[Weekly funding roundup Oct 31-Nov 4] PE players dominate the capital inflow

As a positive sign for the startup ecosystem, private equity players emerged as significant funding contributors to startups this week.

The month of November has started on a positive note with a steady rise in the funding capital inflow into Indian startups, driven largely by private equity (PE) players such as General Atlantic and Premji Invest.

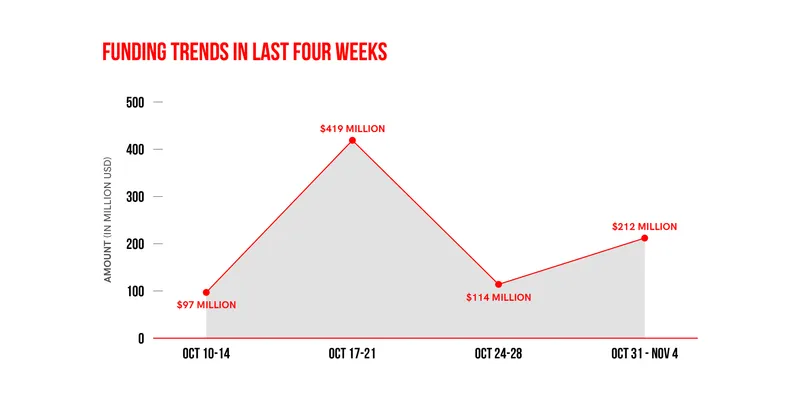

The first week of November saw a total funding amount of $212 million cutting across 18 deals. In comparison, last week saw total venture funding of $114 million.

Investments made by PE players into startups are significant as they bring a larger amount of capital. PE companies also remain invested for a longer period of time.

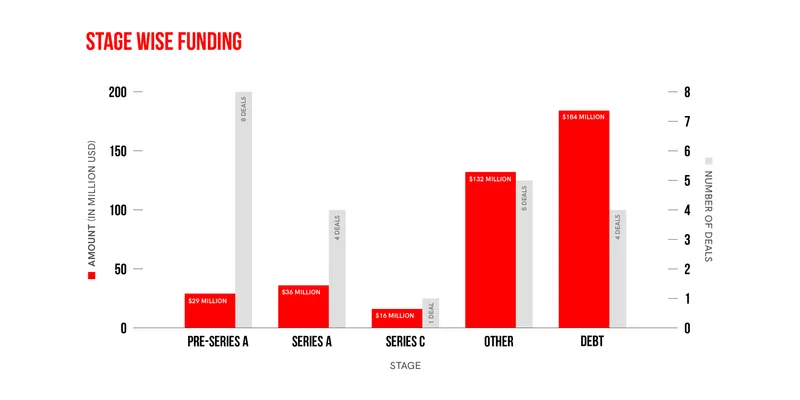

At the same time, the debt component of funding into startups continues to remain significant. This week the debt funding stood at $184 million, which was marginally higher than the $170 million registered in the comparable previous week.

However, the broader trends do not inspire a great deal of confidence as both the US Fed and Bank of England have raised interest rates, which could mean a further tightening of liquidity. Added to this, unicorns like Chargebee and udaan have announced job cuts.

It is likely this current funding winter will persist longer than anticipated and this could lead to startups reworking their business model and looking for profitability earlier.

Key transactions

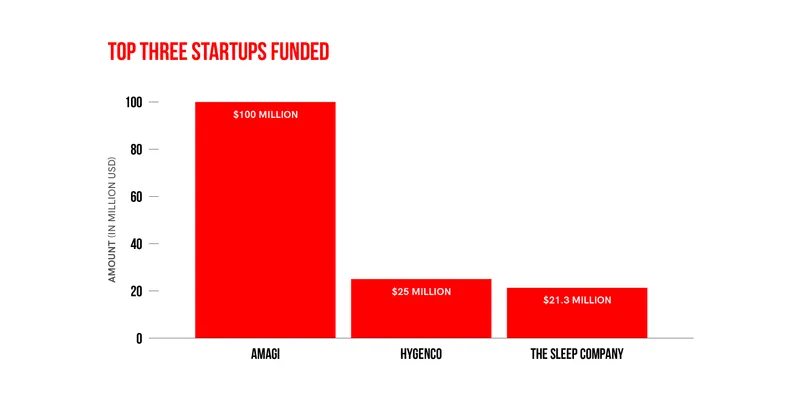

India and the US-based global media SaaS technology provider Amagi raised $82 million from General Atlantic.

Haryana-based green hydrogen company Hygenco has received GBP 22 million ($25 million) investment from SBICAP Ventures managed Neev II Fund.

D2C startup The Sleep Company raised Rs 177 crore ($21.3 million approx) from Premji Invest, Alteria Capital and Fireside Ventures.

CashKaro, a Gurugram-based cashback and coupons site raised Rs 130 crore ($15.7 million approx) led by Affle Global Pte. Ltd. (AGPL).

Solar energy startup SolarSquare raised Rs 100 crore ($12.2 million approx) from Elevation Capital, Lowercarbon, Good Capital, Rainmatter and angel investors.

Fintech startup PayVEDA raised $11.5 million in a Series A funding from SphitiCap, an early-stage, sector-agnostic fund.

Y Combinator-backed Decentro, a banking and payments API infrastructure startup raised $4.7 million from Rapyd Ventures, Leonis VC and Uncorrelated Ventures.

Edited by Affirunisa Kankudti

![[Weekly funding roundup Oct 31-Nov 4] PE players dominate the capital inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-roundup-LEAD-1667575602969.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)