The top ‘Jedi Master’ investors of Indian startups in 2015

At their best, investors are like the legendary Jedi Master Yoda, that is if he had a few (hundreds of) millions to disburse. Investors pumped in $9 billion across over 1,000 deals in Indian startups in 2015. Will these startup backers be Jedi Masters or will they go over to the Dark Side like Anakin did? Only time will tell.

What we can reveal right now the Top 10 Investors of 2015 based on the number of investments made. Sequoia Capital and Tiger Global Management maintained the leadership position they had taken in the first six months of the year. Sequoia had 46 announced investments and Tiger, 35. Both funds declined to confirm the numbers. Accel Partners, IDG Ventures India and SAIF Partners made up the rest of the top five.

Some of the investors in our top 10 have shared data on the deals they closed in 2015 but have not announced yet. We have included this data in our analysis. In the case of Nexus Venture Partners, YourStory has considered only the investments it made in Indian startups. The fund declined to confirm the data. Sequoia and Tiger also declined to participate in this analysis.

Story of maturity and scale

India is now home to eight ‘Unicorns’ (startups with over a $1-billion valuation) and many wannabe Unicorns. The past 12 months have witnessed a tremendous inflow of funding into young companies, especially in sectors like e-commerce and taxi-hailing. The relatively older companies like Flipkart, Snapdeal and Ola have now matured to the private equity stage and have attracted marquee international investors like Alibaba and Softbank.

“2015 has been a great year for Accel. Many of our companies from previous funds are growing and scaling. Many of them have moved to leadership position in their category,” says Shekhar Kirani, Partner, Accel Partners India. Accel launched a new $305-million fund for India in March.

It is not just the biggies that are scaling up and spending money rapidly; younger firms like Swiggy, Grofers, UrbanClap and OYO Rooms also raised multiple rounds of funding in 2015 to fund growth.

Investors YourStory spoke to agree that the Indian startup ecosystem has grown and matured like never before, in 2015.

“The key takeaway for me has been that entrepreneurship is now mainstream. There have been around 4,000 startups founded in 2015, a 400 per cent increase from 2010. Everyone knows someone who’s a founder. No wonder that newspapers now have pages dedicated to the VC industry,” says Vani Kola, Managing Director, Kalaari Capital.

Kalaari, too, launched a new fund in 2015 worth $290 million (disclosure: Kalaari Capital is one of the investors in YourStory). Mukul Singhal, Principal, SAIF Partners, says that 2015 saw a consolidation of the significant spurt in venture capital investments witnessed in 2014. The other top trends of 2015, Mukul says, were: “Few exits like Qikwell, Freecharge; and very high interest from strategics like Alibaba, SoftBank, NewsCorp, to name a few.”

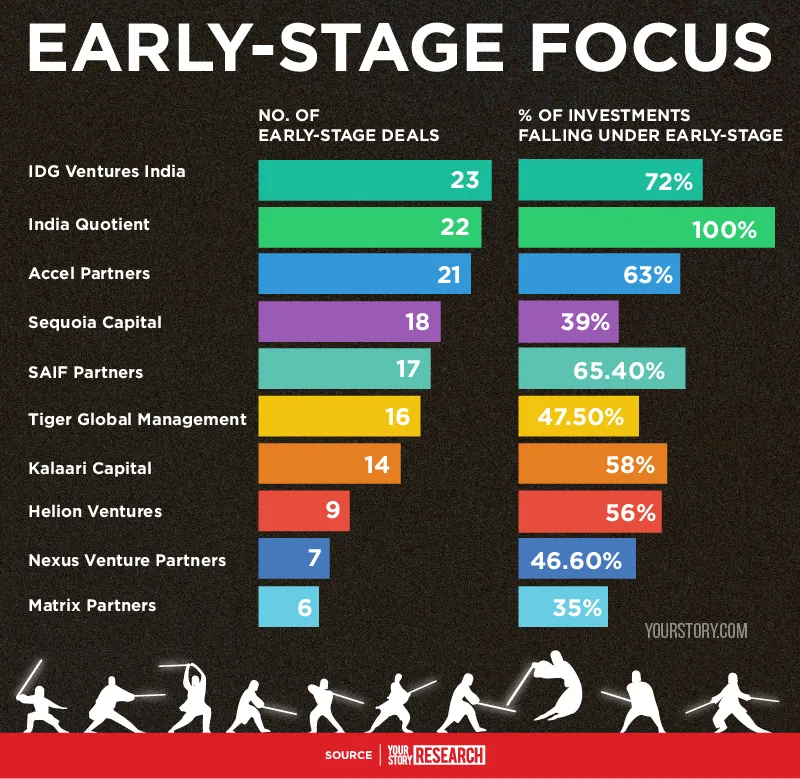

Early-stage focus

A chunk of the deals in 2015 fell in the early-stage category—angel, seed, pre-Series A and Series A. IDG emerged as the leader in terms of early-stage deals in 2015, with 23 investments that fell into these rounds. IDG has been very active in 2015. The fund, which was part of 32 deals, completed its 50th tech investment in 2015. It has committed over Rs 1,000 crore in the Indian VC market till date. The venture capital firm announced a new fund raise of $200 million in September.

Sudhir Sethi, Founder-Chairman and Managing Director, IDG Ventures India, says the biggest change he has seen in early-stage startups over the years has been the attitude of the entrepreneurs. “Entrepreneurship is all about risk taking and the appetite for risk taking is growing for the younger population who start with an idea without the baggage of corporate thinking,” says Sudhir, adding that entrepreneurs today are much younger.

However, there is a concern on whether even a sizeable number of companies raising early-stage investments will go on to raise follow-on funding. Sudhir says that companies showing exceptional growth have raised further rounds of risk capital. “However, we do see a slowdown already in play with seed/Series A-funded startups facing a challenge in raising Series B round of capital,” says Sudhir. He adds that many companies were funded in a single space with no clear leader and such companies are facing issues.

“Companies are facing a Series-B crunch at the moment and this is likely to continue in the near term, as there are not many investors focussed on Series-B rounds,” adds Sudhir.

Anand Lunia, Founder-Partner at early-stage venture fund India Quotient, echoes the view regarding the vacuum in Series B funding. He further says: “…Angel deals have exploded to more than double the previous years'. It's anybody's guess how many of these angel deals will go through Series A.” Every single deal India Quotient was a part of in 2015 fell in the early-stage category.

But, what about a slowdown?

Towards the end of 2015, the talk in startup ecosystems across the world had turned to an imminent slowdown in funding. However, funding continued at a robust clip even in the final quarter of the year. So how concerned should startups be regarding drying up of funding?

“We feel that the Indian VC industry is still under-capitalised and a lot more capital needs to flow into tech entrepreneurship if our GDP has to grow from seven to 10 per cent,” says Sanjeev Aggarwal, Managing Director, Helion Ventures. He, however, has a word of caution.

“Investors are becoming more discerning. We believe only those companies that have strong fundamentals, which is to deliver great customer experience and show strong gross margins, will continue to attract growth capital,” says Sanjeev.

Kalaari’s Vani says she does not believe it is time to panic as the India opportunity is still large, and many investors have just raised fresh funds and have the firepower to last the next two to three years. Kalaari, Accel and IDG are not the only ones to raise funds in 2015. In December, Nexus announced close of its Fund IV with committed capital of over $450 million and in March SAIF Partners had raised $350 million. In 2014, Sequoia Capital, India’s largest VC, had closed a $530-million fund for India that it topped up with $210 million this year.

Shutdowns, scale-backs and mass firings

Year 2015 has also been a controversial one for the ecosystem—from the very public fallout the then-CEO of Housing, Rahul Yadav, had with his investors, to shutdowns and mass firings, especially in foodtech.

The companies at the centre of the many controversies were all venture backed. Do these instances worry investors?

“In 2015, probably all of us learnt the fallouts of short term execution, difference between noise and signal, (importance of) quality of entrepreneurs and, most important, the fact that it takes time and lot of hard work to build a great business,” says SAIF’s Mukul.

SAIF was one of the investors in Spoonjoy, which shut down in 2015 and was acquired by Grofers. Mukul says in any cycle when there is sudden growth (as in 2014), consolidations are bound to happen and are important.

However, there are those that say the instances of shutdowns, scale-backs and firings are due to money chasing bad deals. India Quotient’s Anand says,

“Money has been chasing bad deals for a long time, but 2015 was the peak. However, don't expect things to improve. Funds used to just building portfolios their investors want will suddenly not start looking at things differently.”

Vani, however, says that investors cannot be expected to make right decisions always. “These founders are young and untested but are expected to drive at 200 mph without crashing and burning. Investors need to identify the founders who are ready for the big league – the Formula 1 of company building.” One of Kalaari’s portfolio companies, real estate startup Grabhouse, was in news about a month ago for an alleged mass firing of over 100 employees.

Focus on a handful of sectors

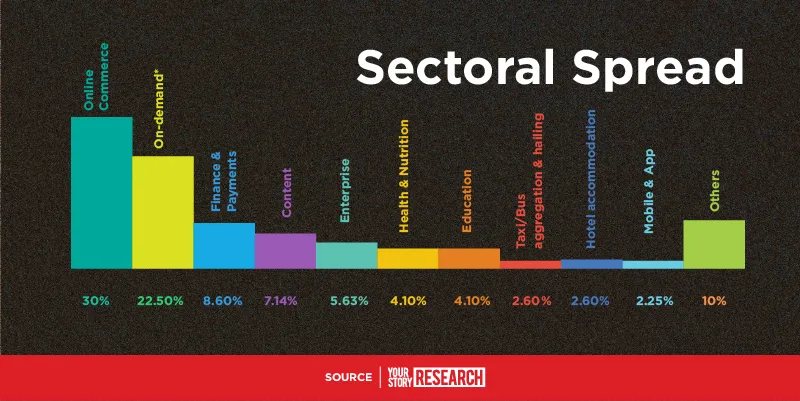

The year gone by will also be remembered for the rise of on-demand and hyperlocal business models. Over 22 per cent of the deals by the Top 10 investors were in the newly emerged on-demand industry. This fledgling sector is second only to the older online commerce (YourStory has combined online product and services in one category for this analysis), which accounted for 30 per cent of the deals by the Top 10.

Accel made a number of investments in on-demand startups in 2015, including in companies like Opinio, Swiggy and UrbanClap.

“India consumer story is intact and mobile-based discovery/transaction/consumption story is growing very rapidly. In fact, 2015 is the year where we can say mass adoption of mobile-based services happened in India,” says Shekhar.

The location-specific sector, in which YourStory has included foodtech, food delivery, on-demand logistics and grocery, has rapidly evolved and grown. Many startups have raised multiple rounds of funding in 2015. Household services company UrbanClap, in which Accel and SAIF are investors, raised pre-Series A, Series A and Series B rounds of funding in less than 12 months.

However, other investors are of the view that there is too much hype surrounding this sector. “2015 was the year when the brains of the country thought the best way to change the world is to home-deliver everything. The fact is that the IT and BPO crowd and middle-class India cannot afford expensive delivery boys,” says Anand of India Quotient.

Online commerce, which has seen the emergence of leaders in many of its sub-categories, has, not surprisingly, accounted for much of the capital invested. Flipkart, Snapdeal, Paytm, Zomato, ShopClues, Urban Ladder and Pepperfry are just some of the companies in this industry to have raised funding in the past year, with Flipkart leading the pack with a $700-million fundraise. The vehicle aggregation/hailing category also saw huge deals thanks to Ola’s two fund raises of $500 million and $400 million. Apart from taxi hailing, bus shuttle service providers like Shuttl and ZipGo and bike taxi aggregators like M-Taxi and Baxi have also launched services and raised funding.

Another newly emerged sector is the branded budget hotel accommodation space, with Sequoia-backed OYO Rooms emerging as the leader. There were reports in December of OYO buying out its biggest rival—Tiger-backed ZoRooms. However, this deal is yet to be confirmed.

Media and content was one of the surprises of the year, accounting for over seven per cent of the deals of the top 10. Firms like Newshunt, ScoopWhoop and YourStory raised funds in 2015.

While certain sectors like enterprise software are still waiting for the blockbuster deals, it is also true that now is the best time to start up in India. As IDG’s Sudhir says,

“The Indian venture ecosystem is coming of age and failure in a startup is no big deal for the young entrepreneur but seen as a stepping stone to build a successful one next time around. We are about the witness the era of serial entrepreneurship!”