Leverage Robotics to Transform Finance & Accounting

What is Digital Automation?

Digital automation is the process of integration of digital technologies to create new or modify the existing business processes, products, strategies and customer experiences.

Need for Digital Automation in Businesses

The transition or reimagining of business is mandatory in the modern world to meet the ever-changing business and market requirements.

- Digital transformation is about maneuvering from analog to digital.

- It is also about implementing digital data to make things simpler and more effective.

- It is undoubtedly about adding value to everything in a business, from processes to customer services.

Robotics & Finance: Initiation of a Great Partnership

A gradual progression that has continued to bring about modification and advancement in all spheres of businesses, be it production, marketing or customer service, is now benefitting it the most with the application of robotics.

Finance and accounting is an integral part of any business. When all other aspects of the business are undergoing a sea change and witnessing automation, how finance can remain immune to it.

Robotics or robotic process automation (RPA) helps in automating business processes across multiple industries. It involves “software robots” (not actual robots) to handle repetitive tasks that were traditionally performed by humans.

Deloitte defines this exponential technology as, “RPA is a computer-coded software, commonly referred to as BOT, that emulates human actions and can drive automation of rule-based processes. It is an ideal automation technique for any process that has a heavy dependence on data entry, data manipulation, triggering responses, and communicating with other digital systems.”

Ernst & Young gives us a simpler meaning, “Robotic process automation (RPA) is the use of software that mimics human interaction with core systems, web and desktop applications to execute processes.”

Mr. Ashwani Kohli, Director, Intelligent Automation, PwC South East Asia Consulting, who sees a bigger role for robotics in finance and accounting said, “To improve data standards and quality, RPA is an efficient and affordable digital initiative, which will lay the foundations for more advanced cognitive technologies such as artificial intelligence (AI).”

Adopting RPA in finance and accounting will turn out to be a partnership that will give the most promising results in effectively dealing with lots of repetitive work, big data, information gathering, entries, etc.

Tasks That Can Be Accomplished By RPA

Since RPA cannot be an ideal fit for all financial activities hence, it becomes pivotal for financial firms and services to identify its best usage.

Know that software robots can be put to use for finance and accounting effectively and efficiently in these fields:

- Tasks that are repetitive.

- Work that involves manual calculation.

- Actions that have electric start and endpoints.

- Tasks that face a high error rate.

- Tasks that are data intensive.

- Actions that require an electronic trigger.

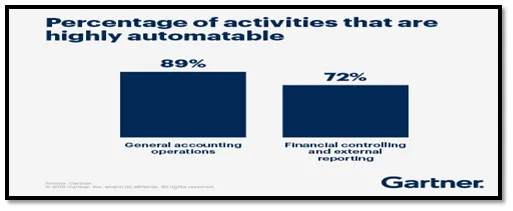

Gartner's research shows that a very high percentage of financial operations can draw benefits from deploying RPA. Thus, the common functions that can draw benefit from robotic automation in finance and accounting are:

- Accounting and Reporting

- Internal Audit and Compliance

- Payroll

- Tax

- Accounts Payable

- Accounts Receivable

- Budgeting and Forecasting

- Treasury Management

- Expense Management

Affirming the vast reach of robotics, Mr. Ashwani Kohli, Director, Intelligent Automation, PwC South East Asia Consulting commented, “Besides the traditional accounting operations, RPA also impacts audit, tax planning, and statutory and regulatory reporting processes.”

It is a prerequisite for CFOs to understand the core areas where finance robotics can bring about the best results.

“RPA can alter the landscape of finance and accounting work sphere as drastically as the Industrial Revolution had brought about a change in factories.”

Benefits Attached To RPA Solutions

The perspective of PwC, the professional services firm, is that RPA is generating a paradigm shift in finance and has ushered in cost reduction and enhanced efficiency. Not only this, RPA has helped in redefining the role of financial personnel and added more value to their job.

As progressive firms have already deployed RPA, like automated cloud accounting software in their day-to-day activities, it is now easier to understand its practicality.

Benefit #1: Saves time

Undoubtedly, the most obvious and rewarding aspect of RPA applicability is that it saves valuable time of personnel by automating manual tasks.

If we compare this to traditional accounting then we realize that the professionals wasted lots of time in mundane, repetitive tasks.

Benefit #2: Enhances productivity

As a result of time saved, these professionals get more time to focus on crucial tasks and add value to their services.

When working with traditional methods of accounting, these people were so tied up with manual work that other tasks would take a backbench.

Benefit #3: Simplifies implementation

The best part of applying RPA is that it is non-invasive thus, the least disruption is witnessed. It can be easily operated by anyone without prior experience in IT.

Benefit #4: Minimizes errors

The biggest hurdle in traditional working was that one mistake would waste several man-hours to detect and rectify it. With software taking over the manual work, the accuracy is enhanced manifolds.

Benefit #5: Reduces cycle time

What humans did in days, these robots can do in hours. This reduces cycle time drastically and improves efficiency.

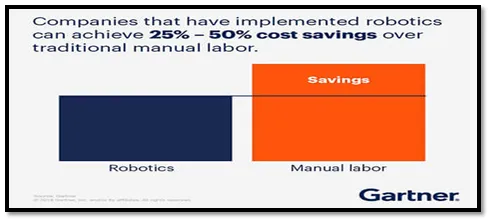

Benefit #6: Cuts costs

With time being saved, errors being eliminated, efficiency is improved. The biggest benefit of deploying RPA is cost reduction which naturally converts to profits for businesses.

Benefit #7: Improves standardization

Standardization of inputs strengthens the process further resulting in a lesser number of queries or reworks.

Talking about the advantages attached to RPA, Deloitte says, “Organizations see this ‘IT-light’ technology as a blessing to dramatically bolster process efficiency levels, accuracy levels, and throughput for transactional processes, without having to navigate IT organization complexities required for other automation interventions.”

“RPA is an effective cost and time enabler, complementing any digital transformation journey to streamline business processes, achieve profitability and maintain a competitive advantage,”- Ernst & Young.

Challenges in Implementation

There is no doubt in the effectiveness, accuracy, efficiency or cost-effectiveness of RPAs but, the crux of the matter is how a company takes full advantage of it.

This observation by Gartner carries a lot of meaning for those businesses that are looking to introduce robotics - “To achieve the full benefit of robotic process automation (RPA), corporate controllers need to restructure their workforce to enable automated work, free from human interference.”

The biggest challenge that lies in the implementation of RPA is the lack of preparedness that includes factors like:

Challenge #1: Employee issues

The biggest roadblock is the negative perception that the employees possess towards automation. Allaying their fear regarding their job insecurity is very essential.

A proper pre-work is needed to develop an understanding among them that robotics will make their job easier and smoother. The employees can work with RPA to achieve unprecedented success.

Professor Michael Davern, Professor of Accounting & Business Information Systems, at the University of Melbourne in Australia comments, “Fears of RPA replacing workers are as unfounded as earlier concerns that computerized spreadsheets would replace accountants. RPA is about automating tasks, not entire processes.”

Challenge #2: Training issues

There is a shortfall in qualified employees who can work with RPA. Companies need to train their workforce well before implementing these measures. They should encourage employees to become knowledge-centric to derive optimum benefits.

Challenge #3: Data privacy issues

Adopting software like business accounting software, the biggest concern for firms is the privacy and security of their data. Well, this concern is legitimate. The data must be safeguarded through effective mechanisms.

Challenge #4: Process issues

The results may not be as expected if all the dots are not connected. Foolproof planning is needed for achieving the utmost from RPA. Lack of preparedness in any form, like untrained employees, etc. will lead to confusion. This will eventually produce unsatisfactory results.

“Every new beginning has hiccups but these should not deter us from embracing change. Instead, we should learn to overcome and diminish the hurdles that come in the way.”

Conclusion

Comparing the pros and cons of RPA, it can be conclusively said that deploying it in the field of finance and accounting is not a choice but a necessity for businesses.

To keep pace with the speed at which the industry is transforming and to counter competition, one must transform accordingly. RPA is a supporting tool that simplifies numerous tasks of finance and accounting professionals.

With time, more innovative tools will be added to RPA that will facilitate a completely automated structure and bring down the need for human interventions.

The industry has finally opened up to all the transformative tools. As the results have been highly encouraging, the leaders are pushing these tools in their firms to reap benefits at the earliest.

RPA has an edge over others as its applicability does not bring massive disruption. Ease in implementation and cost-effectiveness are major reasons for its popularity.

Change or transformation can create confusion or uncertainty for a short period. However, it gives positive results in the long run. Shying away from embracing transformation can result in stagnation in business. Therefore, to survive and flourish, the change should be welcomed.

Those who fail to understand the complications of undermining automation in finance will be hit the hardest soon. When others march ahead and grow, they will be left behind, trampled.

Robotics is not the end of automation, in fact, it is the beginning of the foundation on which real-time automation will take place. RPA should be integrated with other programs to bring about a fruitful result.

Mr. Ivan Phuah, Director, Digital Finance Transformation, PwC South East Asia Consulting, observes, “It needs to be a holistic program, where the Business Case, Automation Delivery, Governance, Risk & Compliance, Operating Model, and Change Management work like cogs in a wheel.”

Thus, each change should be seen in totality and not individually.

A futuristic approach is what is needed by the business leaders, CEOs, and CFOs, to witness exponential growth and a robust future.