[Weekly funding roundup Feb 13-17] Venture capital inflow doubles; early-stage deals dominate

The week saw 18 early-stage deals of over $48 million, two growth-stage deals of over $155 million, and one late-stage deal of $100 million.

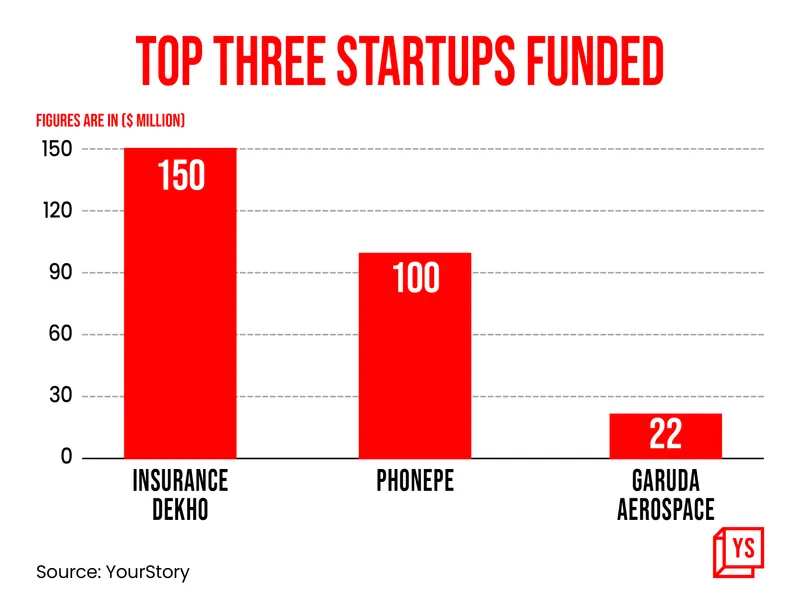

The Indian startup ecosystem this week saw funding nearly double from the comparable previous week, largely thanks to two big-ticket deals from InsuranceDekho and PhonePe.

However, the early-stage category continued to attract the largest number of deals from venture capital firms and marquee investors. The week saw $303.7 million in venture capital inflow, up from $148 million raised in the previous week.

The funding pie was divided into a total of 18 early-stage deals of over $48 million, two growth-stage deals of over $155 million, and a late-stage deal of $100 million.

The biggest contribution came from InsuranceDekho, which raised $150 million in a mix of equity and debt round. TVS Capital Funds and Goldman Sachs Asset Management led the Series A equity round.

Digital payments app raised the second-highest amount—$100 million in additional funding—from Ribbit Capital, Tiger Global, and TVS Capital Funds, at a pre-money valuation of $12 billion.

Then, drone startup raised $22 million in a Series A funding round led by venture capital firm SphitiCap, with participation from other global investors, angel investors, and HNIs.

The tech jobs market continues to remain shaky, especially for Indian employees at big tech companies. Alphabet-run Google's India arm on Thursday laid off 453 employees across various departments. Twitter India, on the other hand, closed down two out of its three offices in India, asking employees to work from home.

Meanwhile, India has been ranked fourth out of 51 countries in having a quality entrepreneurship ecosystem, a new global report said, reflecting the steady rise in the nation's business environment over the years.

Other key transactions

, a Bengaluru-based industrial services platform, raised $8.3 million in a Series A round led by Sorin Investments, with participation from previous investors Accel and Nexus Venture Partners.

, a full-stack supply chain company, raised Rs 45 crore in Pre-Series B via a combination of equity and debt financing, led by Sixth Sense Ventures, with participation from JAFCO Asia and other marquee investors.

Stable Money, a Bengaluru-based fintech startup, raised $4.5 million in its Series A round led by Lightspeed and Matrix Partners.

Edited by Kanishk Singh

![[Weekly funding roundup Feb 13-17] Venture capital inflow doubles; early-stage deals dominate](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)