Zomato’s Hyperpure to kick-off ready-to-eat line, inventory stack for restaurants

The food-delivery company is preparing to launch a host of new offerings at its B2B arm that caters to restaurants—a unit it sees growing to be as large as, or even bigger than, its core business.

For a business centred on procuring farm produce, poultry, and other fresh supplies for restaurant kitchens, a ready-to-eat line might seem counterintuitive.

For Hyperpure, though, which currently services fewer than 5% of the restaurants on 's food-delivery platform, it represents a significant growth bet.

Ultimately, Hyperpure wants to build an end-to-end ecosystem for restaurants to manage their entire backend operations, with offerings including affordable eco-friendly packaging and inventory management.

Hyperpure, which Zomato acquired in 2018, has emerged as a crucial factor of the foodtech giant’s growth strategy as it scales up and integrates its non-food delivery businesses, including the recently acquired quick-commerce platform (formerly, Grofers).

The restaurant-facing unit already supplies food mixes and packaged fruit juices to restaurants. Hyperpure now plans to also introduce desserts and other beverages as it expands its ready-to-eat range for restaurants.

“Most mid-sized restaurants don’t have a good beverage and desserts portfolio. If they want to make it themselves, they will have to expand their staff, which can be a huge expense,” Rakesh Ranjan, Head of Hyperpure at Zomato, told YourStory.

“Through an internal analysis we figured that these two categories are the best way to foray into the convenience food space. Over a period of time, we could look at other categories as well.”

Hyperpure expects to roll out its ready-to-eat desserts and beverages to restaurants in about six months, and may eventually consider appetizers and select main courses as well, Rakesh said.

Vishal Jindal, Founder and co-CEO of , said Hyperpure’s new segment could benefit restaurant chains although quality and price would be the key deciding factors.

Sourcing from a platform like Hyperpure eliminates the need for restaurants to deal with multiple vendors, which often is the case while engaging directly with food distributors, said Vishal.

Anurag Khatriar, Founder of Indigo Hospitality, too said Hyperpure's service can be beneficial if the terms of credit and procurement rates are flexible. Indigo Hospitality operates restaurant brands Indigo Deli, D:OH! and Dakshin Rasoi, among others.

The ready-to-eat dessert segment could help smaller restaurants that don't have the wherewithal to make their own sweet dishes by offering a customised line of products, he added.

Rakesh said the plan is for Hyperpure to evolve as a full-stack procurement solution provider, complete with inventory management, so restaurants can source all their requirements from a single vendor and wouldn’t need to maintain their own storehouses.

“We intend to partner with inventory management solution providers to be able to build a full-stack solution that can be integrated into restaurants’ existing internal systems,” he said. The exact timeline for this rollout is unclear.

Hyperpure is also looking at investing in sustainable packaging for restaurants, addressing a key pain point with several states banning plastic for uses such as packing food parcels.

The B2B unit has also begun supplying to sellers on Blinkit, Zomato CEO Deepinder Goyal said during the company’s second-quarter earnings call last month.

These new bets potentially represent crucial growth levers for Hyperpure.

Infographic by Nihar Apte

The number of restaurants engaging with Hyperpure has been increasing 25% every quarter, according to Rakesh. But considering that Zomato’s food-delivery platform has over 1 million restaurants across India, Hyperpure has some distance to cover.

Overall, Hyperpure serves about 30,000 restaurants across 10 cities, according to the company’s website, with the business accounting for about 15% of Zomato’s total revenue.

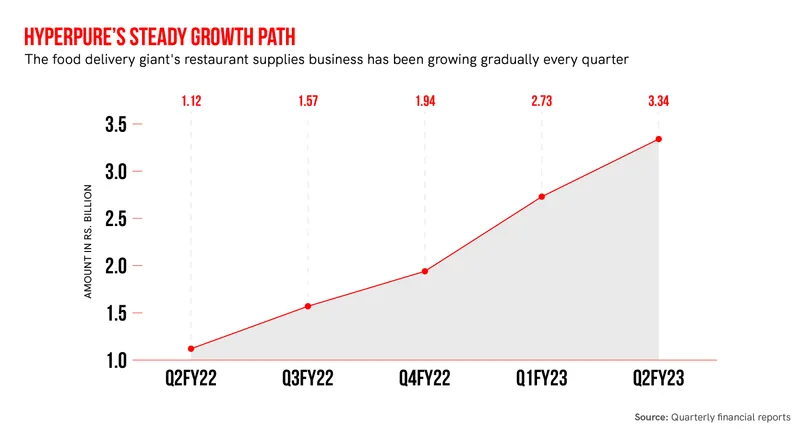

Hyperpure’s revenue nearly tripled from a year earlier to Rs 334 crore in the latest second quarter.

But it lags in the B2B ecommerce segment. While recorded gross revenue of Rs 9,900 crore in FY22, and earned Rs 967 crore, Hyperpure made a revenue of Rs 540 crore for the fiscal year.

Even so, Zomato has lofty ambitions for Hyperpure. Kaushik Dutta, Zomato’s Chairman, said during the company’s recent annual general meeting that the company expects the B2B segment to outperform its core food-delivery business.

Analysts, too, are upbeat about Hyperpure given its steady growth.

“We have increased our FY2023-25 revenue estimates for Zomato largely on account of the better-than-expected performance by the Hyperpure business,” Kotak Institutional Equities Research said in a report in August.

Edited by Feroze Jamal

![[YS Learn] Key takeaways from Morgan Housel’s ‘The Psychology of Money’](https://images.yourstory.com/cs/2/11718bd02d6d11e9aa979329348d4c3e/Imagewf2p-1607509774638.jpg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)