Delhivery's Q4 FY23 loss widens to Rs 159 Cr

For the first time since listing, the company's adjusted EBITDA turned positive to Rs 6 crore in Q4 FY23, compared to Rs 67 crore loss in Q3 FY23.

Gurugram-based logistics startup on Friday reported that its consolidated net loss widened to Rs 159 crore in Q4 FY23. Net loss was at Rs 120 crore in the same period last year.

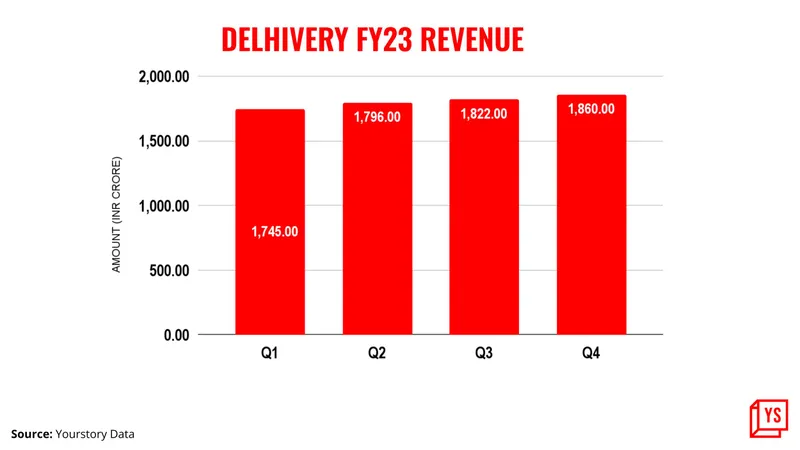

The startup's revenue was at Rs 1,860 crore for the March quarter compared to Rs 2,072 YoY, a decline of about 10%.

However, for the first time since listing, the company's adjusted EBITDA turned positive to Rs 6 crore in Q4 FY23, compared to Rs 67 crore loss in Q3 FY23.

Delhivery's stock closed 1.79% lower at Rs 359.05 apiece on NSE on Friday.

The company has also reported growth in Express Parcel volumes by 10 million shipments QoQ to 180 million shipments in Q4 FY23 from 170 million shipments in Q3 FY23.

Revenue from PTL (partial truckload) services grew 19% QoQ to Rs 328 crore in Q4 FY23 from Rs 277 crore in Q3 FY23 due to increased volumes.

However, the cross-border services business saw a revenue decline of approximately Rs 9 crore.

“Critical leading indicators like service precision, network speed, and delivery quality parameters are at an all time high level and are driving greater customer confidence and share of wallet growth. The momentum built up in Express and PTL in Q3 has carried into Q4 and FY24 as well," said Sahil Barua, Managing Director and CEO, Delhivery, said in a statement.

Earlier this month, Delhivery's compliance officer Sunil Kumar Bansal resigned in the company's second high-profile exit in less than a month. In April, the company’s Chief Customer Experience Officer Abhik Kumar Mitra resigned from his post. He was the CEO of express logistics and supply chain solutions provider Spoton, which was acquired by Delhivery for $300 million ahead of its IPO.

The logistics startup has seen several bulk deals in recent times. Tiger Global sold shares worth Rs 387 crore through a bulk deal in April 2023, months after it sold shares worth Rs 414 crore in the company in February 2023. Softbank sold shares worth Rs 954 crore in the startup through a separate bulk deal in March 2023.

Edited by Affirunisa Kankudti