What makes women angels "most valuable investors"?

More women angel investors are investing in Indian startups than ever before, helping infuse over $600 million through 356 deals over the last 7.5 years. But is it enough?

Last year, LetsVenture started the Women’s Angel Investor Network (WIN)—an exclusive platform to provide women angel investors access to invest in early- and growth-stage startups, and enable them to mentor and support the companies.

The angel investment platform started WIN to improve diversity and gender parity within the investor community, and boost women's presence on boards in both listed and unlisted companies in India.

At Shark Tank India—the desi version of the popular business reality show, 15% of the ventures funded were women-led and 49% had female co-founders.

Namita Thapar, Executive Director of Emcure Pharmaceuticals and a Shark on the show, has been a consistent angel investor.

“I did not go into the show thinking I would be gender-neutral while investing. I am a staunch feminist, and one of the causes I feel strongly about is about supporting women-led companies and giving voices to more women,” she tells HerStory.

Where do women angel investors figure in the male-dominated investing world?

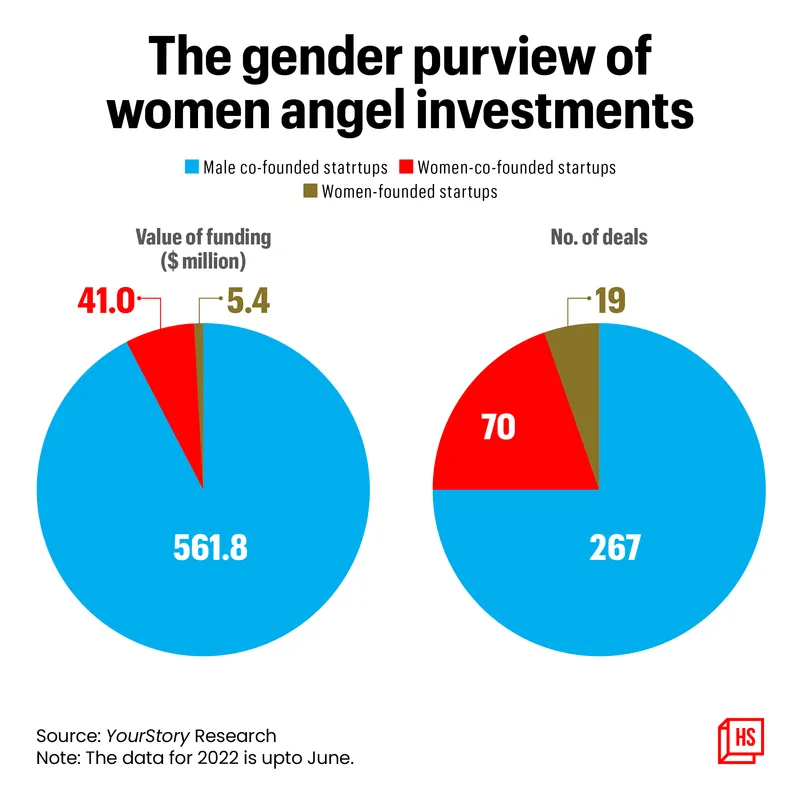

According to YourStory Research, in a span of 90 months (between January 2015 and June 2022), the Indian startup ecosystem saw women investors help infuse $608 million across 356 deals. While a sizable number of these deals were undisclosed, the monthly average funding by women angels stands roughly a little over $7.5 million, with nearly four deals a month.

Out of the 356 deals, women-founded startups saw 19 deals securing $5.4 million, women-co-founded startups saw 70 deals valued at $41 million, while male-founded startups had the lion’s share of 267 deals totalling $561.8 million.

Here, the role of women angels investing in Indian startups, especially those led by women or with women co-founders, is fascinating. Our research shows that between 2015 and 2022, investments by women angels increased by $4.9 million to $33.4 million.

Over the seven years, women angels were a part of 86 deals into startups with women founders and co-founders—registering a 4X growth in terms of participation since 2015. While 29 of these investments were undisclosed, women investors helped raise $77 million for these companies across sectors.

While the figure may not stand out on its own, it points to growing interest among women to invest in startups with women at the helm. This is significant given that an abysmal seven out of 100 entrepreneurs in the country are women, and nearly half (49.9%) of them join or start a business out of necessity rather than aspiration, according to a report by the Initiative for What Works to Advance Women and Girls in the Economy (IWWAGE).

So is there a dearth of women angel investors?

Need for greater participation

Shanti Mohan, CEO and Co-founder, Lets Venture points out that out of 12,000 investors, only 250 women investors joined its Women Investor Network (WIN) initiative.

“Before we ran the initiative, we had about 25 women investors—so the ratio of men to women investors is lower than 15:1,” she says.

Shrishti Sahu, Managing Partner/Angel Investor, SSV and who runs a syndicate on AngelList, concurs with Shanti.

“I have three women LPs (Limited Partner) out of nearly 300 in my syndicate. Platforms like Angellist and others will tell you that they have barely 50 active women angels (perhaps a 200 registered women) out of a total LP base of 10,000+ registered angels. There is tremendous disparity on the investor side, which also affects what kind of startups get funded.”

While she emphasises that she doesn’t invest keeping gender in mind, her portfolio includes 15% female founders (as she doesn’t invest in D2C brands), which is higher than the industry standard.

“I do hope to change this number to at least 30%, and then to 50% as soon as I find women founders building around the sectors I tend to focus on (fintech, SaaS, and consumer),” she adds.

Vineeta Singh, Founder and CEO of SUGAR Cosmetics, who rose to fame as an investor on Shark Tank India, recalls that the pool of women angels was limited when she started out almost a decade ago.

“Going by recent trends, there is an evident increase in the number of women angel investors as well as startup founders. Having proper representation helps create a sustainable ecosystem for everyone to succeed without any bias. These, in turn, create various opportunities for women to be in the industry and will help foster an environment where there is more understanding and acceptance for products that aren't necessarily mainstream and are women-focused,” she notes.

Most valuable investors

Shrishti Sahu, Padmaja Ruparel and Shanti Mohan - prominent women angels in the startup ecosystem

Offering an interesting take, Marci McGregor, Managing Director and Senior Investment Strategist at Bank of America Merrill Lynch, and Lorna Sabbia, Head of Retirement and Personal Wealth Solutions at Bank of America, highlight that investing is about “independence and empowerment.”

“When women invest, they tend to have a better average annual return from their investments than men,” Marci says.

Padmaja Ruparel, Co-founder, Indian Angel Network thinks women entrepreneurs-turned-investors are the most valuable investors.

“Apart from money, they bring valuable mentorship and guidance to women entrepreneurs as they have already traversed the path and solved the challenges. Every woman investor inspires many more women to become entrepreneurs and create their own success path,” she says.

She also finds it heartening to see women angels engage with entrepreneurs, take investment decisions, and work with founders, despite many of them not being entrepreneurs.

“This is a welcome sign as it unlocks valuable capital for startups. But good investors invest in good entrepreneurs, irrespective of gender,” she remarks.

Shanti echoes Padmaja’s sentiments. According to her, an angel investor’s decision to fund a startup should not be based on whether it is run by a man or woman, but on the startup’s probability of success.

“Women founders should get funded because they are building a good business. It’s nothing to do with gender,” she notes.

Founder of Dhruva.io and previously Oxford Caps, Annu Talreja, who received investments from Shrishti Sahu and Sairee Chahal of Sheroes, talks about feeling at-ease when women lead investments.

“A leading VC referred us to Shrishti, and I have known Sairee since my Oxfordcaps days when we engaged with Sheroes to manage our customer support. One thing that both had in common was their clarity in making decisions. It was one call followed by some basic due diligence, but the entire process was extremely quick, transparent, and very respectful of founders’ time,” she says.

Women have better business understanding?

Namita Thapar and Vineeta Singh

A community-led professional network for women, leap.club saw 13 early members participate in the Pre-Series A round in 2021 led by Enzia Ventures, Kunal Shah, and existing investors Whiteboard Capital, Titan Capital, and Artha India Ventures.

The startup had earlier raised $380,000 as part of its seed round in July 2020. Its cap table boasts of 24 women angel investors.

“Women understand our business a lot better, since we are building for women. Every time we pitch to a male investor, they ask if this was even needed. Women get what we are building, they are with us during both our good and bad times, and are great sounding boards,” says co-founder Ragini Das.

In fact, the startup’s last round was led by Namita Dalmia (Enzia Ventures), who was one of leap.club’s early member-partners.

Sanskriti Dawle, Co-founder, Thinkerbell Labs says, “It is worth noting that Padmaja Ruparel (IAN), Shanti Mohan & Sunitha Ramaswamy (both Lets Venture) are not only angel investors themselves, but also lead entire Angel Networks that nurture the startup ecosystem. IAN and LV are also investors in Thinkerbell Labs.”

Shanti believes women investors can make a difference in certain sectors like D2C because women founders find themselves more at ease while presenting to a woman on the investment committee or the VC’s partnership board.

“While, of course, there may be bias in terms of gender, I personally don’t think that's the only reason why women founders don’t get funded. They have to build competitive business models, have to be able to think of large scalable businesses, etc. We have seen many founders who have built D2C brands and raised enough capital—Vineeta Singh from SUGAR Cosmetics, Falguni Nayar from Nykaa, Ghazal Alagh from MamaEarth, etc.”

Vineeta recalls that investors used to be reluctant about sectors that were women-centric, as the audience was untapped and the market was unexplored.

“This could be attributed to the overall perspective of entering a proven space. However, we have come a long way since, and the situation is changing. Now, women VCs can offer a nuanced understanding of the demographic and make a difference by adding a deeper perspective. As of late, VCs are looking to invest in various consumer products, which can also be credited to the rise of the D2C sector,” she notes.

However, Namita doesn’t believe that women investors are only inclined toward certain industries.

“As long as we have the business acumen and networks, we can help any industry. I plan to support more women-led ventures; not just women I invest in, but all those who approach me to help,” she says.

Whether investing personally or as an angel, Marci observes that women tend to be more patient. “They generally develop a strategy and stick to it, buying and holding for the long term rather than buying and selling reactively, or day trading. This ‘steady as she goes’ approach requires fewer trades and so, incurs fewer transactional fees, which can help to create better returns over time.”

Empathy, a strong point

Padmaja observes that women founders are creating companies to solve the problems they see every day, which resonates with women angels as they face the same challenges.

“They are empathetic, resilient and adaptable, and research has shown that female leaders usually display excellence in whatever work they take up and go the extra mile to support their teams,” she says.

Shrishti agrees that women angels bring empathy and diverse perspectives to investing.

“Women tend to be 50% of the consumers, so a cap table with only male investors misses out on adding the female perspective and building for 50% of their audience. I'm on cap tables where there are close to 200 investors but only 2-5 women, so founders miss out on real customer insights because of this disparity.”

Shanti says that along with empathy, women also bring diversity of thought in terms of looking at investments, and that combination is invaluable.

Ragini sums it up by terming the relationship between women investors and founders as “solidarity in sisterhood”.

“Women angels show a lot of warmth towards female founders. We want every one of us to win. Investors believing and investing in women-led startups will benefit the startup ecosystem hugely,” she concludes.

(This story was updated to correct two typos.)

Edited by Kanishk Singh