BNPL catches festive cheer, ecomm spending up 60% despite regulatory hiccups

Lending apps such as ZestMoney, LazyPay, and KreditBee are expecting strong numbers this festive season on demand for zero-interest equated monthly installments and short-term personal credit finance.

The 'Buy Now, Pay Later' segment is experiencing a revival of sorts this festive season, dusting off from a rut after the central bank recently cracked the whip on the digital lending sector.

, , and are anticipating strong numbers this festive season as more shoppers opt to pay via zero-interest equated monthly installments and on increasing demand for short-term personal credit.

“The loan disbursement we did this time during the festive season saw over a 100% growth compared to last time,” says Ishan Bose, Chief Marketing officer at KreditBee. "What also added to the vigour this time was the sustained lull during the last 2 years, which translated to the first full-fledged festive season after the pandemic hit."

KreditBee, which has partnered with , , , , , and Tata Cliq, provides personal loans up to Rs 4 lakh via its own licensed NBFC, Krazybee, and other lending partners such as IIFL, InCred, and PayU Finance.

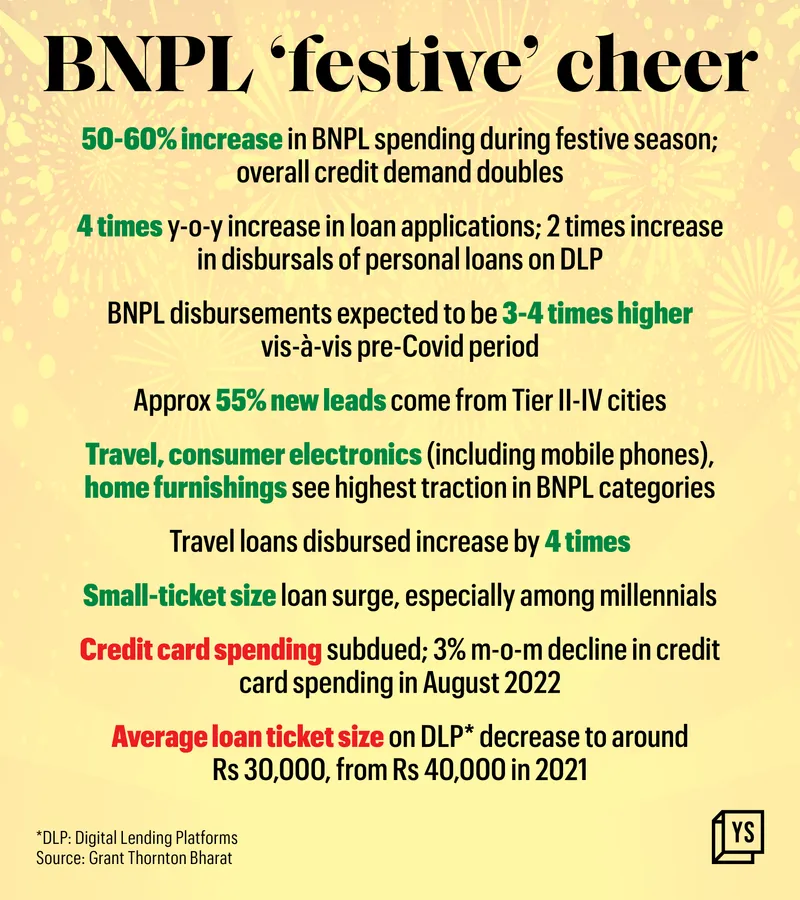

BNPL spending during the festive sales season that began in the last week of September is up by 50-60% as compared with a similar period during last year's season, fuelled by payment gateways, fintech platforms, and banks. BNPL disbursements this year are also expected to be 3-4 times higher the pre-pandemic period, according to estimates by Grant Thornton Bharat.

In July, the Reserve Bank of India (RBI) barred fintech companies from loading prepaid payment instruments (PPIs) such as prepaid cards and mobile wallets using credit offered by non-bank institutions.

In response to the central bank’s move, several BNPL players including Uni, Slice, LazyPay, and KreditBee, which also offered credit via prepaid cards and wallets through non-bank partners, temporarily halted some of their operations.

Since then, however, fintech startups have been gradually updating their terms and business models to comply with the new guidelines and are focusing on providing BNPL services via short-term personal credit, leveraging partnerships with online merchants.

The non-metro booster

As per the estimates of Grant Thornton, a typical festive season results in 25-30% excess credit demand, but this year, there has been approximately 50% increase in credit resulting from new leads coming in from Tier II-IV cities (approximately 55% of overall new leads).

“Coupled with that, the pent-up demand owing to the pandemic has been sharply driving the festive season consumption, and credit demand, by extension,” says Naveen Malpani, Partner and Consumer Sector leader at Grant Thornton Bharat.

For KreditBee, almost 70% of the credit demand was driven by non-metros, typically coming from people in the age group of 26 -34 years. The average range of credit availed was up by 25% owing to higher demand, as well as credit policy basis sustained optimisation, he adds.

New customer applications for ZestMoney (provides loans up to Rs 2 lakhs) also went up by 10X in the last few months in the run-up to the festive sales, while majority of its customers continue to be millennials and Gen-Z, with well-rounded demand from Tier I and II markets. The average ticket size during the festive sale was Rs 14,000.

“We’ve had a great start to the festive season this year that is largely driven by buoyant consumer sentiment and strong demand for credit options like EMIs. We’ve seen an overall growth of 2X in transactions during September compared to last year. Our overall GMV growth is 3X compared to the previous season,” says Lizzie Chapman, CEO and Co-founder, ZestMoney.

ZestMoney offers BNPL services via its lending partners like ICICI Bank, Aditya Birla Capital, Tata Capital, IIFL, and InCred. In addition to digital loans via online merchant platforms, the company claims to have witnessed a 100% rise in offline customer sign-ups during this festive season sale.

“We are also getting requests from merchants to enable digital EMI and checkout finance at their stores as they have seen customers increasingly choosing EMIs for purchases. Therefore, we are doubling down on our efforts to increase our merchant network partnerships by enabling digital EMIs at checkout,” the co-founder says.

Small ticket loans pick up, average loan size recedes

Small ticket size loan segment also witnessed a surge, especially among millennials, to meet their festive demand. Few lending platforms have reported a growth of up to 97% increase in demand for small-ticket loans, out of which the number of travel loans disbursed increased by around four times.

The average loan ticket size on digital lending platforms this year has, however, decreased to around Rs 30,000, from Rs 40,000 in 2021.

Limited inflationary pressure

Similar trend was witnessed by BNPL player LazyPay, which has people in the age bracket of 30-40 age driving its volumes.

LazyPay provides personal loans (up to Rs 1 lakh) and pay later services to customers via NBFC partner PayU Finance and SBM Bank. It has tie-ups with Amazon, Flipkart, Meesho besides other ecommerce merchants. The company stopped onboarding new customers for its prepaid card launched in January 2022 in partnership with SBM Bank India and Visa.

Despite inflationary pressure, the consumer sentiment, as per the firm, seems positive.

“There was definitely a pre-festive uptick in consumer spending this year. The overall spending in August grew ~5% compared to the preceding month. There is an exponential growth of over 90% compared to last year in the overall spends between August 2021 and 22,” says Anup Agrawal, Business Head, LazyPay.

Credit cards out, digital payments in

On an average, credit cards and digital wallets comprise of 2.2% and 0.4% of overall retail transactions by value. Banks have also launched enticing offers to increase credit availability for consumers during the festive season--from cheaper lending rates to cashback and discount deals on making payments via credit cards.

However, the festive season saw subdued credit card spending, with only a few credit card providers outshining industry trends. “This is primarily because consumers in mid-to-low-income segments prefer using digital payments mode. Overall, the industry recorded a 3% m-o-m decline in credit card spending in August 2022,” says Grant Thornton.

First phase of festive ecommerce sales witnesses 5.4X growth in daily sales

Popular BNPL categories

Travel, consumer electronics (including mobile phones), and home furnishings are witnessing the highest traction in BNPL categories.

Majority of LazyPay customers availed credit in entertainment, professional services, and urban transport categories, rising by 36%, 28%, and 19%, respectively compared to the preceding months. For ZestMoney, smartphones and electronics, along with large home appliances, remained the largest category, followed by fashion and accessories and home decor.

“Interestingly, the gender split of the transactions show women driving a higher number of transaction volumes, but a similar growth for both on the amount front,” Anup adds.

Travel and personal care also remained a popular choice among borrowers.

The BNPL category within the fintech sector is growing by 65% Y-o-Y, and has recorded 9 times funding growth in 2021. According to Redseer’s estimates, India’s BNPL market is expected to soar from the current $3-3.5 billion to reach $45-50 billion by 2026.

“India’s digital lending market has grown rapidly and facilitated $2.2 billion in digital loans in 2021-22. While the mode of BNPL that depends on pre-paid instruments has encountered a regulatory impediment after the RBI restricted third-party participation in the credit flow; there has been a growth in credit demand overall,” says Naveen of Grant Thornton Bharat.

In a note, Nikhil Reddy, Senior Banking and Payments Analyst at data and analytics firm, GlobalData, had said, “The RBI’s measure has caused disruption among BNPL players, which will impact the market in the short-term. However, the overall growth in the market will continue to rise, supported by rising consumer and merchant acceptance, growing preference for electronic payments, and the increasing popularity of flexible payment methods.”

(This story was updated to correct two typos.)

Edited by Megha Reddy and Feroze Jamal