Coronavirus: Impact of the pandemic on Indian car industry

The coronavirus pandemic will bring tough and challenging times for the automobile industry in the current fiscal. A drop of around 40 percent in car sales can be expected.

The coronavirus pandemic has dealt a deadly blow to humanity and to the industries globally. This unprecedented crisis has unleashed a global trauma and has become the biggest threat to the global economy in modern history. Major impacted businesses are travel and tourism, consumer goods, automobile, IT, and insurance.

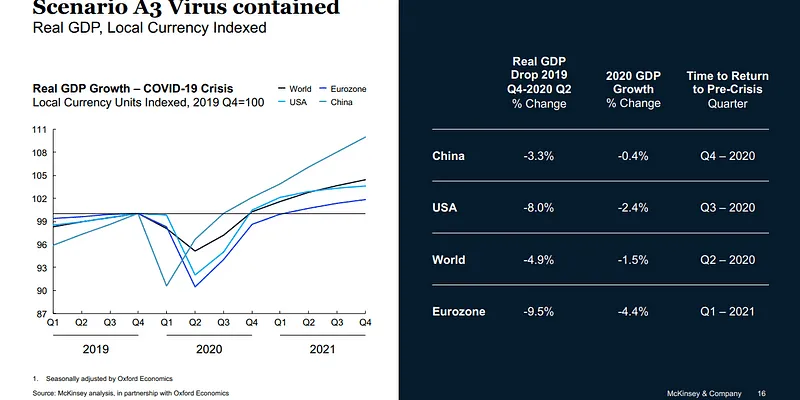

A report from McKinsey & Company claims that the US and Eurozone’s economies could take until 2023 to recover from the impact of the crisis in an optimistic scenario with an average global GDP drop of 4.7 percent.

If the public health response, including social distancing and lockdown measures, is initially successful but fails to prevent a resurgence in the virus, the world will experience a “muted” economic recovery, says McKinsey. In this scenario, while the global economy would recover to pre-crisis levels by the third quarter of 2022, the US economy would need until the first quarter of 2023 and Europe until the third quarter of the same year.

The industries that have to take the maximum shock of coronavirus attack are travel, tourism, hotel, hospitality, automotive, and financial markets. The exact impact to each of these would be clearly known in the next few weeks once countries start to recover from the peak of virus attack and life starts to return to normal.

Impact on the Indian automobile market

India will be the world’s fourth-largest passenger-vehicle market by 2021. It took India around seven years to increase its annual production to four million vehicles from three million. However, the next milestone – five million – is expected in less than five years.

The automotive industry deploys a long supply chain. It has to source a large amount of materials varying from steel to non-ferrous metals, plastics, and electronics. The supply chain must be robust to ensure seamless production on a daily basis. Most of the vehicle makers have either own bases for the supply of materials or have suppliers based in China. These have been seriously affected by the coronavirus crisis.

As supply chains around the world are disrupted, the full impact is yet to be felt. Business leaders must prepare for the effects on production, transport and logistics, and customer demand. These include a slump in demand from consumers leading to inventory “whiplash,” as well as parts and labour shortages due to manufacturing plants shutting or reducing capacity.

With this growth in mind, here is an attempt to build an impact analysis model for the Indian automotive industry post the lockdown.

Due to the coronavirus crisis, automobile manufacturers the world over are faced with a sudden slump in demands. This coupled with environmental factors, technological upheavals, and complex regulatory frameworks are going to result in tough times for the industry.

Author's Source

Is this only a passing phase, or will it have long-lasting repercussions? KPMG in its report ‘Potential Impact of COVID-19 on Indian economy’ estimates, in the event of a quick recovery scenario, Indian GDP growth to be in the range of 5.3 to 5.7 percent. The automotive industry, which moves in sync with the economy of India, has already been struggling with idle capacity, low demand, and high cost of production.

The following assumptions can be made: the auto companies, OEMs will start production from mid of May onwards (if the lockdown is lifted), an expected average price drop of one percent across all segments, supply chains disrupted across the entire industry, however, a mature industry like cars revs up quickly, the companies will be in full production level from June 2020 onwards.

Opportunities and revival strategies

There is never a one pill solution for any business contingency at any point in time. Extremely unpredictable times like these brought about by coronavirus pandemic teaches the value of risk assessment and thereby preparing contingency plans for businesses. There would be opportunities once the time passes and companies who survive would emerge stronger. In the context of the Indian automobile industry, there are silver linings post coronavirus.

Some of these opportunities and revival strategies are:

Personal use cars are expected to see an increase owing to infections, health and safety concerns with shared mobility. However, there are chances of equal opportunity for the shared mobility too due to the size and upcoming growth of the industry. Moreover, the replacement of shared mobility vehicles is 50 percent faster than personal use vehicles.

The world will not trust China again so easily. China has been at the nerve centre of the automobile supply chain for a very long time. It is time now for global companies to de-risk themselves from China and look for alternate sourcing channels. This is where India can pitch in. This is going to be a massive opportunity for Indian component makers to grab business share from Chinese suppliers. Even a two percent increase in market share will lead to a significant $10 billion in revenues. Typically, these customers in US/Europe offer better profit margins too.

Being good or being excellent is not enough in the modern business world. Global customers require innovative world-class products and services at all times. This could be a great opportunity for Indian makers to increase their level of production factories and supply lines to global standards. It calls for very high levels of hygiene, cleanliness, standardisation, and visualisation at the shop floors. It also calls for system driven approach to the businesses.

Alternate and related industries like aerospace, medical appliances, and consumer goods present newer opportunities to the automobile component makers. Since many of these customers will redraw their supply lines shifting from China and Taiwan, it would be a great opportunity for auto component makers to pitch in with the global players and strike collaborations.

It is a great opportunity for Tier-I and II businesses to prepare a long-term roadmap for creating an ecosystem for components industry in businesses like mobile phones, computer components, electric vehicle components, high technology railways and transportation systems. Tier I/II/III companies need to work together and create a joint working model to develop complete product lines. This is a model successfully deployed in Japan, Korea, and Taiwan.

Govt is likely to continue its push towards electric vehicles (EVs). It is time for the automobile makers to come up with definitive plans for the EVs in all segments. There is a great opportunity for serious EV players with reliable technology vehicles. For cars, there is an ecosystem creation with charging stations and swappable batteries technologies. Government and public sectors should take lead in this.

Based on the above, companies can be recommended to draw out their business plans for post coronavirus ‘The New Normal’ world. Indian companies have a great opportunity to create newer business networking lines, establish global business networks of suppliers, customers, and partners. Investments in these areas would take them far and insulate from future coronavirus-like shocks.

Barometer of the country’s economy

The coronavirus impact on the automotive industry which is considered a barometer of a country’s economy is surely going to be negative. Car purchases are discretionary purchases and not essential except for service provider like shared mobility services, etc. In India car purchases have a lot of emotional value attached to it.

There are going to be tough and challenging times for the automobile industry for the financial years which just started. A drop of around 40 percent in car sales from its peak of around 3.2 million in 2017-18 can be expected. Regression model predicts total car sale of 20.43 lakh in the financial year of 20-21. There is also an opportunity for growth of the auto industry upon restart. The customers in the US and Europe will definitely look to move away from China. Indian industry needs to step up the efforts and grab these opportunities.

Edited by Javed Gaihlot