[Product Roadmap] How deeptech startup SatSure is turning satellite imagery into intelligence

Bengaluru-based deeptech startup SatSure processes satellite imagery with its proprietary tech and combines it with external data sets to generate actionable insights in the form of dashboards, APIs, mobile apps, and reports.

A simple image clicked by satellite has the potential to solve the most complex problems on ground. When combined with technology and data, the layers within that image can provide unique insights into almost any place on the globe.

Now, while the geospatial data could help researchers, private sector players, and policymakers address critical challenges, only those with considerable expertise can extract and analyse valuable data from that particular imagery.

Bengaluru-based deeptech startup is looking to build and provide for that expertise.

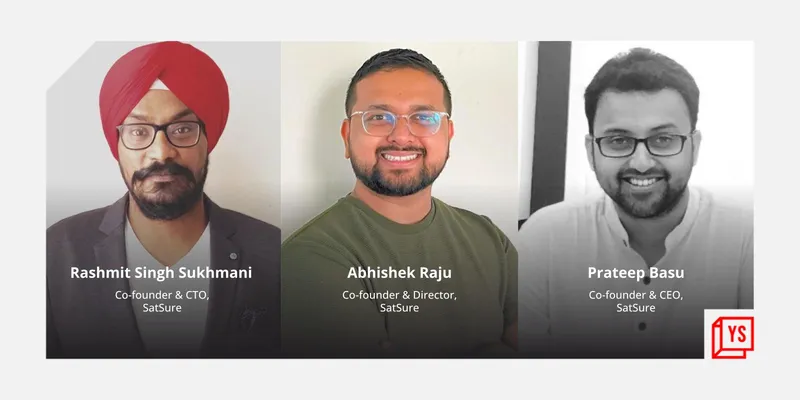

Founded by former Indian Space Research Organisation (ISRO) scientists Prateep Basu and Rashmit Singh Sukhmani, and Abhishek Raju, SatSure applies Machine Learning (ML) algorithms to petabytes of satellite imagery drawn from various sources, and combines them with weather, IoT, social and economic datasets among many others, to generate location and sector-specific actionable insights.

The insights, in the form of reports, APIs, dashboards, and mobile applications, could be leveraged by government, policymakers, banks, and private manufacturers, to address problems in their respective domains and improve processes.

Satellite images contain an incredible amount of data, and hence creating an end-to-end system, right from sourcing the images to its effective usage and application by the end user, is an arduous task. The team at SatSure has spent the last five years working on the value chain to unlock the innumerable potential of satellite imagery.

From a simple tech stack to building standardised plug-and-play SaaS tools, the startup today has about 34 enterprise clients spread across Southeast Asia, Africa, and Latin America. It works with brands like ICICI Bank, Reliance General Insurance, and Samunnati Finance apart from state government departments and research firms, which are using its offerings for present and predictive analytics.

Building the intelligence

Equipped with the relevant tech know-how at the back of their respective science and engineering backgrounds, the founders started out by understanding the needs of two specific sectors — agriculture and BFSI.

This was a part of their primary and secondary survey where they met with bank officials, agri scientists, BFSI experts, and farmers to analyse the problem statement at hand before devising the analytics.

As a part of their initial assignment, the team looked at providing insights to a bank to help reduce its operational costs and improve loan collections in a particular region. This included building a dashboard to provide end-to-end monitoring of farmlands that would help bankers determine and analyse cropped acreage, yield predictions, availability of ground and surface water, price movements, and so on.

The analytics would allow them to reduce the requirement of regular customer visits, decreasing the loan life cycle management cost besides assessing if the loan proceeds were only being used for farming, and hence cut down operational costs and bad debts.

The first step of the process was sourcing satellite imagery. While some images are freely provided by government channels, others are sold by commercial organisations and companies on their respective platforms. Marketplaces like UP42 and Geocento aggregate the satellite data provided by owners like Airbus, Planet Labs, Spire Global etc, and sell them on request.

The frequency, resolution, and type of the imagery vary as per the use case.

Sourcing of images is one of the major costs borne by a startup in this space until it has its own set of micro satellites. With a limited budget, SatSure decided to begin by sourcing images from both commercial and non-commercial channels.

The second part of the chain involved deriving insights from the imagery. In a span of 12-13 months, the co-founders, along with their small team of experts, built a technology stack of big data analytics and proprietary algorithms, into which the imagery was fed, along with parallel computing techniques and other set of data, including market pricing, soil data, land title records, social and economic datasets, and weather information, to generate historical, current, and predictive analytics in the form of farm reports and dashboards.

“It is all about refining raw data into actionable insights. It took us almost two years to hit the market as we continued to perfect our product,” Rashmit says.

Over time, SatSure built multiple AI models that ran through its servers simultaneously to provide different solutions.

SatSure Sparta explorer

SaaS play

As the startup started gaining more clients and building on more use cases, it looked at standardising these multiple models and building a plug-and-play SaaS product that would serve stakeholders in the agriculture financial services and banking sector, across the board. This led to the inception of SatSure Sage.

The SaaS tool provides a life cycle risk monitoring and business intelligence product suite to agriculture banking/financial services to manage risk and take decisions about loans and payouts.

For farmers, the benefits are reduced financial friction. So far, SatSure says, its systems have helped two million farmers secure loans, and 400,000 farmers settle insurance claims much faster than was previously possible.

Since every use case and requirement differs, the startup provides customisation in the tools through layers of external data and information, depending on the problem the client is looking to solve, Rashmit says.

Sage’s core clientele is banks, government departments, and insurance companies.

“It's a continuous process. The algorithms are continuously evolving, and incremental innovations and data upgradations into the system will continue to take place. New images are captured and processed regularly, and new analytics are generated to be fed into the system. This process has been standardised,” the co-founder says.

The startup also launched an open innovation platform — SatSure Sparta — where innovators can bring their own set of data and merge with SatSure’s APIs to build new products in the field. “A lot of our unique use cases have come from Sparta,” he adds.

Expanding use cases: SatSure Skies

Following the launch of Sage, the team looked at expanding its use case to the non-agriculture segment, specifically the utilities, infrastructure, and energy sectors.

In 2019, SatSure launched its second SaaS product, Skies, which provides remote sensing for infrastructure monitoring/change detection.

For instance, a cement manufacturer looking to increase his sales could use the Skies platform and leverage satellite imagery to locate construction sites or potential leads instead of running tedious and costly on-ground surveys. He could aggregate coordinates on the map and approach those locations to have a higher hit rate of selling.

“We have developed algorithms and AI/ML models, which do this on a scale and on cloud, and can filter the information like types and size of the sites as per client needs,” says Arpan Sahoo, Assistant Vice President, Program Management, SatSure.

The idea is to help companies lower operational costs.

The same service can be leveraged by utilities and highway authorities looking to lay large networks of transmission lines/towers and roads, respectively, or solar manufacturers looking to map potential sites in a feasible and cost-effective manner.

Damage assessment (floods, cyclones, earthquakes) is another area that the SatSure system caters to.

“We worked with the Kerala government during the 2018 floods. Our system identified flood pockets and damaged areas at a pixel level and this information was leveraged for timely mobilisation of resources. This had helped in evacuation of more than 12,000 people,” Arpan says.

As a part of their future roadmap, the company may look at supporting the mapping and analytics requirements for mobility and ecommerce players.

SatSure was awarded as the top 3 innovators of AP Agri Tech Summit, 2017

SatSure today operates with a 100-member team comprising data scientists, business development executives, agri scientists among others. It operates in Switzerland and the UK as well, and has customers in Myanmar and the Philippines.

The startup recently acquired US-based geospatial startup Old City Innovations (OCI), which provides geospatial services in the domains of mortgage, agriculture, insurance, and drone markets in the US.

Its key clients, including names like Syngenta, DMI, and Applied Residential, will be taken over by SatSure, which aims to leverage OCI’s expertise to expand its geospatial analytics business footprint in the US market.

In February 2022, SatSure raised $5 million in a pre-Series A funding round led by Baring Private Equity India and ADB Ventures, Asian Development Bank's venture arm. It had previously acquired Indore-based farm management SaaS tool CropTrails.

Next stop: Fleet in space

SatSure has been silently working for the past one year to build its own Earth Observation (EO) satellite payloads. It has hit the proof-of-concept stage and completed the base version of the satellites.

It’s a capex-heavy business but would ultimately bring in economies of scale as the startup would be able to reduce the high-resolution imagery sourcing costs and gain control over the type of satellite data required as per their use cases.

“The idea is to build an end-to-end EO data and analytics stack and serve multiple sectors. The applications of satellite data are countless, and we will continue to explore unique use cases and help bring in efficiencies,” the co-founder signs off.

(This story was updated to correct a name and designation in a photo.)

Edited by Teja Lele

![[Product Roadmap] How deeptech startup SatSure is turning satellite imagery into intelligence](https://images.yourstory.com/cs/2/a0bad530ce5d11e9a3fb4360e4b9139b/ImageEditorSuman25-1654613046964.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[Product Roadmap] How CropIn developed tech solutions to address challenges faced by farmers](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/CropIn-1633433693111.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Tech50] How GreenSat is using satellite imagery and tying up with institutional banks to serve the agricultural sector in India](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/Featureimages-newdeck9-1640183533349.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)