Zerodha warns revenue, profitability will be hit from FY 2023-24

The company blamed not only a 50% decline in new monthly account openings and weakening market momentum, but also said it had temporarily plateaued in terms of its target market.

India’s largest stock broking platform, , has said the company will not be able to match its current revenue and profitability from the next financial year, and continuing for a few more years.

Zerodha said while it was on track to earn as much revenue and profit in FY 2022-23 as in the previous financial year, monthly new account openings since January had plunged by nearly 50%.

The decline in account openings is similar across the industry, Zerodha Co-founder and CEO Nithin Kamath said in a business update posted on the company’s website late Wednesday.

As for its revenue and profit warning, Zerodha blamed not just the decline in new account openings and slowing bull market momentum, but said it was also because the company had “temporarily hit a plateau in terms of the target market”.

“The business will also most likely get impacted due to the changing regulatory landscape, where, among many things, the working capital requirements are going up quickly,” the company warned.

Market sentiment was upbeat in November, with the benchmark Nifty index hitting a new high. Despite this, traction across several key parameters for the domestic brokerage industry has remained muted in recent months.

Zerodha posted the update as part of pitching for more transparency and company disclosures.

“From now on, every six months, we will publish updates on our business performance and financials, various risks that we face, the overall customer performance when trading higher-risk products, any technical issue reports, our internal metrics on our customer support performance and quality, and more,” Nithin said in the report.

Zerodha’s profit in FY 2021-22 surged about 60% to Rs 1,800 crore, riding a similar increase in revenue to Rs 4,300 crore, as per regulatory filings.

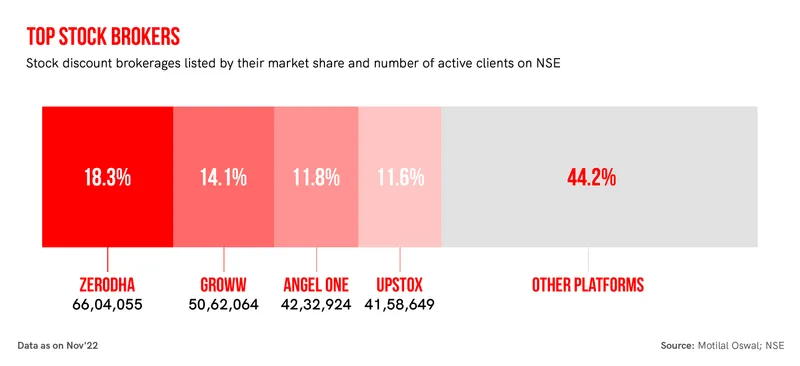

Despite a 0.5% month-on-month decline in its client base in November to 66 lakh, Zerodha remained the top broker that month with a 24 basis point increase in its market share to 18.3%, as per a 12 December report by Motilal Oswal.

Zerodha is followed by Groww in terms of active clients (50.6 lakh), Angel One (42.3 lakh), and Upstox (41.6 lakh), as per the report and NSE data. Together, the four discount brokers command about 55.8% of the market.

Zerodha valued itself at $2 billion during an ESOP buyback programme in 2021. Later, the Hurun Startup Valuation list pegged the company’s worth at $3 billion.

Groww was valued at about $3 billion during its previous fundraise in October last year, while the Ratan Tata-backed Upstox was pegged at $3.4 billion when it raised funds a month later.

Zerodha said the company has a runway for more than 15 years as it has been allocating 10% of its profit to a war chest since inception as a contingency to cover for any “black swan” event.

The company invests its funds in bank fixed deposits, government bonds, and a long-term stock portfolio. Zerodha’s portfolio currently has exposure of 33% to bank FDs, 32% to stocks, 13% to government securities, 9% to tax-free bonds, and 13% to gold bonds.

(The story was updated with a graphic)

Edited by Feroze Jamal