[Weekly funding roundup Aug 17-23] Venture capital inflow dips

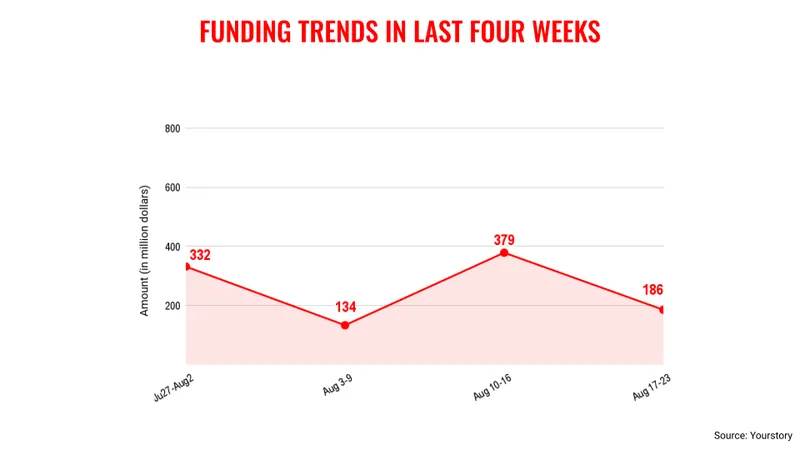

The month of August witnessed uneven inflows of venture capital funding into Indian startups, revealing the challenges of fundraising by companies.

Venture capital (VC) funding into Indian startups for the month of August has been very uneven, and the third week saw a drop in inflow of capital primarily due to the absence of large deals.

The fourth week of the month saw total VC inflow of $186 million across 20 transactions. In comparison, the previous week saw an amount of $379 million boosted by larger value transactions of and .

This uneven inflow of VC funding is not a very encouraging sign for the Indian startup ecosystem as companies continue to face the uphill task of raising capital. There is an increased scrutiny on transactions, which is leading to delayed funding rounds even as investors wait for broader positive signals from the macroeconomy.

The focus now is on how the US Fed is going to deliver on the interest rate regime, as any cuts would mean greater inflow of capital. The Fed Reserve Chairman has given indications that they would be looking at an interest rate cut, which should happen next month.

At the same time, there is considerable activity in the startup ecosystem, which also includes companies that went public. Zomato has announced the acquisition of Paytm’s ticketing business for Rs 2,048 crore. This could see interesting changes in the market with strong competition for BookMyShow.

The Indian startup ecosystem will soon witness one more important initial public offering (IPO) from foodtech company Swiggy, which is gearing up to come out with the listing documents in the month of September.

Key transactions

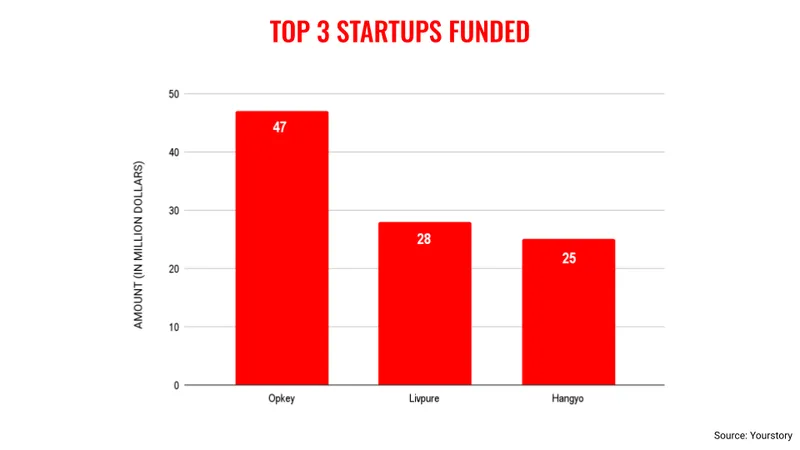

Opkey, a test automation tech startup, raised $47 million led by US-based PeakSpan Capital, with participation from existing investors.

Livpure, a water purifier and air conditioner brand, raised Rs 233 crore ($28 million approx.) from M&G Investments and Ncubate Capital Partners.

Hangyo Ice Creams raised $25 million from Faering Capital.

Consumer finance startup Axio raised $20 million from Amazon Smbhav Venture Fund.

Fintech startup InvestorAi raised Rs 80 crore ($9.5 million approx.) led by Ashish Kacholia, Founder of Lucky Investment Managers, along with his associates.

Uppercase, a luggage brand, raised $9 million from Accel.

Edited by Jyoti Narayan

![[Weekly funding roundup Aug 17-23] Venture capital inflow dips](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)