Report Card 2015: Did vehicle aggregators make the grade?

The year 2015 did not start well for the taxi/autorickshaw aggregators in India.

The December 2014 rape of a Delhi woman by a radio cab driver highlighted the potential dangers associated with hiring these cabs. With protests erupting all over the country, it was reminiscent of the aftermath of the Nirbhaya case of December 16, 2013. The government, confounded by how to make such services safer, banned them altogether in parts of India.

Till the third quarter of 2015, aggregator services were trying to reach a settlement with the government. The State, on its part, seemed clueless about how to frame legislation for aggregators, which was a relatively new concept at the time.

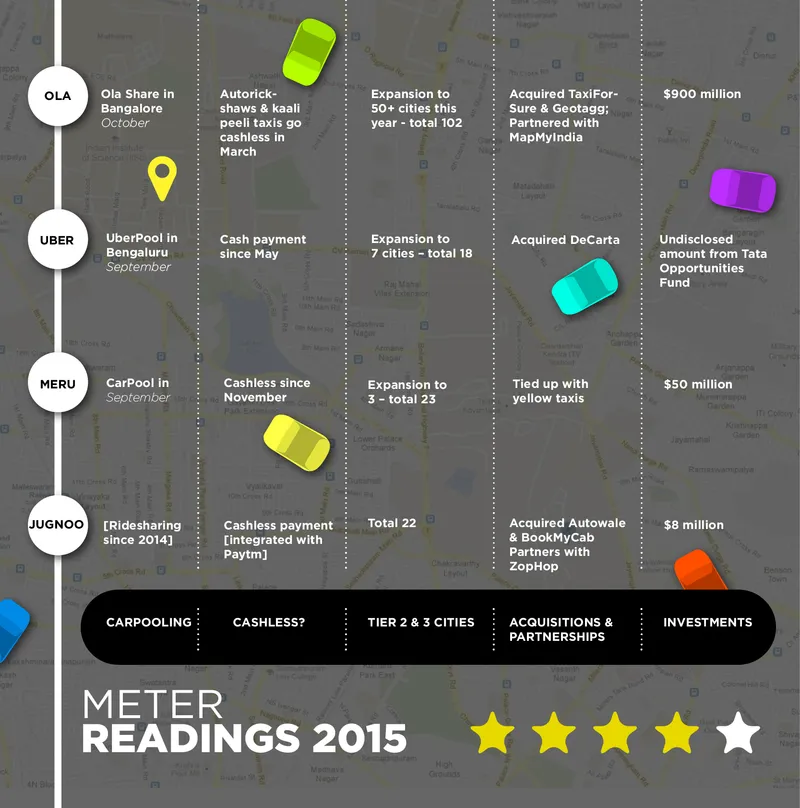

However, this did not hinder the progress of the industry this year. While a handful of newbies entered the sector, the biggies made about $1billion in funding. Ola joined hands with international players like Grabtaxi, Lyft, and Didi Kuaidi to stem the rising popularity of rival Uber.

Money matters

However, Ola won the funding game in 2015 with at least $900 million from SoftBank, Sequoia Capital, Matrix Partners, Accel, and [angel investor] Kunal Bahl, CEO of Snapdeal. Tiger Global, which had invested in Ola, turned a few heads when it also invested [an undisclosed amount] in Uber. Auto and taxi aggregator Jugnoo got funding from Paytm.

SoftBank, an aggressive investor in the e-commerce and service sectors [Grofers, Snapdeal, and OYO Rooms, among others], had also invested in Ola’s international counterparts – Didi Kuaidi and Grabtaxi. However, Matrix Partners stood out by diversifying their investments across sectors – their investees include Chumbak, LimeRoad, HouseJoy, Practo, Quikr and TinyOwl.

But money could only help with expansion – more important was the permission to do so. The real transformation in the way this business was conducted in India happened when the Ministry of Road Transport and Highways finally provided a detailed advisory on aggregators in October 2015. The ‘Advisory for Licensing, Compliance and Liability of On-demand Information Technology-based Transportation platforms’ clearly distinguished technology-based aggregators and taxi companies.

However, it’s not yet smooth sailing for this sector. The hurdles for new entrants have also been significant, but so are the efforts they have taken to establish themselves in the sector.

New Entrants, Old Hurdles

The beginning of the year saw French ride-sharing service BlaBlaCar driving into India after a successful ride in Europe. The concept of inter-city ride-sharing was soon taken up by AHA Taxis. Bike Taxis also made news in Bengaluru and Gurgaon, although they are yet to make waves in the country.

However, state policies continued to hinder disruptors like Zipgo, which launched a shuttle service in Bengaluru but was immediately shut down by the Karnataka Transport Department claiming violation of laws. Shuttle services launched by Ola, Shuttl, and Trevo in Gurgaon were also shut down by the authorities for similar reasons.

Focus on Safety

Ensuring safety for passengers has been a prime concern for aggregators. To this end, Ola and Uber installed SOS buttons within their apps for passengers to send instant distress messages to emergency numbers. Meru went the extra mile and provided pepper spray in the cab for passengers. Uber tied up with the police in Kolkata and Pune, and have been trying to get retired police officers as driver partners; Ola also introduced the ‘Sainik Driver Programme’ for veterans to become driver partners. Both Ola and Uber made third-part verification mandatory for drivers joining their platform.

Meru also launched Meru Eve exclusively for women; Meru Genie and Meru Plus followed, offering different price points. Zipgo launched a women-only shuttle service in Delhi in December 2015. Although the results are yet to show, the best news is that there have not been any other major attacks this year by cab drivers.

Novel Strategies

Meanwhile, other services too wanted a share of the aggregator action. Online travel-search marketplace ixigo started a booking service for cabs. Apps like Niki and LocoCabs also became aggregators of aggregators, providing a single platform for the customers to find Ola, Uber, and TaxiForSure cabs in their vicinity without having to look in different apps. CabsGuru became the MySmartPrice of cab aggregator platforms while Jugnoo partnered up with a similar app Zophop, which provides information on public transport, cabs, routes, and prices.

Ride sharing also got attention, and not just the likes of Ola. The LiftO app, which was launched in Mumbai in September, enabled customers to share taxi or autorickshaw rides.

Many biggies went beyond providing taxi services, and ventured into the grocery sector. Ola launched Ola Café and Ola Store for the delivery of food and groceries. Both Uber and Ola were active in sponsoring entrepreneurship programmes by tying up with various state governments – especially in Telnagana and Andhra Pradesh – and heavily nesting in them.

Meru changed its business model by going into aggregation rather than owning the cars. Meru also entered into the cashless payment mode with Paytm, which was soon taken up by Uber.

The Future that 2016 Holds

With the Central government having released an advisory for state governments on how to mould their own set of laws, the likes of Ola and Uber are relieved as there is more clarity on norms now. However, they are still troubled with protests by drivers over incentives, and taxi unions against their charges.

There is no denying that the taxi aggregator industry is here to stay. The $15 billion taxi market in India is sure to attract more players and investors – the fact that Ola alone raised nearly $1billion this year is testimony to this. While taxis will remain the largest segment in this sector, strategies such as carpooling and shuttles will see growth in the coming year if it were to follow the American and European markets.

The Indian radio taxi market will grow at a CAGR of over 17 per cent by 2020. So is the bus shuttle market which is expected to grow at a CAGR of 9.36 per cent by 2020. The space is expanding rapidly, hopefully taking India to an age of efficient and inexpensive public transport.

![[YS Exclusive] SquadStack debuts AI-driven CX platform featuring humanoid AI agent](https://images.yourstory.com/cs/2/fe056c90507811eea8de27f99b086345/CopyofNewPPTTemplates-2025-03-05T190037-1741181509927.jpg?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)