All you need to know about GSTR-3B Filing

How tile GSTR-3b?

Under this GST regime, it’s mandatory for every business to register them under GST. Currently including GSTR-3B companies have to file three other returns i.e. GSTR-1, GSTR-2, and GSTR-3.

But GSTR-3B is not mandatory for all there are some exceptional cases. Let’s find out who all can exempt GSTR-3B filing:

Business falls under the composite scheme

Persons who are not registered

Unique identification holders

Keynotes related to GSTR 3B:

1- GSTR-3B needs to on 20th of every month

2- If a business fails to file GSTR-3B then he has to pay 18% of tax as penalty charges

3- Its mandatory for all even if you are not registered under GST

4- GSTR-1 can be filed using same data filed in GSTR-3B

5- GSTR-3B needs file separately for each GST number

6- This filing can’t be revised, unlike other filings. GSTR-3B can be revised only through GSTR-1, GSTR-2 & GSTR-3 filings

7- GSTR-3B need to file every month up to June 2018

8- All taxes need to be paid before filing GSTR-3B

99- GSTR-3B is a summary of all other filings. So, in GSTR-3B input total sales figures, purchase amount, input tax credit amount & total payments.

10- GSTR-3B can’t be used to claim any refund

11- For migrated taxpayers, it’s necessary to provide all details mentioned in REG-26 to file GSTR-3B

12- GSTR-3B need to file on govt. GST portal i.e. gst.gov.inNow how to file GSTR-3B: Detail GSTR-3B filing process on Government portal:

13- First, visit GST portal gst.gov.in

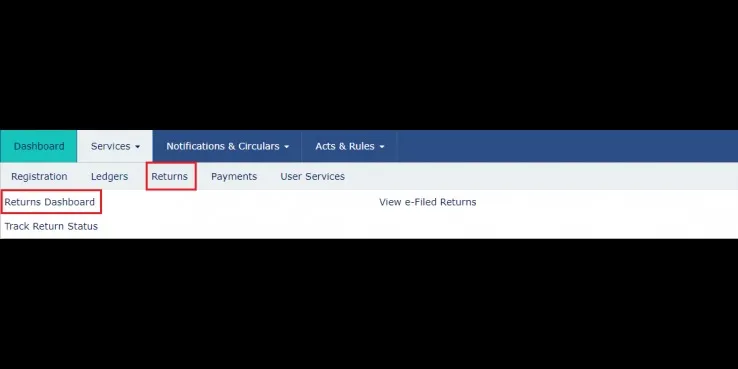

14- Then find RETURNS under SERVICES button

15- Then click on Returns DashBoard and fill the required period for return filing

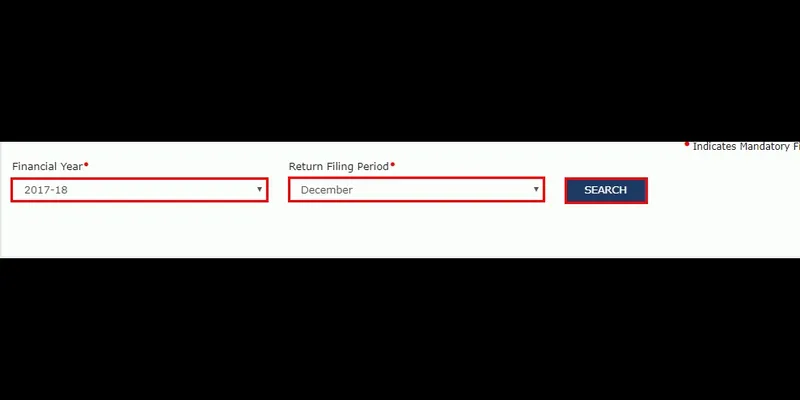

16 - Here you need to enter the Return Filing Period & Respective Year details to start the return filing process

17- Then click the SEARCH button

18- Now you will see various returns filing buttons. You need to select the GSTR 3B return filing box and click on PREPARE ONLINE

Then Click on OK button to proceed

This will redirect you to a page where you need give answers to a lot of questions to reach to the relevant section

Answer all questions and click on next to proceed

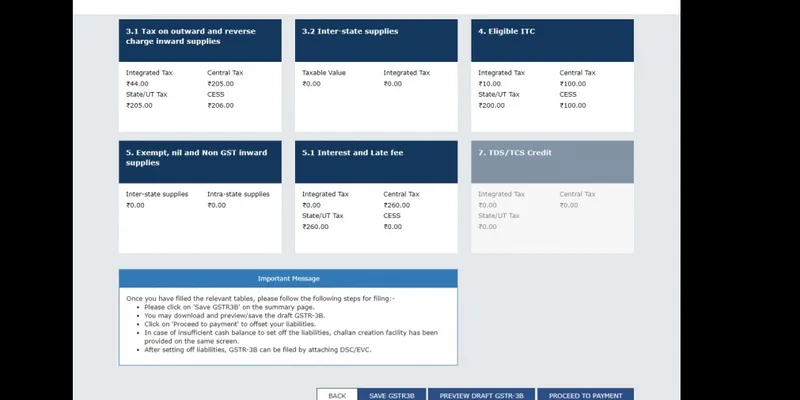

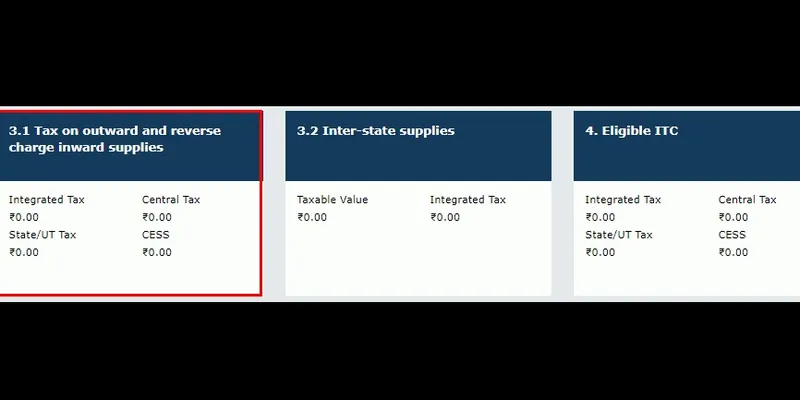

You will see the GSTR-3B page to provide inward supplies, outward supplies etc. details

Now you will see different tiles with different heads, click on the respective tile and fill up details

And you will see all details entered under respective heads

Then do a proper review and click on SAVE GSTR-3B

You can also preview the details submitted by you, click on PREVIEW DRAFT GSTR-3B and verify all details

Then a PDF will pop up showing tax details

Click on PROCEED TO PAYMENT

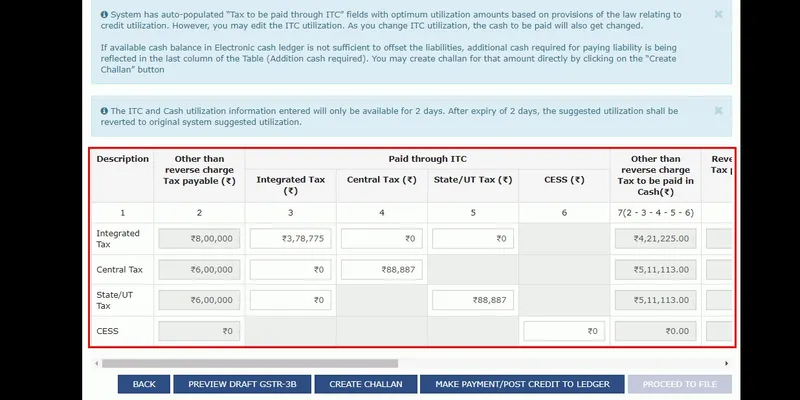

You will see cash & ITC available on the respective date. Now check if the available cash balance is enough to pay liabilities or not

If the available cash balance is less then you may create a challan for rest amount

Click on MAKE PAYMENT/POST CREDIT TO LEDGER button to pay off the liabilities or to claim credit in case of no liabilities.

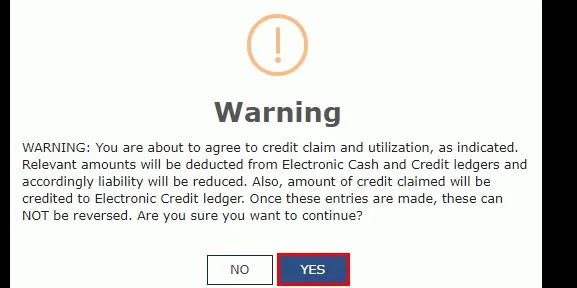

Now you will see a message asking a confirmation to credit claim & utilization

Click on YES button

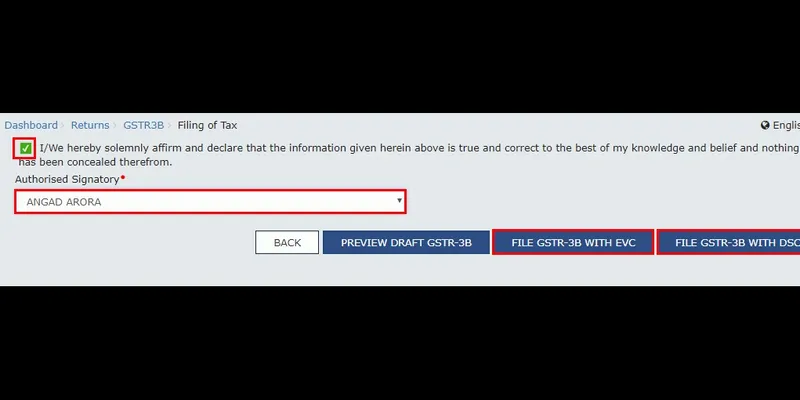

Go to the bottom of the page and you will see a declaration message with a checkbox

Now click on PROCEED TO FILE button

Click on the box and select the authorized signatory

Bottom of that you will see two options one is FILE GSTR-3B WITH DSC and other one FILE GSTR-3B WITH EVC

Click on the appropriate button

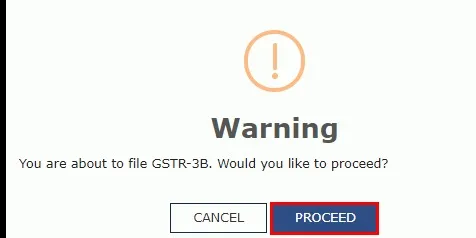

You will receive a warning message asking whether to proceed with GSTR-3B filing or not

Click on PROCEED

Enter the OTP sent to the registered mobile number & email id of the authorized signatory

.png?fm=png&auto=format)

Now you will receive a confirmation message and the status of GSTR-3B return will change to FILED

You can also view the return details by clicking on VIEW GSTR-3B

GSTR-3B filing dates

For the month of July 2017 – 20th & 28th of August 2017

For the month of August 2017 – 20th September 2017

For the month of September 2017 – 20th October 2017

For the month of October 2017 – 20th November 2017

For the month of November 2017 – 20th December 2017

For the month of December 2017 – 20th January 2018

For the month of January 2018 – 20th February 2018

For the month of February 2018 – 20th March 2018

For the month of March 2018 – 20th April 2018

For the month of April 2018 – 20th May 2018

For the month of May 2018 – 20th June 2018

For the month of June 2018 – 20th July 2018