Skydo’s tech solution is simplifying cross-border payments for SME exporters

Bengaluru-based Skydo is helping small and medium-sized enterprise (SME) exporters with its tech-based platform and charges a flat fee, eliminating swift fees or card charges.

India holds 14th position globally in terms of exports. Of this, the micro, small and medium-sized enterprise (MSME) segment accounts for 43%, according to a report by FICCI. While Indian SMEs unlock their potential by engaging in exports, they are also finding it difficult to navigate through the challenges when it comes to managing cross-border payments.

From volatility of exchange rates, potential delays in clearing payments, high transaction fees to lack of transparency, cross border money transaction has been a deterrent to entrepreneurs in the export business.

Bengaluru-based is addressing this problem of Indian SME exporters with instant and low-cost cross border payments similar to Unified Payment Interface (UPI). Skydo was co-founded by Srivatsan Sridhar, a mechanical engineer and an ISB alumnus, along with Movin Jain in Bengaluru in 2022.

According to Sridhar, most payment providers such as PayPal charge as high as 10% for Indian exporters and freelancers to receive money from their clients overseas. He says that cross border payments is an evolving landscape with high charges for exporters receiving payments from their overseas clients.

Skydo is trying to solve this problem by offering a tech-based platform and charging a flat fee instead of forex charges.

How it started?

After completing his education and working abroad for some time, Sridhar returned to India to join his family’s export business. During this time, he realised the issues facing export businesses when it came to payments, and he wanted to build something of his own in the tech space that isn’t reliant on physical infrastructure.

“Having gained experience with firms like Ola and Rupeek, I acquired insights into the financial aspect of business operations. During my time at Ola, I met Movin Jain, and both of us aspired to create a solution addressing consumer needs. We identified a significant gap in the realm of seamless cross-border payments for exporters, which led to the inception of Skydo in 2022,” explains Sridhar.

How Skydo works?

Skydo is a web-based application where an exporter needs to sign up and link their India bank account with Skydo. According to Sridhar, “the platform generates international accounts that are ready to accept payments."

The second step is to raise an invoice. “Now, if the exporter uses the Skydo invoicing tool, the bank account details are already filled up, but if they are creating invoices outside Skydo, they need to add the international bank account details and share with the overseas customer,” Sridhar explains.

After the invoice is raised by the exporter, Skydo automatically tracks and communicates payment status, credits the India bank account with the payment, and sends the payment advice and compliance details.

The total turnaround time for the payment to credit to the receiving bank is 1.5 days. Skydo works with DBS Bank to facilitate the transaction and charges a flat fee, eliminating swift fees or card charges.

“Our tech platform connects together local payment methods in all the major currencies. Local payments are usually free. Senders pay locally in their countries, and Indian exporters receive money through NEFT / RTGS,” Sridhar highlights.

Skydo already has 500 exporters onboard, and with its scale of operations, Sridhar says the platform is able to get forex conversion at much lower rates than individual exporters. “We do not lock in forex rates, instead we pass the live rates to exporters without adding our margins. So, we don't make or lose money on forex rates,” he adds.

Some of the companies currently operating in this space include PayPal, Payoneer, Stripe, and Razorpay.

Sridhar claims that Skydo facilitates transactions of around $2 million every month.

“We aspire to support lakhs of exporters and gain a significant market share of $250 billion SMB forex inflow. So, we are focusing on making a reasonable margin, but going after a large scale,” Sridhar says.

At present, India holds 14th position globally in terms of exports, commanding over $776 billion for FY 2022-23 encompassing both goods and services. Notably, around 35-40% of this revenue originates from SMEs. The country is home to 8 to 10 lakh active exporters. While the export of goods is projected to expand by approximately 10% annually, the services sector is anticipated to experience an impressive growth of 25% year on year in the coming years. Skydo’s current focus is directed towards the SMB segment, which accounts for inward payments totalling around $300 billion.

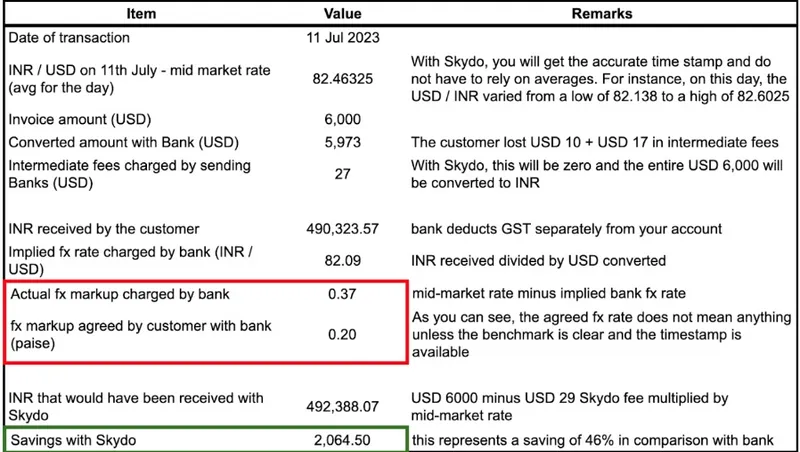

An illustration shared by Skydo explaining the transaction done via their platform

Challenges and the way ahead

While India is rising in cross-border trade, legacy exporters often face trust issues with new players. Sridhar says that many exporters are hesitant to switch away from their existing processes and that will change with awareness.

Skydo is collaborating with various SME associations and bodies to spread awareness of export payments and the Skydo platform.

Sridhar elaborates, “Our payment tracking service bears resemblance to parcel tracking on an ecommerce platform, putting an end to the anxiety that often arises when a money transfer has been initiated from the sender’s country but is yet to reflect in the recipient’s bank account.”

He further explains that Skydo goes beyond by furnishing GST-compliant remittance advice and centralising all business documentation, thereby eliminating the need to scurry for invoices and payment confirmations as the quarter draws to a close.

In a recent stride, Skydo has also introduced an invoicing feature tailored for businesses. This functionality not only streamlines the creation of invoices but also aligns with the newly-launched government initiative for e-invoicing.

In the next six to nine months, Sridhar says Skydo plans to launch the same payment feature for importers as well.

Edited by Megha Reddy