 110+ idea and product startups including a few growth-stage players like Vedantu, ShipRocket, and ShopKirana.

Touted as ‘India's Y Combinator’, Mumbai-based accelerator 9Unicorns – India's first stage and sector agnostic accelerator VC that provides acceleration support and seed funding to early and growth stage startups – recently announced the fifth closure of its maiden fund at $100 million.

While the fund was launched in late 2020 with a total size of $50 million, the overall positive sentiment in the Indian startup ecosystem and the fund’s current portfolio performance has led it to double to $100 million so far.

Focussing on deeptech, enterprise SaaS, Web 3.0, fintech, media, insurtech, healthtech, edtech and D2C startups, the accelerator fund has made investments in more than 110 deals so far. It plans to invest $500K to $1 million in idea-stage startups and, up to $2 million in high-growth stage (Series C and above) startups this year. The fund has invested in startups like , , , , , , IGP.com, Faarms, , and .

Commenting on the fifth close, Dr Apoorva Ranjan Sharma, Managing Director and Founder of 9Unicorns, said, "Our unique approach to redefine idea-stage funding has led to an increased fund size with several leading LPs believing in our strategy.”

Besides, last year was one of the best times for the startup ecosystem with a funding rush. We invested in 101 deals in 2021 and plan to double that amount this year. We will finish deploying the fund by mid-2023, post which we plan to launch our second fund,” he added.

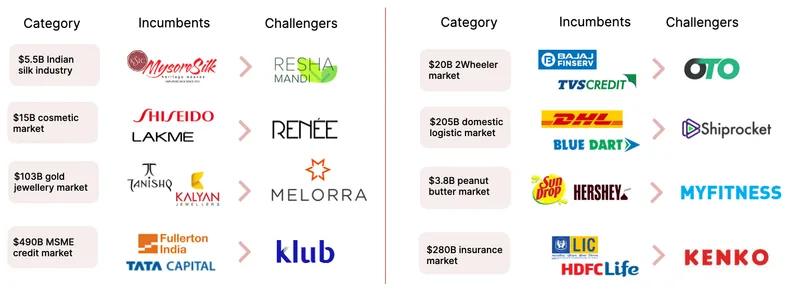

Some of the category leaders from 9Unicorns portfolio

Backed by global LPs, 9Unicorns’ USP lies in the fact that it allows the startups to tap into its vast Indian business communities in cities beyond the metros, immediately enabling them to go pan-India. It directly allows getting early customers, distribution partnerships, cross-portfolio synergies for startups leveraging the pre-existing network of over 5,500+ investors, founders, and executives in its ecosystem.

9Unicorns' strength and focus is on a hands-on support ecosystem for startups beyond the capital. 9Unicorns, besides investment, opens doors to the startups for access to a vast network of successful founders, category-leaders, CXOs of large corporations, seasoned angel investors, and partners of global VC funds. Every portfolio company receives access to TopLine Push ($5 million revenue growth via its business networking community), D Day (Global Demo Day with 900+ VCs), C Day (Corporate Demo Day with 100+ corporate CXOs), Head Hunting (talent pool from 1000+ senior leaders), WeNetwork (internal networking platform among portfolio and mentors).

Addressing the gap of seed funding in India

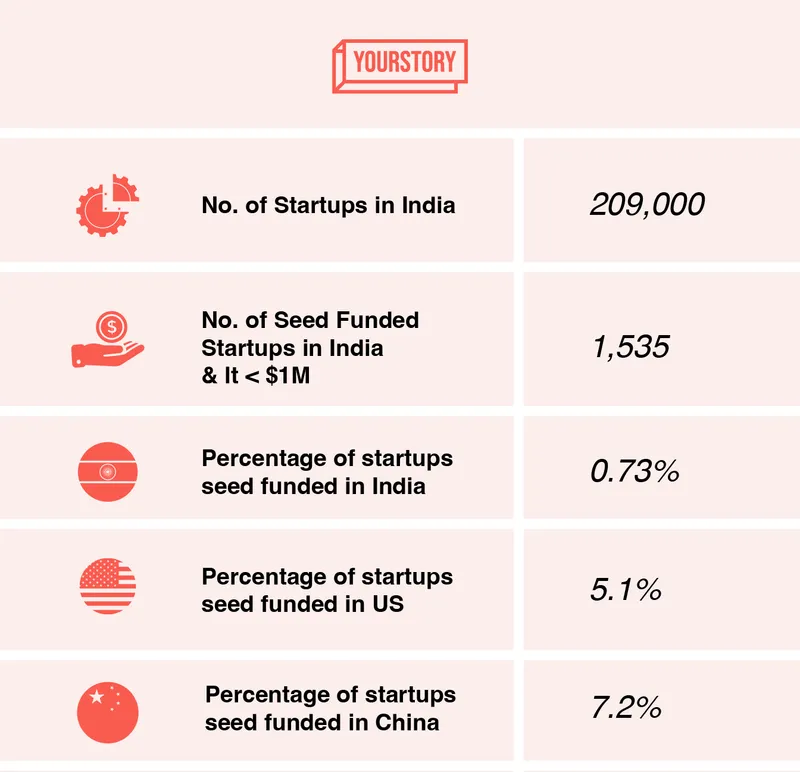

India has over 209,000 startups as per data platform . Yet only 1,535 startups are seed funded, that’s barely 0.73 percent, the same rate is 5.1 percent and 7.2 percent in US and China respectively - a gap that 9Unicorns hopes to address.

To do this, the VC reviews and reaches out to more than 700 startups every month to ensure that seed funding in India improves, and more founders get access to funding and resources to solve local and global problems.

9Unicorns’ current extension of the fund to $130 million is a step in the right direction to close this crucial gap in the Indian seed funding space.

A rich and varied startup pool

Till date, 9Unicorns has reviewed over 9,180 startups, and invested in 110 deals. It has been able to attract a rich and varied startup pool, ranging from serial entrepreneurs starting their next innings, the best tech talent from top institutes to the most disruptive startups from Tier II and III cities in India.

One of its portfolio founders is Anurakt Jain - an IIT Delhi alumni and prestigious Kauffman Fellow. Before starting Klub, Anurakt was ex-intrapreneur at InMobi where he helped create two global businesses, Glance and TruFactor, as core growth areas for the group. He is an ex-venture capitalist at Vertex Ventures, himself.

‘’9Unicorns has been a key supporter from Day Zero for Klub. The team is more like founders turned entrepreneurs, 9Unicorn’s latest fundraise from $50 million to $100 million has enabled them to double down in portfolio significantly in subsequent rounds of financing. In current markets, it has become extremely crucial to have a long-term committed partner like them in any startup,” said Anurakt.

Another portfolio founder Dr Arbinder Singal, a pediatric surgeon by qualification, and a 2X successful entrepreneur who sold an internet startup a few years back said “9Unicorns’ ability to co-invest with top tier funds is remarkable. They are one of the most founder-friendly teams in the VC ecosystem. As we build Fitterfly into one of the largest digital healthcare platforms, their partnership and pace of decision making over multiple rounds is something I would always recognise as their most important quality,”

Tags: 9Unicorns, VC, Seed Funding, Venture Capital