VC funding in Q1 2024 declines by 22%; Bengaluru tops cities with $1B

Venture capital funding for Q1 2024 saw a decline compared to Q1 2023, but deal activity remains at similar levels, showing investors continue to back Indian startups but with less capital.

Venture capital (VC) funding into Indian startups for the first quarter (Q1) of the 2024 calendar year dropped by 22% compared to the same period last year, as the ecosystem continues to see a slow inflow of capital.

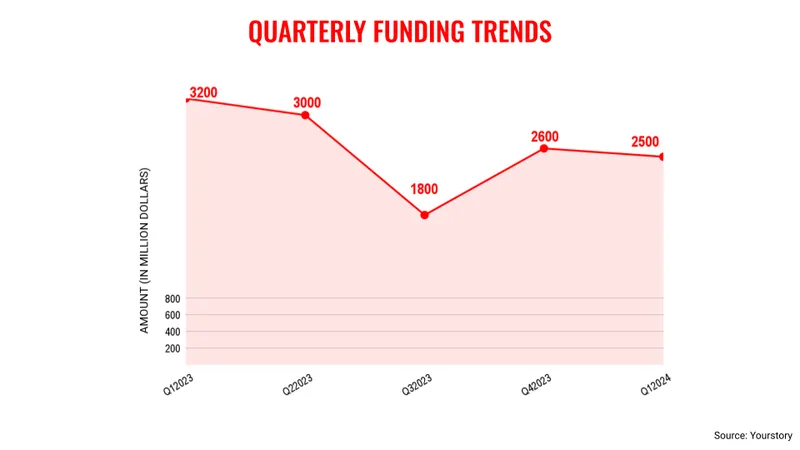

Indian startups raised a total of $2.5 billion in VC funding in the first quarter of 2024, i.e., in January, February and March. In Q1 2023, they raised $3.2 billion, according to YourStory Research.

VC funding also declined 4.6% compared to Q4 of 2023, where startups secured $2.6 billion in investments, primarily because of fewer large deals. In Q1 2024, only seven deals bagged $50 million and above funding. The highest amount raised during the quarter was $140 million by Capillary Technologies.

The other six were Vivifi, Arzoo, Krutrim, Shadowfax, Perfios, and Ambit Finvest. Meanwhile, Wow Momo and Sharechat raised $49 million each.

This drop in VC funding shows that the Indian ecosystem continues to be in the grip of a funding winter. However, there is room for optimism, if one goes by the number of deals signed in Q1 2024.

The first quarter of 2024 saw 310 deals, fractionally higher than the 305 deals recorded in the same period last year, which reveals that there is a lot of activity in the startup ecosystem, although the quantum of money is low.

This is reflected in the amount of money raised across various stages, where early and growth stages are almost at similar levels. While early-stage companies received $795 million in funding across 229 deals, growth-stage startups raised $790 million with 43 deals.

The large quantum of money went to the late-stage companies, which

is yet to pick momentum.

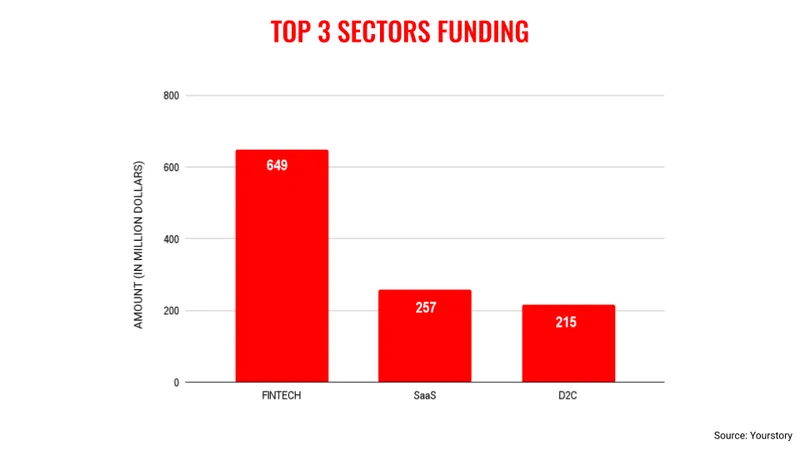

In terms of the sectors, fintech saw the largest capital inflow in the first quarter, followed by Software-as-a-Saas (SaaS) and Direct-to-Consumer (D2C). Sectors like electric vehicles (EV), social, logistics, and food raised funding in the $100 million range.

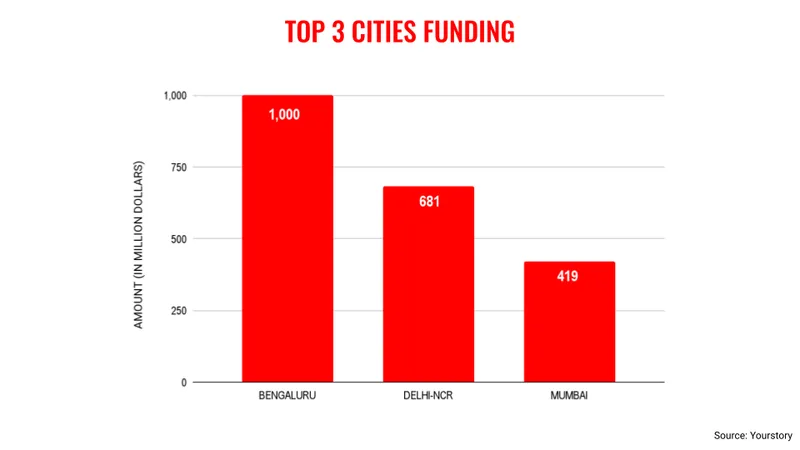

In terms of cities, Bengaluru led with $1 billion, followed by Delhi-NCR ($681 million) and Mumbai ($419 million). Hyderabad, Chennai, and Pune were the other metro cities, which raised in the $100 million range.

In Q1 2024, and emerged as two new unicorns, and it is expected more startups will reach the $1 billion valuation.

However, the current funding scenario is a reset of sorts for the entire ecosystem, as the valuations of startups are at more reasonable levels, and investors are much more diligent in scrutiny of transactions.

It also means that capital will not be easily available for all startups, and those who have a sound business model will not find it challenging to raise capital.

As Ritesh Chandra, Managing Partners, Avendus Future Leaders Fund, in an earlier interaction with YourStory remarked, “Those who have demonstrated their chops will not have a problem raising capital.”

Edited by Suman Singh