How Credgenics ‘SaaS’ed the lenders loan recovery and resolution game

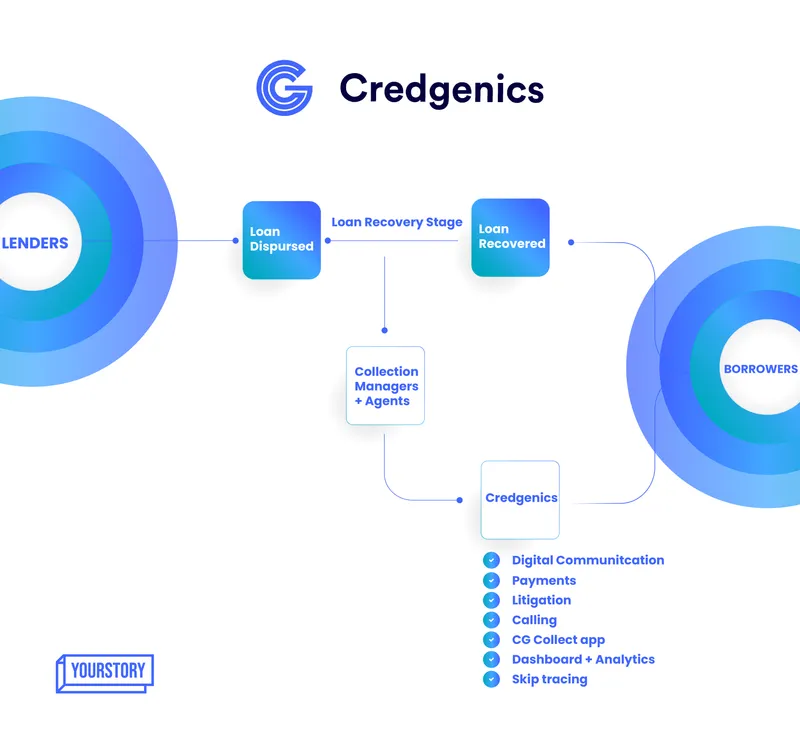

Started as a litigation management tool, Credgenics today offers an end-to-end SaaS platform with 8 modules around communications, billing, litigations, and collections, enabling lenders to improve recovery rates.

A couple of years ago, the fintech wave swept Indian startup shores, with scores of innovators building products across lending, payments, budgeting, insurance, and more.

While almost every part of the financial services thread was being picked up and upgraded with technology, there weren’t many solving for one of the major pain points of financial institutions—collections, or loan recoveries.

Delhi-based startup was among those that picked this problem and looked at automating a debt recovery and collection pipeline for lenders, with SaaS.

Since its inception in 2018, the startup has created a collection management tool for banks, NBFCs (Non-Banking Financial Companies), and fintechs that allows them to streamline and manage their loan recovery workflow, including litigations, billings, payments and collections. The tool also creates an effective communication channel with borrowers through tech and analytics, consequently increasing loan recovery rates and reducing collection costs.

“Collection as a category has always been mostly manual. Multiple systems or software are deployed by banks, FIs, or fintechs for collection and recovery, but they all work in silos,” says Co-founder and CTO Anand Agrawal. "There was a need for a single tech solution to make this process efficient."

Today, the platform has built 8 modules that lenders can pick and choose as per their needs and integrate with their systems. Each module has been created over time to cover different processes/stages involved in the debt resolution journey, starting from the pre-due stage to writing off an account.

Credgenics Founding Team

‘Legally’ starting out

Credgenics is the brainchild of IIT alumni Anand Agrawal, Rishabh Goel, and Mayank Khera, who studied law at GGSIPU, Delhi. While Rishabh, the current CEO, worked in the financial sector for Deutsche Bank and BlackRock, Mayank is a practising advocate in Delhi courts.

The trio started out by building a simple Customer Relationship Management tool to help fintechs manage their litigations around lending.

This involved tracking legal cases for courts and consumer forums, appointing and allocating matters to advocates, sending out legal notices (digital and physical) to borrowers, seeking and providing approvals, tracking vendor billing besides maintaining and tracking the overall data and documentation relating to cases. Typically, the process is managed manually by lenders on excel sheets and no specialised tools are deployed.

“The initial idea was to have a CRM type of a platform where lenders can get clear visibility of delinquent accounts, select them and have a digital notice sent out in bulk, automatically, via different channels followed by tracking,” says Anand.

Some of the initial clients included fintechs and NBFCs, who could integrate their systems with the Credgenics platform. The Application Programming Interface software would store and manage the information and take care of the processes, while in-house teams would communicate with borrowers.

By 2020, the team looked at digitising other parts of debt collection, as they continued building on their platform and expanding its offerings.

“It was just not the legal aspect which needed to be solved but the entire end-to-end collection space, starting right from pre-dues where the default has not yet happened and the reminders are being sent, to customers missing out on their payments, and thereon the last stage of the account being written off,” says the co-founder.

“All these processes were broken. Even the largest of the banks were running collection systems manually,” he adds.

Interestingly, the entire tech was built by the founders, along with a couple of their juniors as interns, and the first external hire (a product manager) was made after 1.5 years.

Building the digital ‘nudges’

Given the complexities of financial processes, it was crucial for the team to understand what their clients need and co-create different modules for them. The strategy for a home loan collection for a bank could be very different from the requirements of a fintech lender offering small ticket loans. Hence, each one required a different campaign and a mix of different modules to connect with the borrower.

The startup looked at offering its platform mostly to fintechs during its early years of operations as it provided them a larger space to experiment and understand in-depth the key performance indicator (KPIs) they (lenders) want to drive. This could be costs, average resolution time, and so on.

For this purpose, they spoke to multiple lending players and built case studies before offering the tool to the banks.

“There is a common collection pattern followed among lending players. There is a popular precept—collections aaise he hota hai (Collections happen in a set way). We started thinking out of the box by taking cues from the market. Can a rule engine be created for debt collections?” Rishabh says.

Communication with borrowers comes at different stages, typically pre-delinquency and delinquency. Now, this can be done via multiple digital channels like SMS, WhatsApp, emails, IVR, and calling.

The founders explain the idea is to automate this communication where next stages and follow-ups are triggered automatically based on a borrower’s response to the previous stage (event-based communication), covering the entire collections lifecycle. It leaves to the lenders how they want their communications/campaign to be designed (how, what, and when communications should be sent).

They can supervise, track, and make adjustments to such communications should they choose to. The team continues to add new channels like AI-enabled voicebots and chatbots to send soft payment reminders in different languages.

Calling was introduced as a separate module owing to its sensitive nature as it involves a direct human-to-human interaction, the co-founders explain.

What Credgenics set out to build was capabilities to turn a ‘cold call’ into effective calling with the help of AI. For instance, this particular module looks through the loan details and the system triggers bulk calls to all cases through a round-robin method. With relatively lower call drops and lesser time wasted on waiting, the agents can make more calls within the monitored time. This approach, as per their study, increases the effectiveness of calling.

Analytics at the core

Data analytics form an important part of the entire automation process that Credgenics has built.

By 2021, as it started gathering more customers data with the help of payment history, CIBIL scores etc, the platforms worked on building a ‘data intelligence layer’ on top of its system, to yield behavioural insights for the lenders.

These insights could be around a borrower’s intent to pay, probability of payment success, categorisation of borrowers (low, medium and high risk) and so on. This enables lenders to identify and prioritise the collections cases and also draw predictions. It is working on a tool to recommend the best possible collections strategy for each case.

Developing new modules

Owing to the feedback loop, the 100-member team went on to build 8 different modules ranging from predictive dialling, litigation management to different communications engines—all serving one purpose, to help lenders collect loans better.

At present, Credgenics is handling about 2.2 crore loan accounts on its platform. According to the company, its clients have been able to register a 20 percent increase in overall resolution rates, and a 25 percent increase in the collections amount, while the total collections cost has been brought down by 40 precent.

It has onboarded over 75 clients including ICICI Bank, Kotak Mahindra Bank, Yes Bank, IIFL Home Loan, Hero FinCorp, LoanTap, Reliance Asset Reconstruction, and Tata Capital.

Recently, it introduced a payment module, Billzy Payments, which allows lenders to generate ‘borrower-specific' payments links, supporting multiple digital payment modes. The data for fields such as outstanding loan amount and loan number are automatically populated.

To streamline the communication between collection managers and their on-field agents, the startups also developed a mobile app that allows the former to assign tasks and track the latter while agents can map details for borrowers/loans (allocation month, DPD values etc) and schedule visits.

This takes us back to the ‘broken’ management system among lending players and the Credgenics inception proposition. Since Credgenics ties up multiple systems on a single platform, a simple update regarding the loan process or a borrower’s behaviour/action is updated across the board, right to the agent on field to the team writing off accounts in the back office, enabling everyone to work as a single unit.

Replicating success

The platform has taken a hybrid cloud infrastructure approach and never remained dependent on a particular cloud infrastructure, apart from heavily investing in the latest technologies since the beginning. This has allowed it to scale up its system smoothly.

The startup is now looking to replicate its success in the South East Asian market, besides focusing on strengthening R&D capabilities.

“Building a smart collection system is a continuous process,” says Anand, as the founders wrap up their weekly catch-up meeting with clients to talk metrics, performances, and features that could be added. “Eighty percent of our product is based on feedback. Majority of our features have been built after such meetings. It’s a co-build exercise.”

(This story was updated to correct the number of modules offered by the company.)

Edited by Teja Lele

![[The Turning Point] Why Paytm-backed CreditMate pivoted from bike loans to collections](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/TP-1589549412585.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)