Startup shutdowns in 2015-2016 - is the ecosystem finally hitting maturity?

The year 2015 and the first quarter of 2016 has brought pivotal changes in the startup ecosystem and has definitely changed the talking points around it. If funding and scaling was the buzz of early 2015, acquisitions, layoffs, and shutdowns have surely taken over in 2016.

This year, the startup ecosystem has seen a 40% decline in funding compared to last year. But at this juncture with the rise in number of funding announcements, things seem to be getting better, although it may be too soon to infer.

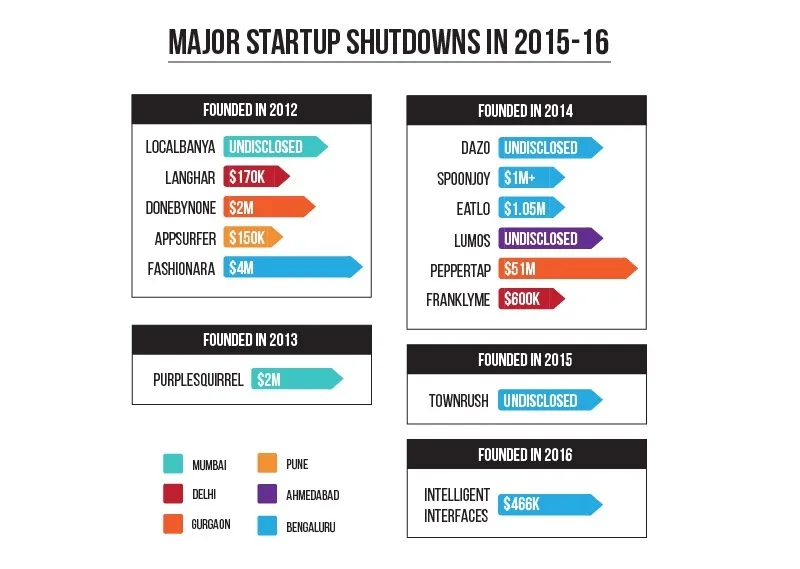

A brief about the overall startup shutdowns in 2015 and 2016 till date, is here:

FoodTech

The food tech segment has evidently witnessed a grim scenario over the recent past with no investors willing to back the mid stage food tech startups. The challenges finally led to the shutdown of numerous startups across the metros, including few popular names like Spoonjoy, Langhar, Eatlo among others.

A major reason for these startups to shutdown is failing to compete with biggies like Zomato and Foodpanda. Dazo was a clear example of this.

Sadly, even Langhar which worked on a different business model where housewives and food lovers cooked the meals, and survived quite a few years finally shut down. The reasons for its shutdown, is still unclear.

After firing over 600 employees, TinyOwl which had raised hefty funding from investors like Sequoia Capital, Nexus Venture Partners and Matrix Partners finally merged with logistics player RoadRunnr which was also backed by Sequoia Capital, Nexus Venture Partners.

Post-merger, the new entity is now ‘Runnr’ operational only in Mumbai, a B2B logistics company.

Online Grocery segment

The segment has not paved much way for new players. With the layoff of 150 employees and shutdown of PepperTap in April, BigBasket – which follows inventory model - remains the dominant player in the market, followed by Grofers. Although other hyperlocal delivery startups are thriving, no competent business model has been proven yet.

Right before shutting down, the founder had said, “Shutting down PepperTap is extremely difficult call for us but it’s the need of hour. Our foray into full stack logistics space is a well-pondered decision and our experience in consumer as well as business-focused logistics will certainly help us to build next generation e-commerce logistics startup.”

Online Marketplaces

With e-commerce pioneers struggling to ramp up their business and failing to raise funding, it has been inevitably a more challenging and crucial scenario for the smaller players like DoneByNone, Fashionara.

DoneByNone in its official Facebook page posted,

Fashionara had reported the company’s net sales increased by five-fold to Rs 32.86 Cr in the financial year 2014-15, but its net loss widened to Rs 32.13 Cr. from Rs 21.11 Cr. in 2013-14.

B2B Segment

The number of B2B startups in the ecosystem has always been lacking, as the current scenario of the market as well as the market challenges have undoubtedly been quite tough for these startups to prove their products.While the market is now on the brink of saturation with countless B2C startups, it might finally shift its focus to the B2B platforms.

Lumos’ founder Yash Kotak, while shutting down, said, “The product will not sell because it is cool; or because the market is projected to be worth $19 trillion in the next 5 years. It will only sell if customers get significant value out of the product.”

Interestingly Rahul Yadav’s venture Intelligent Interfaces also failed, even after raising funds at a valuation of Rs170 Crore.

This surely raised speculations, especially since the announcement was made just within a few months of its launch, though no details about the platform was disclosed.

Rahul Yadav through his Facebook account regularly posed questions, which obviously kept the spectators riveted.

“Intelligent Interfaces (i) for Government is not working out. Should I make ii for enterprises or come back to real estate?”

“Thinking of giving up on entrepreneurship and do a simple job. Will take decision by this weekend. What's your advise?

Reality Check

Lacks of funds and rising competition had clearly been the major reasons for the shutdowns and exits. Although the market till now, has been grabbed by the big names, with the crunch in funding it will now be the showtime for the smaller players.

To squeeze the deep pockets, along with an incredible product, entrepreneurs now also need a sustainable business model. High cash burn and dependency on investors may not be a survival strategy anymore. New tactics or survival strategies will definitely help the ecosystem to move on from funding, discounts and other cash burn marketing gimmicks and render a stability.