How much is your valuation and equity dilution in the first round of funding?

We recently carried an article about a company which builds a technology product for an entrepreneur in exchange for 20-40% of the company. The concept certainly is useful but isn't that an obnoxiously high percentage of equity being given away even before a company has launched? A very interesting Twitter conversation followed and we decided to dig deeper to know what would be the ideal amount of equity to be given away.

The first round of funding

First, it is not always necessary to raise funds; one can always bootstrap. But in businesses where scale is a necessity and revenues would take time to come in, funding becomes important. For the first round, there are multiple routes an entrepreneur can take: angel investors, angel networks, accelerators and incubators (there are other modes - family and friends, loans and schemes but we will not discuss that here).

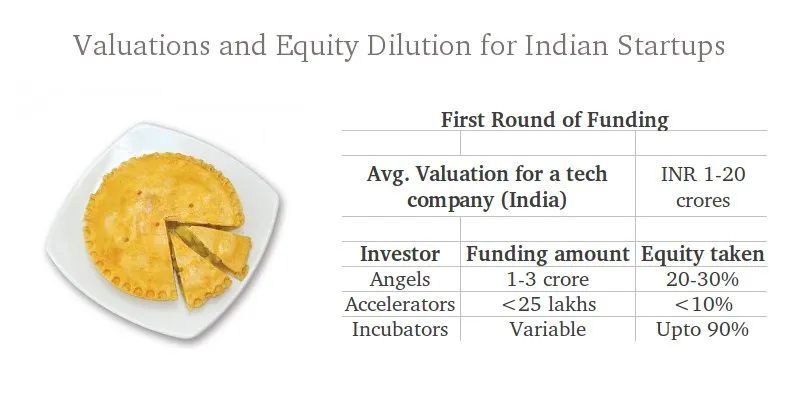

What does an investor look for while funding? Primarily three things: team, the idea (market and scalability) and the trump card -- traction. “Valuations and equity dilution depend upon a lot of factors but if one has to put a number, a broad range for a serious product would be anywhere between INR 1 to 20 crores,” says Rajesh Sawhney, founder at GSF Accelerator. But according to conservative estimates, a product company with a good traction (according to the industry) would be valued at INR 4-6 crores pre-money.

Angel investors in India typically take up 20-30% of equity for investment worth INR 1-3 crores. This is relatively a large chunk of the company but it is so because hardly one of the 10 companies an angel invests in will give returns and most of the money has to be made via these deals. Anil Joshi, the ex-President of Mumbai Angels, says, “Angels are the first people who put in the money and take the highest risk. Depending on a lot of factors, angles can take as less as 10% as well. Typical valuations are between five to 10 crores.” Pranay Srinivasan of Sourceasy, who has been pitching for investments, says, “Less than 10-12% total for approx $100,000.00 (INR 0.6 crores) for an angel round with the pre-money valuation at $750,000.00 (INR 4.5 crores) is what I've seen generally.”

Comparing the situation to the US, Pankaj Jain of 500 Startups says, “The situation is better there as more deals happen via convertible notes and also the fact that USA has a lot more investors.” A convertible note is basically a kind of investment which is given out as a loan and there is no explicit mention of valuation. Anand Jain, co-founder at WizRocket, agrees, “'Angels' are called so not because they're after your equity, but they believe and trust in the team. They give you your first cheque, and then sit back and relax while the team churns out something great. Ideally, an angel should work off a convertible note, which is very popular outside India.”

The next step for most angel-funded or accelerated startups is raise money from a VC. “It is best to have at least 60% of the company with the founders (after removing the options pool and initial investors) to make your company attractive to a VC,” says Pankaj. And a VC round is not always the next round after an angel round as there may be a seed round or a bridge round before reaching a Series A. This makes it necessary for entrepreneurs to be very careful with their equity.

Considering accelerators and incubators, the models vary widely over here as well. “We take equity in single digits and prepare the company for the next phase of growth via VC funding,” says Rajesh. GSF, 500 Startups and The Morpheus all take up less than 10% of the equity while there are others on the opposite end of the table like Rocket Internet that takes up about 90% of the company and the model is more like hiring intrapreneurs as founders.

The entrepreneurs are also given salaries in some cases. Then there are incubators like AngelPrime which work very closely with the companies and also act as a co-founder. The incubators also take up a significant amount of equity (sometimes more than 50%) which is justified by the degree of involvement.

At the end of the day, it is about growing a business. And funding is the rocket fuel that most of the businesses need. Things depend on people, industry, time frame and many other variables. The above mentioned modes are all different models and there is no wrong and right but these numbers should serve as a reference point while raising funds in India.

Do share your experience.

Related read: