No user charges on UPI; GoMechanic finds buyer

An interchange fee of 1.1% is only applicable for merchant transactions made through PPIs. No charges will be levied on normal UPI payments.

Hello,

seems to have finally found a buyer.

Two months after the car servicing startup admitted to financial irregularities and received a notice to initiate insolvency proceedings, it has found an unlikely buyer in Delhi-based Lifelong India Pvt Ltd.

Under its Servizzy entity, the company is acquiring GoMechanic as the majority shareholder. A Lifelong Group spokesperson confirmed the deal to YourStory, adding that it will focus on building upon GoMechanic’s business. Most of GoMechanic's employees will be laid off, while a few are likely to be absorbed into Lifelong.

Elsewhere, a two-member bench of the NCLAT has upheld the order of the Competition Committee of India (CCI) imposing a penalty of Rs 1,337.76 crore on Google, asking the company to deposit the amount in 30 days.

Speaking of the CCI, on Wednesday, the Lok Sabha passed the Competition Amendment Bill, 2022, which provides for the CCI to impose penalties on entities based on their global turnover instead of the current practice of considering only the relevant market turnover.

Oh, and ChatGPT came up with 500 ways to end a letter.

You know, to jazz up all your passive-aggressive emails.

In today’s newsletter, we will talk about

- NPCI clears doubt over UPI charges

- upGrad raises Rs 300 crore

- Healthtech funding falls 55% in 2022

Here’s your trivia for today: When was the first Indian edition of Reader’s Digest magazine published?

Fintech

NPCI clears doubt over UPI charges

Starting April 1, an interchange fee of 1.1% will be levied on UPI transactions of over Rs 2,000 made through prepaid payment instruments (like wallets and credit cards), revealed a National Payments Corporation of India's (NPCI) circular, leaving several users confused.

But, good news! Nothing is chargeable for users.

Respite for you:

- If you are making a UPI payment at a store via a wallet, the wallet provider will receive the applicable interchange fee from the store itself. This is similar to how merchants are charged for payments made by users via credit cards—also known as the merchant discount rate.

- The issuer of prepaid instruments will also be required to pay 15 basis points of the fee to the remitter bank for loading a transaction value above Rs 2,000.

- Meanwhile, NPCI has enabled BharatPe, Cashfree Payments, Google Pay, Razorpay, Paytm, PayU, and Pine Labs to help merchant transactions through RuPay credit cards on UPI in the Indian market.

NPCI Bharat BillPay has onboarded CRED as a key agent

Funding Alert

Startup:

Amount: $16.4M

Round: Series C

Startup:

Amount: $5M

Round: Series A

Startup:

Amount: Rs 40 Crore

Round: Series B

Edtech

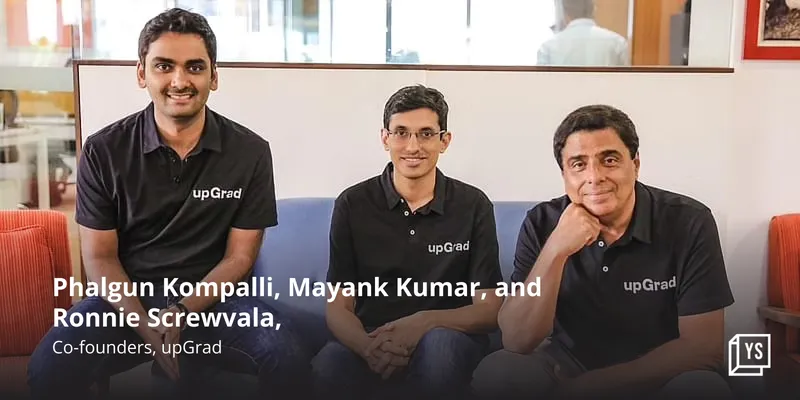

upGrad raises Rs 300 crore

Edtech startup completed an internal rights issue of Rs 300 crore from existing shareholders and founders. Co-founder and Chairperson Ronnie Screwvala contributed Rs 212 crore and existing shareholder Temasek contributed Rs 81 crore while other minority stakeholders completed the balance.

Key takeaways:

- The company is focused on organic and inorganic growth across multiple verticals of formal education via degree, diploma, and doctorate courses in partnership with the best universities in India and globally.

- The edtech startup is also focusing on segments like skilling, short certification courses, bootcamps, and job-linked programmes, the spokesperson added.

- Last August, upGrad raised $210 million from ETS Global, Bodhi Tree, Singapore's Kaizen Management Advisors, the Family Office of Bharti Airtel, and existing investors Temasek, IFC, IIFL, and others.

Healthtech

Healthtech funding falls 55% in 2022

Total funding pumped into the healthtech sector fell 55% in 2022 compared to 2021, hurt by a massive decline in the number of late-stage deals. More than 70% of the total funds raised throughout 2022 were recorded in the first half of the year, according to Tracxn's Healthtech India report.

Winter continues:

- Late-stage investments, which are meant to support companies that have grown beyond the development phase, dropped 75% to $606 million in 2022.

- The healthtech sector saw only two late-stage funding rounds of over $100 million in 2022 compared to 10 deals in the previous year.

- Sequoia Capital, Accel, and Chiratae Ventures emerged as the top investors in the healthtech segment in India to date.

News & updates

- Comeback CEO: Sergio Ermotti will return to UBS as CEO to tackle the integration of Credit Suisse, less than two weeks after the shotgun marriage of the two Swiss banking giants. Ermotti, who led UBS for nine years until 2020, is credited with restoring the bank to health after a government bailout in 2008.

- Workers wanted: Japan may face a shortage of more than 11 million workers by 2040, a study has found, underscoring the economic challenges the nation faces as its population ages rapidly. The working-age population is expected to rapidly decline from 2027.

- Mammoth meat: A giant meatball made from flesh cultivated using the DNA of an extinct woolly mammoth was unveiled at a science museum in the Netherlands. It has been created by the Australian cultured meat company Vow, which wanted to get people talking about cultured meat.

When was the first Indian edition of Reader’s Digest magazine published?

Answer: In 1954, with a circulation of 40,000 copies.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail [email protected].

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.