Inside Zepto ex-CFO Jitendra Nagpal's big plans for early-stage VC firm Capinity Partners

Mumbai-based Capinity Partners will make the first close of its $30 million corpus first fund later this year. Its second fund, focused on climate startups, will be announced in the next 15 months.

Jitendra Nagpal, the former chief financial officer (CFO) of quick commerce startup Zepto, has now turned to fulfilling the financial needs of early-stage startups. He is pioneering a new venture capital firm, Capinity Partners, which is targeting a first close by the end of this year, Nagpal tells YourStory.

Capinity Partners will focus on investing in startups up to pre-Series A round, with a special focus on digital-first firms.

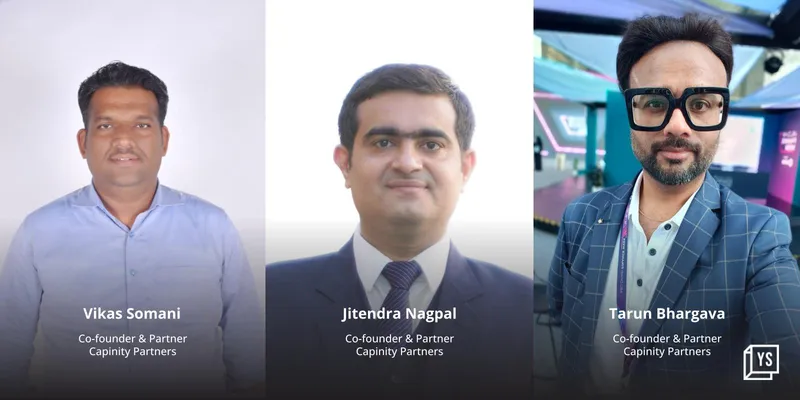

Nagpal is joined by two veterans of the finance and banking fields—Tarun Bhargava and Vikas Somani.

Bhargava is the Founder and Managing Partner at TalentGen Advisory LLP, and a prominent angel investor in several startups including , , , and . Somani is the CFO at Ovik Finance and has several years of experience in the field of banking, including overseeing MSME loans in ICICI Bank and IndusInd Bank, among others.

Both Bhargava and Somani will join Nagpal as partners in Mumbai-based Capinity Partners. At present, it has nearly 10 associates working closely with the partners.

Nagpal managed Y Combinator-backed Zepto’s financial operations for nearly three years. Prior to that, he held top positions in the finance divisions of dairy startup Country Delight and e-pharmacy firm PharmEasy.

“I knew early on that I wanted to build something to fuel capital needs for startups,” Nagpal says. Through his extensive experience working in startups, he realised that often there is a mismatch between founders and investors on vision and mentorship, which must be bridged.

Believing in being a “catalyst to entrepreneurial success,” Capinity Partners is expected to make the first close of its $30 million corpus fund by December 2023. The fund will be sector agnostic, Nagpal adds, noting that its investment thesis comprises three core conditions.

One, the startup should be looking to serve a “large enough” total addressable market. Two, it should be capable of achieving positive unit economics quickly (without burning cash heavily). Three, it must provide a good return on capital employed and free cash flow.

Incorporated in May this year, the VC firm is bullish on several sectors, including ecommerce, clean tech, consumer technology, and fintech.

“I am very clear that Capinity will not be investing in any startup that is building products or services for the cream of the population as it is very hard to grow business in most cases,” Nagpal tells YourStory. Instead, the investment firm will keep its eye out for digital-first startups serving people who shop online and have a reasonable disposable income.

Capinity has already invested pre-seed and seed money in four startups, says the Co-founder and Partner of the VC firm, without divulging names.

Meanwhile, Nagpal, Somani, and Bhargava are spending time mentoring startup founders on product development, perfecting go-to-market strategies, shaping revenue models, and pitching coherently to investors. So far, it has guided about 10 Indian startups.

“We call this an incubator programme, internally. We started advising last year alongside building Capinity to understand the pain points of founders and the ecosystem,” Nagpal said.

Tough market

According to YourStory’s research, about $10 billion has been raised by leading venture capital (VC) funds from 2022 till now. The slow deployment of funds and the increased timeline for closing deals are likely to impact founders adversely.

However, Capinity believes it is the right time for early-stage startups to thrive.

“Even for investors, it is a favourable environment to advise and invest in fundamentally strong product organisations,” Co-founder and Partner Bhargava tells YourStory, adding that firms can scale and grow tremendously with global support once the funding inflow improves.

To this end, Capinity has roped in limited partners (LP) from around the world, including the Middle East and Europe. “Investors in these regions continue to be optimistic about India and have pegged high hopes on its growth potential,” Nagpal adds.

With extensive experience in investing across stages, the partners will help founders gain additional runway with lower dilution, given the current macroeconomic scenario where valuation multiples are depressed, Co-founder and Partner Somani notes.

Sectors such as e-mobility, deeptech, and generative artificial intelligence (AI) have global scope as well, the partners add.

Climate-focused fund

Capinity is also building its second fund focused on clean tech and climate startups. Likely to be announced in the next 15 months, the new fund will have a corpus of $100-200 million.

“The nuances of the climate fund are still under discussion. We are hoping to drive a wave of clean tech startups in India through this fund,” Nagpal adds.

Edited by Kanishk Singh