No funding winter at Inflection Point Ventures as it adds 100+ investors every month

The Gurugram-based angel investment platform says its strong diligence process and post-investment support for startups gives it an edge with both retail investors and the companies it backs.

Jignesh Kenia, a chartered accountant who holds a key position at a media company, has been an angel investor since 2018. He has invested $250,000 so far in over 50 startups, and exited from seven with an internal rate of return of more than 150%.

Jignesh has been investing through angel investment platform Inflection Point Ventures (IPV), which has created an ecosystem to benefit both entrepreneurs and investors.

Since its inception in 2018, Gurugram-based IPV has been driving the narrative that startup investments are not a huge risk while providing an opportunity to investors who come with relatively less amount of capital.

Founded by professionals who had decades of experience in the financial services world, IPV was quite clear on why and in whom it would like to invest.

“Our core objective has been to democratise the world of angel investment,” says Ankur Mittal, Co-founder & COO, IPV.

The other co-founders of IPV are Vinay Bansal, Mitesh Shah, and Vinod Bansal.

Today, the early-stage angel investment platform has an investor base of over 7,200 people, and more than 60% of them belong to the CXO category from around 45 countries.

The start

Ankur says the co-founders, including him, went about creating their own channels to get into the funding mode.

The founders saw that a significant number of early-stage startup investments were very personality-driven, i.e., based on decisions made by a key individual who is well-connected within this ecosystem.

“This investment philosophy was driven by who is investing rather than whom you are investing in,” says Ankur.

IPV started creating its own network of investors, which mostly included CXOs of companies. It also consisted of professionals who were experts in their respective fields--be it finance, tech, HR, etc., which led to startup deals coming onto the platform.

“We consciously built a CXO-driven platform, which ensured better deal flows and deeper relationships within the ecosystem,” says Ankur.

However, the core focus of IPV was there should be a return on investment (RoI) as it had many investors who were partaking some amount of money from their salaries to be part of this funding activity.

Focus on returns

To ensure better returns for its investors, IPV put in place an exhaustive due diligence process for any startup investment, which was backed by its CXO network, which had sectoral experts.

Ankur says IPV has built a proprietary scorecard, which looks into 30 variables and has over 400 plus questions. Based on the feedback of startup founders, it gets inputs from its investors.

“We combine the art and science of investing though one cannot discount the element of luck,” remarks Ankur. He adds, “We are constantly improving our selection process, which has reduced the failure rate of startup investment.”

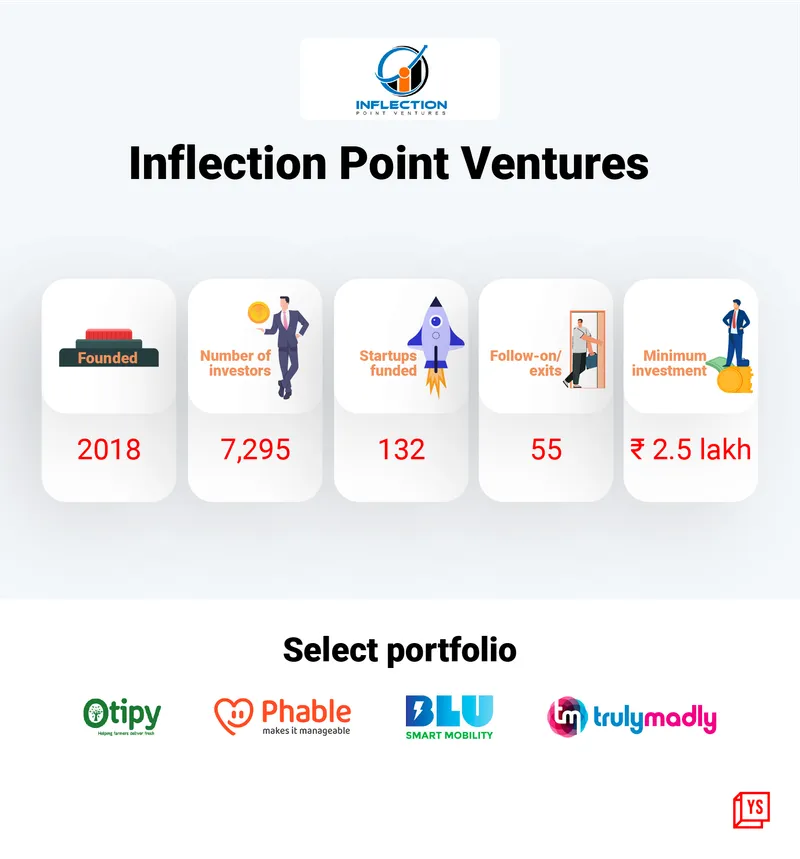

Ankur claims that of the 132 investments made by IPV till now, only four startups have failed to return the capital, and 55 of them have gotten exits or follow-on funding.

No funding winter

Given the present environment of a funding slowdown, Ankur says IPV is doing more investment deals than last year.

The platform is adding about 100 plus investors every month, with 80 percent of them coming through referrals.

“This environment works very well for us as people will invest in opportunities that are well-researched,” says Ankur.

This has had a bearing on the quantum of investment that IPV makes into each startup. The average cheque size was around Rs 2.5 crore in 2021, and this has increased to Rs 4 crore in 2022.

Today, any investor can come onto the platform with a minimum investment of Rs 2.5 lakh. IPV has close to 7,200 investors on its platform at present, and it has made 132 startup investments amounting to Rs 520 crore.

Angel investing platforms are something similar to crowdfunding but are more structured where deals are sourced and presented to the investors, who then decide whether to invest or not.

Ankur also cites the example of March 2020 when the first nationwide lockdown was announced to combat COVID-19, and cheques dried up for startups. It was during this time that IPV invested in startups such as Otipy, Samosa Party, BluSmart, and Toch, which have all gone on to raise their next round of funding.

“We were willing to write the cheques, but did not drop our due diligence process,” says Ankur.

Benefitting both investors and entrepreneurs

The investment philosophy of IPV has benefitted both investors and startups. For the investors, they get an opportunity to invest in a good asset class, and Ankur believes it has created a level playing field.

In the case of startups, besides the money raised through the platform, it gets access to other important inputs like connections, market linkages, strategic inputs, etc., all due to the CXOs available on IPV.

“We identify areas where the startup founders need help and our network does the needful,” says Ankur.

IPV is a stage and sector-agnostic platform for startup investment. It typically comes in at a seed and pre-series A stage of funding.

The USP

In terms of competition, IPV runs into other angel investing platforms like Indian Angel Network (IAN), Mumbai Angels, and Ah! Ventures, as well as incubators and accelerators.

Ankur believes the strong diligence process and post-investment support for startups give IPV an edge in the market. It has built strong linkages with other VCs, family offices, and universities, which helps support its startup portfolio.

According to an investor, the big differentiating factor for IPV is its lower investment threshold, which is not the case with other platforms, where an investor will have to invest anywhere above Rs 5 lakh.

In the present funding environment, Ankur is quite clear about the startups IPV wants to invest in. Unless they can show an 18-month runway in terms of capital availability, it will not invest.

He remarks that during the boom time of 2021, IPV had advised its startups to raise as much capital as possible, because one never knows when the situation would change.

The platform also launched a new VC fund called Physis Capital early this year with a size of $50 million to invest in pre-Series A to Series B startups.

Ankur says Physis Capital will allow it to invest in those startups in the IPV portfolio, which are absolute winners.

“We have never believed in the FOMO (fear of missing out) style of investing, and IPV has created an ecosystem where one earns the trust of the investors,” says Ankur.

Edited by Megha Reddy

.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)