MPL sells Good Game Exchange assets; diversifies revenue streams from other geographies

Mobile Premier League forayed into the NFT marketplace with the acquisition of Good Game Exchange in March this year.

has sold its assets in Ante Multimedia Private Limited, Good Game Inc, and GGX PTE—all subsidiaries of Good Game Exchange (GGX), which was acquired by the former from existing investor’s tokens.

With the acquisition of Good Game Exchange in March this year, MPL made its debut in the non-fungible token (NFT) trading space as a competitor to , which is owned by fantasy sports platform .

As per the regulatory filings, MPL has identified assets of GGX and intends to “add substantial liquidity to the group” by liquidating such assets.

At first, VC firm CoinFund had entered into a token purchase agreement with MPL to fund the acquisition of GGX Protocol. But that agreement was cancelled, and now CoinFund has invested $300,000 in the parent entity at an enterprise valuation of $1.8 billion, a decrease of $500 million compared to its last funding round.

Filings also reveal that MPL moved two properties—Underworld Gang Wars and Underworld Gang Racing—to its subsidiary Mayhem Studios through a business transaction. These transfers were valued at $12.5 million paid in shares by Mayhem Studios to MPL.

On a cumulative basis, MPL made $32 million from all the transactions mentioned above and reduced its losses in FY23. Founded in 2018 by Sai Srinivas Kiran G and Shubham Malhotra, the company has raised nearly $375.5 million till date.

Diversifying geographies

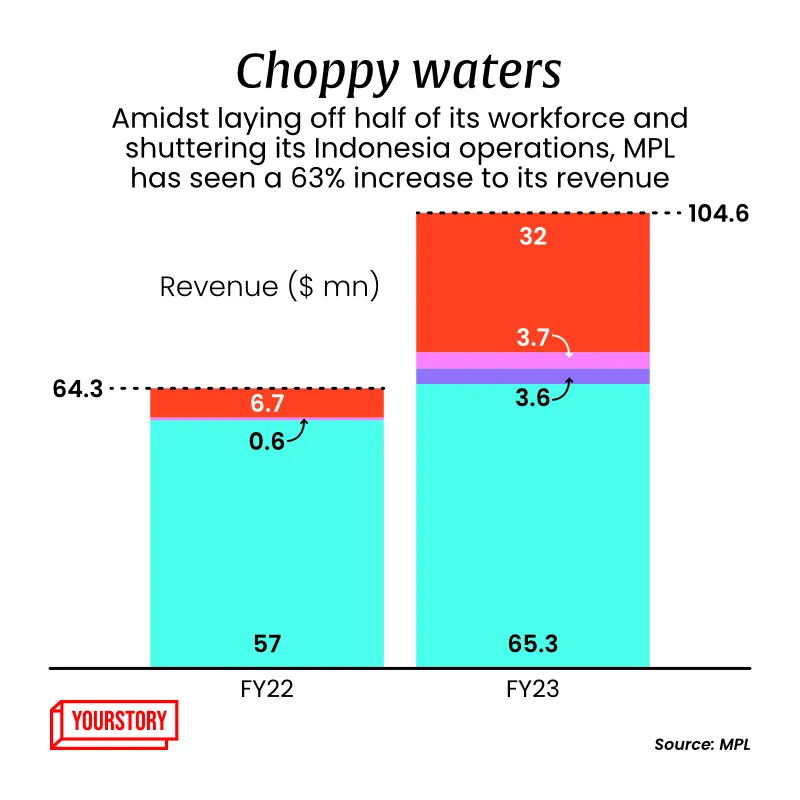

MPL, which has a presence in Singapore, the US, and Europe, saw its presence in India shrink in FY23, with revenue from the country accounting for $65.3 million of the total revenue it generated in FY23, which accounted for 62.43% of overall revenue.

Further, MPL made $3.6 million from its Singapore operations in FY23, which contributed to 3.44% of the gaming firm’s overall revenue, which is up from the previous year.

Overall, MPL made $104.6 million in revenue in FY23, a 63% increase compared to $64 million in FY22. The company also sharply narrowed its losses to $37.04 million as per data from its Singapore filings, compared to $194.47 million in FY22. Besides annual losses, the company also registered $21.3 million in losses related to discontinued businesses.

MPL has also shut down its operations in Indonesia as per the company’s regulatory filings.

Founded in 2018, Singapore-headquartered MPL develops internet-based games, and its primary business is operating games based in India. It received the coveted unicorn status in 2021 after raising a Series E round of $150 million at a $2.3 billion valuation.

In August this year, MPL laid off 350 employees, about 50% of its workforce. Co-founder Sai Srinivas cited the new GST regulations for real money gaming companies as a reason for the layoffs in an email to employees, adding that the move could increase the tax burden on the company by 350-400%.

For context, the government made a decision to revise the tax rates on real money gaming companies from 18% to 28% on player deposits.

Edited by Megha Reddy