Startup news and updates: Daily roundup (August 12, 2024)

YourStory presents the daily news roundup from the Indian startup ecosystem and beyond. Here's the roundup for Monday, August 12, 2024.

Funding news

Haldèn secures Rs 5 Cr in seed funding

Mumbai-based luxury men's brand, Haldèn has secured Rs 5 crore in a seed funding round led by Prajay Advisors.

Anuj Beriwal and Mukund Singhal, co-founders, Haldèn

The company, founded in 2019 by cousins Anuj Beriwal and Mukund Singhal, plans to use the funds to enhance its brand presence and expand its product line.

“The fundraising will be strategically used to expand Haldèn’s offline presence too. The goal is to enhance brand visibility, increase sales, and penetrate new online and retail markets,” said Mukund Singhal, Co-founder and Director of Haldèn.

The company aims to “make luxury products accessible to a wider audience while maintaining the quality and affordability that our customers expect,” said Anuj Beriwal, Co-founder and Director of Haldèn.

Haldèn previously operated as a bootstrapped company until FY24, the company said.

Infinyte.Club raises $3.6M in seed funding

Infinyte.Club has secured a seed round of $3.6 million led by Elevation Capital. The company is supported by 40 super angels, including Kunal Shah, Vidit Aatrey, Gaurav Munjal, Sanket Shah, Varun Dua, Anjana Reddy, Ashwini Asokan, Tanmay Bhat, Harshil Mathur, Shashank Kumar, and others.

Infinyte.Club has also stepped out of beta mode. The product has opened access to a range of private investment opportunities and addresses the issue of ESOP (Employee Stock Ownership Plan) liquidity, it said in a statement.

Ankita Tandon and Joylita Saldanha, co-founders, Infinyte.Club

“In the next 3-5 years, we aim to establish a comprehensive ecosystem that not only facilitates the realisation of equity value but also provides cutting-edge financial tools and exclusive investment opportunities,” said Ankita Tandon and Joylita Saldanha, co-founders of Infinyte.Club.

The company, launched in 2023 by Ankita Tandon and Joylita Saldanha, is a product designed for wealth creation and management for top Indian tech and startup employees, and operator-investors including early employees of leading Indian startups with significant ESOP holdings.

Ziptrrip raises Rs 2 Cr in pre-seed funding

AI-driven travel tech SaaS startup Ziptrrip has secured Rs 2 crore from angel investors and industry leaders, including Anil K Jha (ex-Coal India Chairman and ex-Jindal Power Ltd Chairman and Board of director), and Prantik Dasgupta (Country Head – Coeclerici and a seasoned angel investor).

Ziptrrip Founding Team

The company plans to allocate the funds to fuel its market expansion plans, enhance team-building efforts and drive continuous product innovation.

“The investment will serve as a catalyst, enabling us to accelerate our growth trajectory, further enhance our AI capabilities, and continue delivering unparalleled value to our corporate clients,” said Shan Prabhakaran, Co-founder and CEO of Ziptrrip.

The platform enables corporations to automate travel bookings, streamline approval

process, and implement dynamic travel policies using algorithms.

HealthCRED secures $1.2M seed funding

HealthCRED has raised $1.2 million in a seed funding round led by Antler India, TRTL VC, DeVC, iSeedVC, and Angel List India.

It also saw participation from angel investors including Dr Subho Ray (President, IAMAI), Nitin Gupta (CEO, Uni Cards), Amit Lakhotia (CEO, ParkPlus), and founders of InsuranceDekho and SEA-based Docquity.

Founders Shrey Jain and Arpit Jangir, with team HealthCRED

The company plans to use the funds to enhance customer relationships and expand operations to the southern and western parts of the country, hire fresh talents, and develop state-of-the-art B2B loan onboarding and loan management systems, creating an end-to-end digitised B2B healthcare lending framework, the company said in a statement.

“With the rapid penetration of health insurance in the post-COVID-19 scenario, there has been an increased working capital management stress for hospitals and HSPs. The key factor is the delay associated with the realisation of insurance receivables. Our aim is to work towards stabilising their cash flow cycles, through early financing of these delayed receivables,” said Shrey Jain, Co-founder and CEO, HealthCRED.

Founded in 2022 by Jain and Arpit Jangir, the company provides swift, comprehensive, and adaptable financing solutions tailored for the healthcare sector.

Real estate technology platform Truva raises $3M in seed funding

Led by Stellaris Venture Partners, Truva secured $3 million in funding in a seed round.

The round also saw participation from Peercheque (Aakrit Vaish and Miten Sampat) and notable angel investors including Mukesh Bansal, Ramakant Sharma, Ram Raheja, Ankit Nagori, Lalit Keshre, Natasha Malpani Oswal, Akhil Aryan, Sanjay Mandava, and Indian Silicon Valley (Jivraj Singh).

Truva Founders Ankit Gupta, Monil Singhal, Puneet Arora

“Since the launch early this year, we’ve facilitated transactions worth over Rs 30 crore in Powai, Mumbai alone. Our average time to sell a property is 19 days, compared to the market average of nine months,” said Puneet Arora, Co-founder, Truva.

Truva plans to use the funds to expand its team, enhance the product, raise debt for working capital, and scale its operations. It plans to expand to new markets in Mumbai and other cities next year.

The company offers an online listing experience with features including the natural light score, noise rating, 3D tour, and high-quality photos and videos.

MiClient raises Rs 3.9 Cr funding in seed round

MiClient, an AI-driven B2B sales enablement platform, secured Rs 3.9 crore in funding in a seed round led by IAN Group. It also saw participation from Anicut, GSF, RTAF, and Keiretsu.

The company eyes building a stronger team and expanding market presence across more geographies in India with the latest investment.

“We are deeply committed to empower the MSME/SMBs with right digital tools to conduct their sales better. This new funding will enable us to grow our team, address more relevant pain points of MSME/SMBs and strengthen our market presence. We welcome exceptional sales talent to join us in our journey to build India’s best deal closure platform,” said Swati Sharma, Co-founder and CEO, MiClient.

MiClient is also developing an AI-based model to create quotations and invoices in seconds, further streamlining the sales process for its users, the company said.

Other news

Gupshup expands workforce by 20% to meet conversational AI demands

Madhuri Nandgaonkar, VP-HR, Gupshup

Conversational experience cloud Gupshup accelerated its hiring in FY24 by 20% to 1,400 people.

This is set to support the company’s growth and expansion across India, Latin America, Middle East, SEA, Africa, and Europe. It also made several senior-level hires across marketing, GTM (go-to-market), engineering, and solutions.

Gupshup saw 40% YoY growth last year driven by brands' escalating demand to engage customers through conversational advertising, marketing, and support on messaging channels, the company said in a statement.

"As we continue to expand our footprint globally, we are actively seeking top talent across engineering, product development, marketing, and customer support roles to drive this conversational revolution. Our people are our greatest asset, and we are committed to building a diverse and inclusive workforce that can unlock massive value for our customers through innovative conversational experiences,” said Madhuri Nandgaonkar, VP - HR, Gupshup.

The company saw a 15% increase in women in senior leadership positions and hired 22% women employees and 33% women interns as part of its internship programme.

NuVentures backs domestic snacks brand Adukale

Early-stage investor NuVentures backed domestic snacks maker Adukale. This comes as a part of the Adukale’s ongoing fundraise.

Earlier this year, the ready-to-eat and ready-to-cook brand had raised Rs 11 crore in a funding round led by Force Ventures, which also saw participation from Aanya Ventures, as well as Accel partner Subrata Mitra, among others.

Adukale CEO Bharat Kaushik and NuVentures founder Venk Krishnan

“Adukale is poised for significant growth, and the funding from NuVentures bolsters this journey to expand our operations and extend our distribution network. It reinforces our dedication to honoring Karnataka's rich culinary heritage and positions us as leaders in the traditional snacks market,” said Bharat Kaushik, Director and CEO, Adukale.

The Bengaluru-based company plans to scale its products and recently opened a new 20,000-square-foot production facility on the outskirts of the city, with the aim to increase production capacity over fourfold.

US grocery conglomerate Hy-Vee moves to Bengaluru

Hy-Vee, a retail grocery conglomerate headquartered in west Des Moines, Iowa, has moved to a new office location in Bengaluru to drive innovation and enhance operational efficiency.

Hy-Vee office

This move plays a part in enhancing its footprint in India and comes to use India's talent pool for technical and non-technical roles, which will allow the company to work on projects on a 24/7 basis, the company said in a statement.

"We are excited to see the HST Global team's growth over the last year and a half and look forward to this new space supporting them as they continue to help move Hy-Vee forward as a retail leader,” said Travis Hoover, Chief Data Officer, HyVee.

The 54,000-square-foot facility is situated in Karle Tech Park on the Outer Ring Road and is set to accommodate up to 350 people and has 17 meeting rooms, collaboration spaces, and phone pods.

Standard Chartered appoints Aditya Mandloi as Wealth and Retail Banking head

Standard Chartered Bank appointed Aditya Mandloi as Head, Wealth and Retail Banking (WRB), for India and South Asia effective August 1, 2024.

Aditya Mandloi, Head, Wealth and Retail Banking, India and South Asia

In his new role, Mandloi will be responsible for driving the WRB business in India, Bangladesh, Sri Lanka, and Nepal.

Mandloi, who started with Standard Chartered as an International Graduate 27 years ago, has held various roles in Product Management, Collections and Sales, in the Bank.

He was the head of SME Banking in India, where he built a sustainable and profitable business. and also led the WRB business for Bangladesh.

Pace 360 launches an ETF-Based PMS Strategy

Pace 360, a Delhi-based macro top-down focused asset management firm, launched its new PMS strategy—Tresor Smart Alpha.

Amit Goel, Co-founder & Chief Global Strategist at Pace 360

Tresor Smart Alpha aims to capitalise on India's economic ascent by identifying a basket of opportunistic investments through a dynamic asset allocation approach leveraging Exchange Traded Funds (ETFs), the company said in a statement.

It uses Pace 360's screening methodology and identifies overlooked growth opportunities in the Indian markets.

"With Tresor Smart Alpha, we're offering investors a unique opportunity to participate in India's economic growth story while controlling risk and minimizing drawdowns by fully capitalising on our macro top-down expertise," said Amit Goel, Co-founder and Chief Global Strategist at Pace 360

The fund rotates between opportunities based on macroeconomic indicators, market cycles and analysis of both the fundamentals and technicals of a theme or sector aiming for a beta below one when markets are overvalued and higher than one when they are undervalued, the company said.

Tresor Smart Alpha portfolio includes investments in a diverse range of ETFs across geographies and sectors like auto, FMCG, pharma, IT, financial services and themes such as electric vehicles, defence, and infrastructure.

Flam launches MR product backed by KL Rahul

Cricketer KL Rahul has invested in Flam, an AI-powered mixed-reality publishing platform.

The platform enables fans to create personalised experiences with celebrities of their choice. It also allows brands to publish their mascots or products as characters.

“This is going to change sports fandom forever. It will open up so many creative possibilities for fans to engage with their favourite athletes. The ease with which we can create this content really surprised me. This is going to be a big hit among fans,” said Rahul.

“Flam will unlock the full potential of user-generated content with celebrities, empowering fans to create and share viral experiences. We envision marketers everywhere using this innovation to engage and captivate audiences across events, concerts, sports, films, and TV shows,” said Shourya Agarwal, the Founder and CEO, Flam.

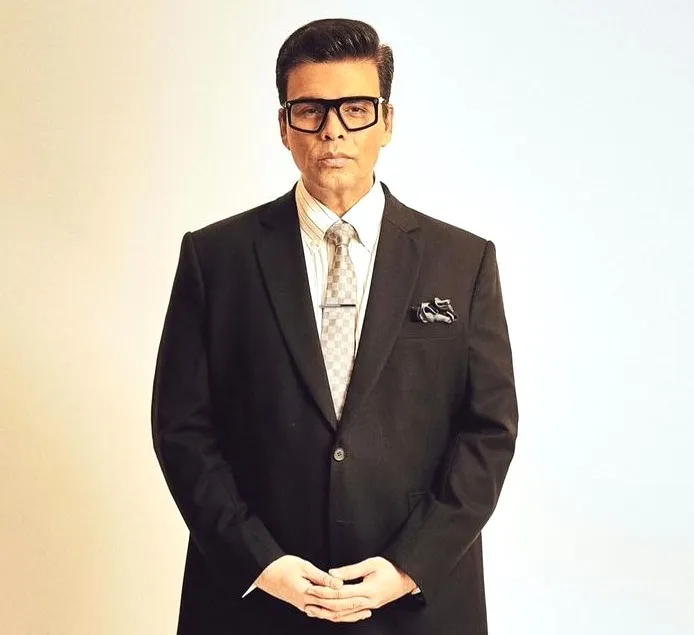

Karan Johar joins Fashion Entrepreneur Fund as investor and promoter

The Fashion Entrepreneur Fund (FEF) has joined hands with Indian filmmaker and fashion icon Karan Johar as an investor and promoter.

“Mr Johar’s passion for innovation aligns perfectly with our goals and his experience and extensive networks will be invaluable in reaching out to fashion brands and entrepreneurs,” said Vagish Pathak, Chairman, and Sanjay Nigam, Founder, Fashion Entrepreneur Fund.

“My objective is to bring glamour and trends to the forefront, supporting these brands as they captivate audiences globally. Through this initiative, we will help fashion entrepreneurs set new trends and achieve unprecedented success,” said Johar.

CARS24 launches super app, introduces new feature ‘Orbit’

CARS24 has launched Superb app that enables buying, selling, and financing a car, on-demand driver services, insurance, repair and maintenance RTO assistance, FasTag, service history record, and car scrapping.

The platform plans to include more than 40 services over the next few years.

“We're not just transforming car transactions; we're elevating them into experiences. This super app is our pledge to continually innovate, inspire, and seamlessly integrate the best of technology and personalised service into the everyday lives of our customers," said Gajendra Jangid, Co-founder, CARS24.

AIC T-Hub selects 20 startups for sustainability cohort

Startup incubator T-Hub, in collaboration with Atal Incubation Centre (AIC), has unveiled its new sustainability cohort of the AIC T-Hub programme.

This initiative aims to support entrepreneurs who are pioneering sustainable solutions. The startups part of the cohort will gain access to mentorship, workshops and webinars, investor connect, corporate partnerships, and access to T-Hub’s facilities.

“We are thrilled to support these innovative startups in their journey towards creating sustainable solutions. The Sustainability Cohort is not only about nurturing new ideas but also about driving tangible impact for a greener future,” said Mahankali Srinivas Rao, CEO, T-Hub.

Twenty startups out of the 220 applicants were selected to join the Sustainability Cohort, the company said in a statement. These include Earthtech India, Ambiator Private Limited, Hubeco Green Ventures Pvt Ltd, Reverent Technologies Private ltd, Myplan8, Sheen Solar, Zero Carbon One, NetZero Living, Visarj Systems, Sustech Innovations, V Transform, Airth, Nanowings, Renote, Newboo, Thinksmart Technologies (Clean carbon), Electrik Bee Private limited (Solarfix), CI Metrics, and Goodeebag.

Sourav Ganguly joins Blue Ocean Corporation’s Board

Former India cricket captain and Chairman of the ICC Cricket Committee, Sourav Ganguly has joined the boardroom of consulting and training organisation Blue Ocean Corporation as a Non-Executive Director.

The addition comes as Blue Ocean continues expanding across the UK, Middle East, and India.

“The supply chain industry is a vital backbone of global business, and I look forward to contributing my insights as we work collectively towards achieving the company’s vision,” said Ganguly.

This development was unveiled at Blue Ocean Corporation’s flagship event, the International Procurement and Supply Chain Conference (IPSC) 2024 in Mumbai, where he was the chief guest.

(This article will be updated with the latest news throughout the day.)

Edited by Kanishk Singh