[Weekly funding roundup March 9-15] VC inflow into startups continues to remain steady

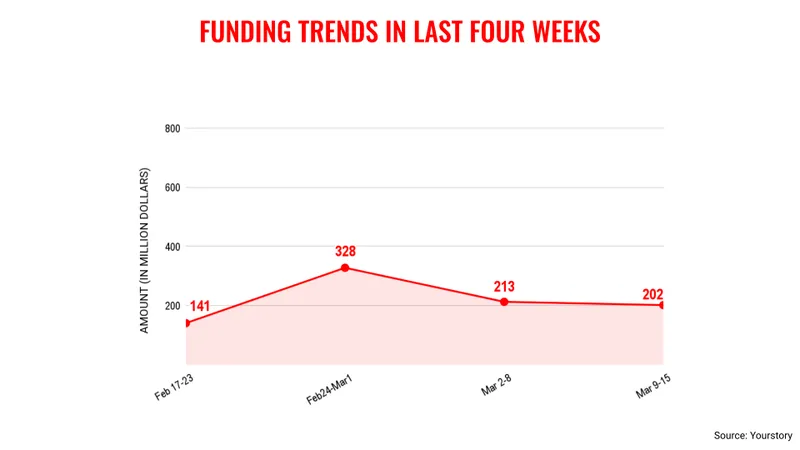

Venture capital funding into Indian startups has moved into a higher orbit, as the weekly funding amount now hovers around the $200 million mark.

The venture capital (VC) funding into Indian startups is showing strong signs of a pickup as for three weeks in a row, the total amount raised on a weekly basis is above $200 million, which beats the previous benchmark of around $100 million.

The second week of March saw total VC funding of $202 million across 14 deals, including the emergence of a new unicorn—Perfios. The previous week saw a total amount of $213 million in VC funding.

This development is certainly a good sign for Indian startups as it lifts the overall spirit of the ecosystem and lays down the foundation for a higher inflow of capital in the near future.

However, this would not mean there would be a rush of money, as investors continue to remain cautious with increased scrutiny on how they are going about with their transactions.

At the same time, several VCs raising capital for their funds is another positive development for Indian startups. Prath Ventures raised Rs 120 crore as the second close for its maiden fund, while 8i Ventures created a seed investing platform.

A report by Bain & Company drove home the point that optimism among investors continues to remain high about Indian startups, as the consumption story of the country is only going to expand.

Key transactions

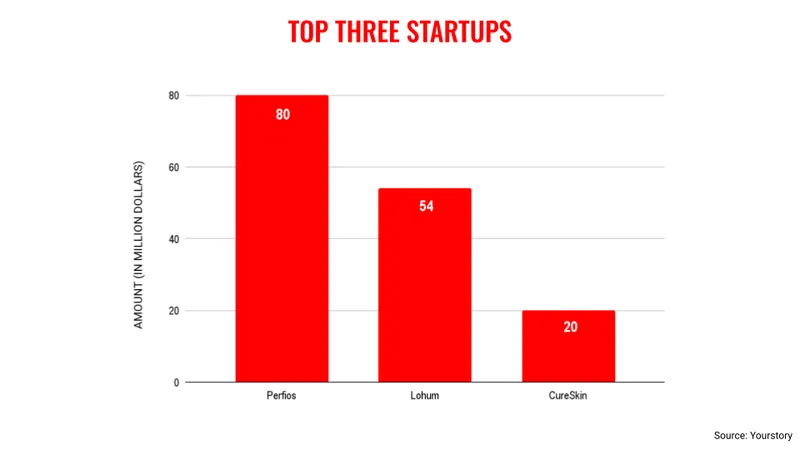

SaaS fintech startup Perfios raised $80 million from Teachers’ Venture Growth (TVG) at a valuation of more than $1 billion.

Lithium-ion battery pack maker and recycling firm Lohum raised $54 million from Singularity Growth, Baring Private Equity, Cactus Venture Partners, and Venture East.

AI-driven dermatology platform CureSkin raised $20 million from Healthquad, JSW Ventures, Khosla Ventures, and Sharrp Ventures.

BlackSoil NBFC, the flagship company of the BlackSoil Group, raised equity of Rs 100 crore (about $12 million) from existing Indian investors and family offices.

Geriatric care service provider KITES Senior Care raised Rs 65 crore (about $7.8 million) led by Dr Ranjan Pai’s Manipal Education and Medical Group (MEMG) Family Office Fund.

Fintech startup FREED raised $7.5 million from Sorin Investments and Multiply Ventures and Piper Serica.

Energy Beverages raised Rs 45 crore (about $5.4 million) from JM Financial Private Equity.

Healthtech startup Sugar.fit raised $5 million from MassMutual Ventures, Tanglin Venture Partners, Endiya Partners, and Cure.Fit.

(The copy was updated to correct a factual error.)

Edited by Suman Singh

![[Weekly funding roundup March 9-15] VC inflow into startups continues to remain steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)