How JARVIS provides costly investment services to the common man at affordable prices

Mumbai-based startup JARVIS AI offers personalised portfolio management services to users at affordable prices based on their risk tolerance.

The process of investing looks very different for a high-net-worth individual (HNI) and somebody who wants to invest smaller amounts. For HNIs, there are banks and investment firms, brokerages and brokers. For the smaller guys though, we’re mostly left to our own devices, to make (mostly uninformed or at least half-informed) investment decisions ourselves.

A big reason retail investors don’t make a lot of money off of stock markets is a lack of proper, informed, and researched guidance. For example, portfolio managers in a traditional set-up keep reevaluating and course-adjusting the assets they manage for investment purposes. Retail investors either don’t know how to read these signals portfolio managers do, or don’t know how to react to them, which is why they lose out on lucrative investment opportunities.

wants to change that.

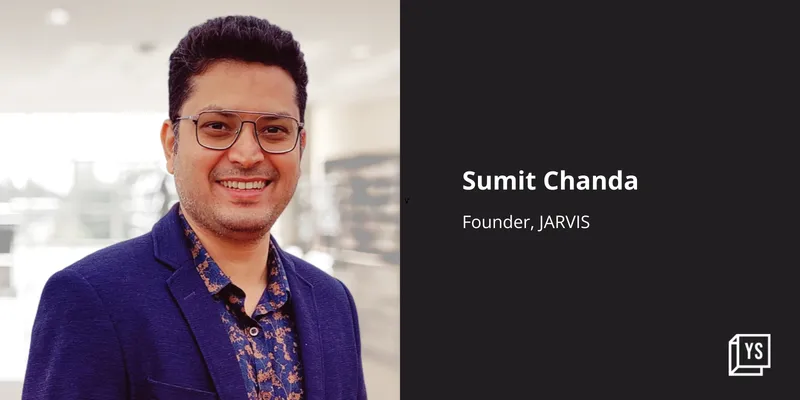

Founded in 2016 by Sumit Chanda, JARVIS is an artificial intelligence platform that provides end-to-end, tailored, and personalised investment services for retail investors. It targets people who have Rs 30,000 to Rs 1 lakh to invest, and it does all the functions of a traditional investment bank, including asset reallocation and risk management.

“JARVIS was founded with an aim to address limitations in the traditional equity investment model,” Sumit says.

These limitations were mostly lack of access to personalised investment advisory, the influence of human emotions and biases during investing, absence of a risk management system, and a one-size fits all approach.

JARVIS manages to address these limitations via its artificial intelligence, which uses the reinforcement learning model to keep getting smart over time.

Today, the AI platform uses 1.2 crore local and global data points to determine investment outcomes and make decisions, Sumit says.

How it works

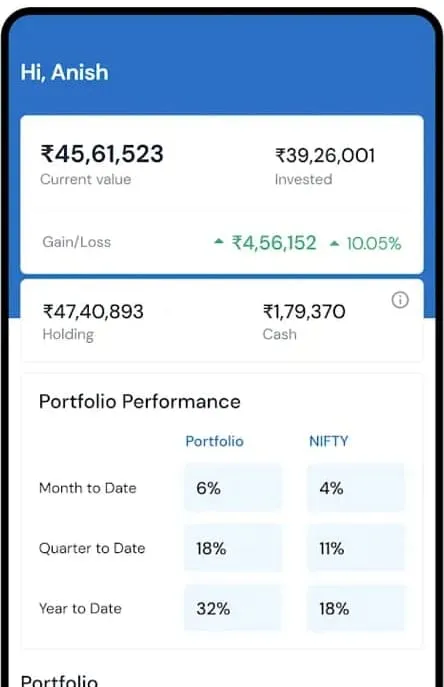

JARVIS Invest, the startup’s retail investors-focused platform, puts each user through a quick risk assessment test consisting of 10 questions to gauge their risk appetite, and then assigns one of six risk profiles (from risk-averse to very aggressive).

The platform then creates a personalised portfolio of stocks and other financial instruments based on the profile, as well as real-time market movements.

"Each portfolio is unique to the user’s requirements, all created in real-time. The same user may get two different portfolios depending on real-time market conditions at two different times of the day," Sumit says.

The AI then keeps tracking the portfolio’s performance—much like an investment manager would—and recommends rebalancing when it deems necessary. It also provides real-time advisory to users on profit booking, partial profit booking, exits, and portfolio resent. The user has to only accept or reject each recommendation or trade.

Sumit says JAVRIS-curated portfolios have provided average returns of 50%-80% across portfolio categories to date. Its risk management capabilities were able to recently predict the market crash of March 2020 and January 2022.

Most of JARVIS’ early adopters have been millennials between 25-40 years. The platform has over 85,000 customers and has crossed Rs 100 crore in assets under management.

Business model

JARVIS charges users around 2.5% of their total portfolio, similar to a portfolio management service. Users pay 1.25% when they’re being onboarded, and 1.25% after six months on the real-time portfolio value.

The startup says it hasn’t reached break-even yet—it expects to do so by FY24-25.

Nearly $600K has been raised by JARVIS in funding so far from a family office in Dubai. The company was bootstrapped until October 2021, after which it raised a pre-series round of $1 million from BNP Investments.

The platform has generated 50,000 personalised portfolios, it says. It processes around 2,000 transactions daily, including fresh portfolios, rebalancing, and general stock buys and exists. Its DAUs are about 3,000 to 3,500.

In the coming months, the Mumbai-based startup plans to expand its operations to the UAE markets. It wants to eventually expand to other Middle Eastern countries, as well as the US.

JARVIS competes with the likes of Blackrock’s Aladdin, IDFC AMC, and SmartMoney Investment Advisors, although there are some differences between each of the companies’ models. Sumit claims JARVIS is India’s first AI-based advisory platform for retail investors.

Startups like , , TradingRooms by RAIN Platforms Inc, , , , and also perform similar functions as JARVIS—recommending stock buys and putting together personalised portfolios for retail investors at affordable prices.

As per data from the National Stock Exchange (NSE), the share of retail investors in companies listed on the NSE reached an all-time high. Retail investors held Rs 19.16 lakh crore in listed companies, as of March 31, 2022, up from Rs 19.05 lakh crore in December 2021.

Edited by Megha Reddy