[Weekly funding roundup Jan 11-17] VC inflows continue to rise steadily

The Indian startup ecosystem is witnessing a steady increase in venture capital funding, with the early stage segment leading the way.

The Indian startup ecosystem witnessed a steady inflow of venture capital (VC) as the deal momentum increased and early stage funding continued to show traction.

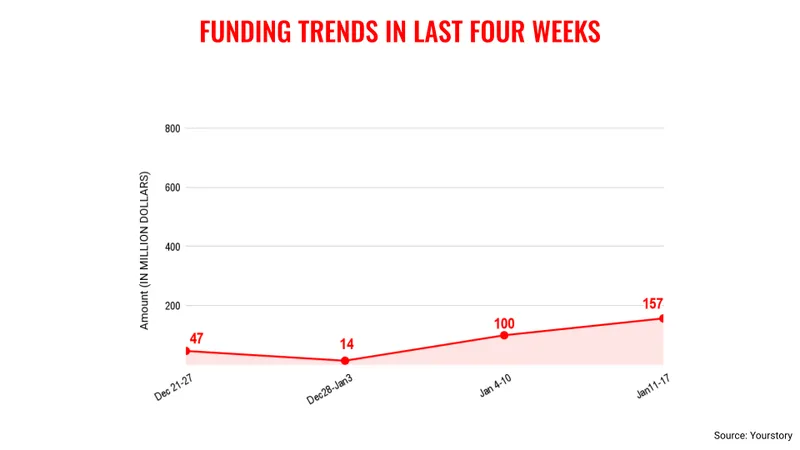

The third week of January saw total venture funding of $157 million across 27 deals. In comparison, the funding in the previous week was $100 million. This is a welcome relief for the startup ecosystem as the year did not begin on a very positive note.

There has been a steady increase in the deal flow, with the early stage funding category continuing to show momentum as seen in the last two years. The growth category also continues to show traction. At the same time, funding from the debt category remains steady.

Now, there has been a mix in the investments with varied sectors raising funding ranging from direct to consumer (D2C), electric vehicle, space and fintech. There are no large deals as yet, but there have been reasonable sized transactions in the range of $10-30 million.

The week saw SaaS startup Netradyne raising $90 million. This should be a welcome sign for the SaaS segment, whose prospects now seem a bit tepid, with investors wary about the kind of impact AI and GenAI will have on this sector.

However, it is quite early to talk about the broad direction on VC inflows as the external environment continues to remain challenging. The domestic economy is showing signs of slowdown and stock markets continue to remain volatile. In addition, another big uncertainty is the impact around the policies of the new US President Donald Trump.

In the startup ecosystem there continues to be both positive and negative news. Startups like Sharechat and Pocketfm have reduced their employee count. On the other hand, investors such as Avendus and Cornerstone Ventures continue to raise fresh funding.

Key transactions

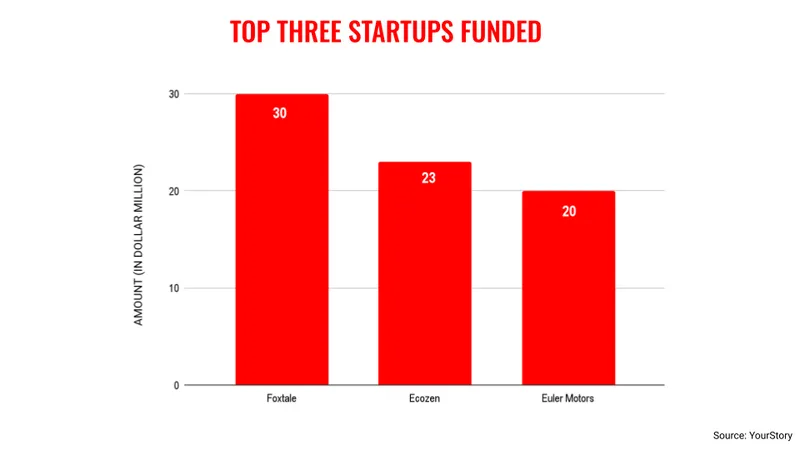

D2C skincare brand Foxtale raised $30 million from KOSÉ Corporation, Panthera Growth Partners, Z47, and Kae Capital.

Agritech startup Ecozen raised $23 million from responsAbility Investments AG, Northern Arc Capital Limited, and Maanaveeya Development & Finance Private Limited.

EV startup Euler Motors raised $20 million from responsAbility Investments AG.

EV startup BGauss raised Rs 161 crore ($18.5 million approx.) from Bharat Value Fund.

Proptech startup MicroMitti raised Rs 90 crore ($10.3 million approx) from HNIs and family offices.

Sarla Aviation raised $10 million from founders of Flipkart, Swiggy, Urban Company, LivSpace, Udaan among others.

Tech startup Eccentric Engine raised $5 million from Exfinity Venture Partners and Arkam Ventures.

Edited by Jyoti Narayan

![[Weekly funding roundup Jan 11-17] VC inflows continue to rise steadily](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-roundup-1670592545805.png?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)