Borzo wants to mirror its India hyperlocal playbook around the world

Logistics firm Borzo has been betting big on its hyperlocal delivery service in India, one of its earliest and biggest markets. It is now looking to replicate the strategy in other geographies, including Brazil, Philippines, and Indonesia.

Key Takeaways

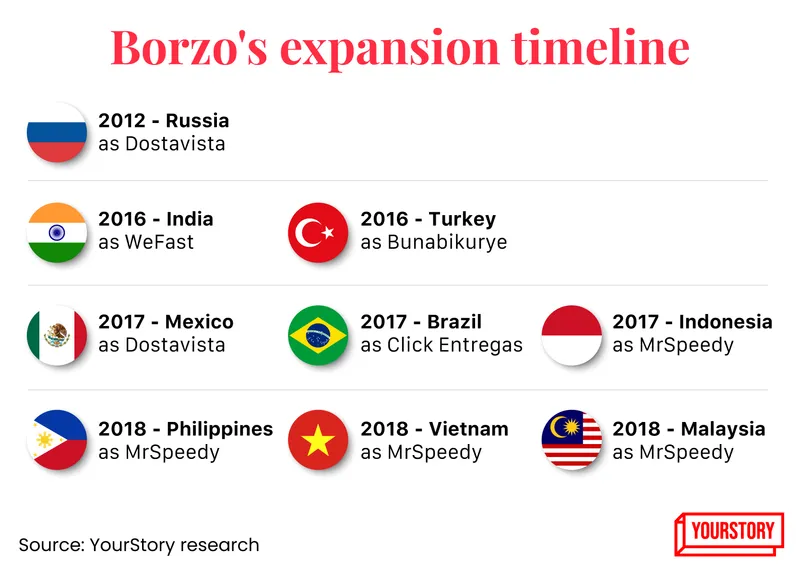

- Formerly known as WeFast, Borzo was incorporated in Russia in 2012 as a door-to-door courier service. It entered India in 2016.

- In 2022, it started business-to-business (B2B) hyperlocal deliveries and is looking to scale its order volume in this segment.

- In January 2022, the company acquired Now, a Noida-based 90-minute intra-city delivery firm for an undisclosed sum, to fulfil last-mile deliveries.

Hyperlocal has been the buzzword in India since 2020 with players such as , , and Grab that have championed the intra-city logistics game. Now, Netherlands-based Borzo is competing for a slice of India’s hyperlocal pie.

Formerly known as WeFast, the logistics firm initially entered India in 2016. In early 2022, it started business-to-business (B2B) hyperlocal deliveries in the country and is now confident about significantly scaling its order volume in this segment.

“We are way beyond the development stage. After serving numerous small and medium-sized businesses in the last 1.5 years, we are in a strong position to double down on the Indian market,” Eugene Panfilov, General Manager of Borzo India and Brazil, tells YourStory.

So far, the company—which has a 250-member team in India—has been primarily serving micro, small and medium enterprises (MSME) by fulfilling door-to-door delivery of food, pharmaceutical products, and ecommerce items. Now, it is looking to expand its portfolio to include apparel, electronics and cosmetics.

At present, has more than three million customers globally, which caters to both businesses and end consumers. Panfilov says India contributes 40% to the company’s overall revenue and a sizeable chunk of the orders come from Indian consumers—Borzo has completed 15 million orders as of December 2022.

According to Panfilov, most of the funding Borzo has raised so far (~$60 million) has been used to further its growth strategies in India. The company counts UAE-based Mubadala, Flashpoint Venture Capital, and Sweden-based VNV Global, among others as its investors. The company will continue to invest in millions in India as part of its growth strategy, he adds.

With India proving to be a crucial market accounting for a third of Borzo’s hyperlocal business, it is now carrying some of its strategy lessons to its other geographies, including Southeast Asia, Latin America, and the Middle East.

“Consumers around the world have some common traits. Especially in Southeast Asia and Latin America, consumers are conscious about cost and timeliness,” says Panfilov, adding that the Indian market can set a good example for other countries.

Borzo’s hyperlocal segment is already operational in parts of Brazil, Indonesia and the Philippines.

A strategic shift

In 2020, logistics was among the many sectors that witnessed a massive modification. Fuelled by impatient consumers and intense competition, logistics players shortened delivery timelines to cater to the growing demand.

Borzo was incorporated in Russia in 2012 as a door-to-door courier service. It entered India in 2016 with the same proposition sensing a large opportunity in the growing number of online shoppers and MSME firms. By then, several players including Dunzo and Shadowfax had already stepped foot into the lucrative industry. This not only led the wave for the emergence of hyperlocal delivery firms but also those that focused on B2B clients.

Panfilov says the initial years in India were interesting—when online orders were surging every day, making seamless logistics more necessary. When the pandemic struck, hyperlocal gained momentum.

“Consumers have changed the way they shop. Same-day delivery became an obvious foray for us at Borzo, so we decided to introduce hyperlocal deliveries a few years later,” he says, adding that the company received the “warmest and most unexpected welcome” from small and medium businesses in India when it started out.

In January 2022, Borzo acquired Now, a Noida-based 90-minute intra-city delivery firm for an undisclosed sum, to fulfil last-mile deliveries. Now used to serve well-known brands such as Amazon, Apollo Pharmacy, and KFC, with a fleet of 1,500 riders. It had fulfilled more than 2 million orders per annum at the time of acquisition.

Speaking of the customers, Panfilov says, “Homegrown and mid-sized companies are cornerstones of Borzo. We will keep expanding our MSME partnerships with a focus on timeliness, cost-effectiveness, and quality.”

Since last year, the company has served over a million MSMEs in India that contribute to 60% of the firm’s on-demand deliveries in the country. It also has five large enterprises in its portfolio and is in the process to add another seven this year, Panfilov adds, without revealing names. He says Borzo is committed to the pure B2B play in the hyperlocal segment as enterprise partnerships provide large economies of scale and generate consistent orders.

Priya Shah, Founder of Mumbai-based homegrown bakery Another Day Another Bake, uses Borzo’s delivery service for almost 80% of her orders every month. “Timeliness is crucial for perishable goods like cakes. Borzo hasn’t disappointed so far,” she says.

Another selling point for Borzo is that it is also cheaper— at least 20% lower—than other players such as Swiggy Genie and Dunzo, says Anjali Bhanushali, Co-founder of A-Dog, a pet care startup based in Mumbai.

However, the company continues to bear the disadvantage of the crowded space with plenty of alternatives available. As a result, brands are willing to switch between platforms often based on cost, time efficiency, and hassle-free delivery.

Borzo isn’t the only firm that entered B2B logistics. Reliance-backed Dunzo, for instance, started off in 2014 as a courier service but began strengthening its B2B vertical Dunzo for Business in 2020.

“It’s a smart strategy to switch to B2B,” says an investor in the logistics space, asking not to be named. Although B2B is still a small part of the overall hyperlocal market (which includes same-day delivery and quick commerce), there is an opportunity for growth, the investor adds. “Companies can optimise delivery fleet and cost since on-demand courier orders can be scanty.”

The hyperlocal market is estimated to be a Rs 3,000-3,500 crore opportunity today, and set to grow 5X over the next four to five years, Rahul Sanghvi, partner at management consulting firm BCG, had told YourStory previously.

While Panfilov refused to share Borzo’s exact revenue numbers, the company had earlier said its India revenue and order volume doubled year-on-year in 2022. In terms of gross merchandise value (GMV), Borzo said it was “approaching $100 million” in 2020 globally.

For comparison, Dunzo logged a GMV of $197 million (Rs 1,500 crore) as of April 2022, as per media reports.

Expansion strategy

Borzo India is headquartered in Mumbai and is present in 22 Indian cities, with its latest expansion in Hyderabad earlier in May. It will now focus on strengthening its presence in Tier II and III markets as there is a large opportunity in terms of the total addressable market, Panfilov says.

“Our enterprise customers are tapping Tier II and III markets, making it necessary for us to establish strong supply chains there,” he adds, noting that Borzo is optimistic about capturing clientele of varied sizes and business types.

Earlier this month, Borzo said it sees Hyderabad as its gateway to South India and expects the city to become one of its biggest urban markets in the region. Its operations in the Tier I cities, including Mumbai, Delhi-NCR, and Bengaluru, contribute the most to its India revenue, Panfilov said without divulging numbers.

At present, it has more than 80,000 active delivery executives in the country for both B2B and B2C (on-demand courier) services, and the number is steadily growing.

Borzo is well equipped to compete with rivals Dunzo, Shadowfax, and Grab, the investor says. However, larger players like , , and benefit from larger order volumes and intercity logistics capabilities, which may give them a bigger advantage than Borzo, the investor adds.

When asked about the company’s outlook on quick commerce, Panfilov says he is slightly averse to entering the space in the near future, an unusual strategy given that most delivery players in the country are keen on the segment. “The grocery delivery space is a cash-intensive business and does not align itself with our overall business objectives.”

But he isn’t completely against the idea, adding that if economic conditions improve and the markets allow for experimentation, Borzo would be open to giving quick commerce a shot. “But the question that remains is how many players can actually make it,” he says.

“Quick commerce is certainly a cash-guzzling proposition meant only for companies that are open to frequent pivoting and experimentation,” said the investor quoted above.

Intercity logistics is also not a priority for Borzo. Panfilov says it synergises poorly with Borzo’s vision and will take away its motive to keep local businesses close to its daily operations.

For now, it is B2B and Tier II for the company.

(Infographics and cover image by Winona Laisram)

(The story was updated to make a correction in the blurb)

Edited by Saheli Sen Gupta