Why being ‘macho’ about entrepreneurship is not a good strategy

Ashok Soota, founding Chairman of Happiest Minds, describes himself as an accidental serial entrepreneur. He ran the Wipro IT business for 15 years, was part of the founding team at Mindtree for 11 years, and since the past four-and-a-half years is running Happiest Minds, which he founded.

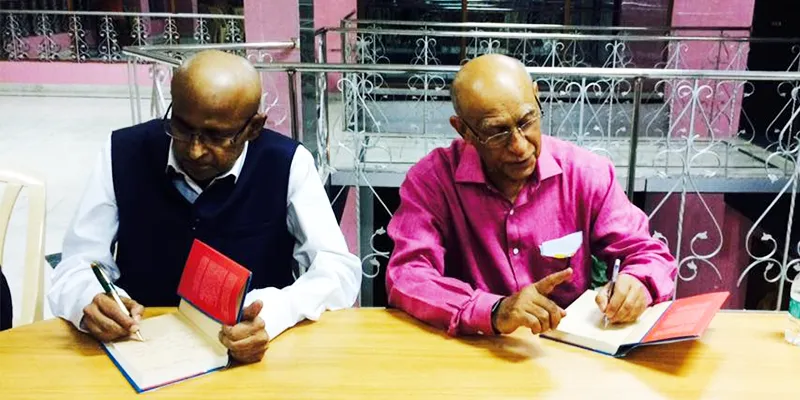

At the formal launch of his new book, Entrepreneurship Simplified, From Idea to IPO, co-authored with SR Gopalan, Founder of Dawn Consulting and Bizworth India, in Bengaluru this week, Ashok said, it had been a long journey from “easy to tough to toughest. But I must add that it has also been from happy to happier to happiest.”

With remarkable candour and easy wit, Ashok captured the rollercoaster journey of an entrepreneur, saying the true measure of its success is only when the journey has been a joyous one.

In a fireside chat with Shradha Sharma, Founder and CEO of YourStory -- where there’s never a dull moment -- co-authors Ashok and Gopalan talked about various aspects of this journey and lessons in it for entrepreneurs today.

Excerpts from the fireside chat.

Shradha Sharma: What prompted you to write Entrepreneurship Simplified at this point of time?

Ashok Soota: As you all know, there’s a huge entrepreneurial boom in the country, but at the same time there are a large number of ventures, which, even if they get funding, there are still high rates of failure. The whole idea of the book was to spell out simplified steps, which would help people improve their probability of success. It is a bit of a handbook where we talk about what and what not to pursue, when and when not, how and how not, and why and why not.

Timing is really key in all of this. What was also a very important driver for me when I did this book was the fact that I had help from Gopalan. We complemented each other on our capabilities.

Gopalan: My role in this is completely accidental. Since I was going through some challenging and difficult times personally, I had reduced activities like running, wildlife photography. Co-incidentally, Ashok reached out to me and I jumped at the offer. The process helped me a lot.

SS: You talked about ideas and said your ideas will be the single most important decision you take on your entrepreneurial journey. How crucial is the idea or is it the timing?

AS: I’ll stick with what the book says that it is the single most important decision you will take. But timing is equally important. Too early and too late are both large problems and the danger, in fact, is higher when you are too early. You have to have funds to be able to create a market. When you are late you can still do something better than the people who preceded you.

Gopalan: Timing has become more and more important in the last couple of decades because the lifecycle of companies has shortened so fast.

SS: One thing that stayed with me is the emphasis you gave to culture. How do you put a value to investing in culture, because in our country, especially the startup community, you are not valued because you have an extraordinary culture?

AS: The culture is not about investing. It is a question about seeing what you need to do to create a vibrant organisation, an organisation where people are committed, where people are all aligned by common values. It is a most difficult thing in that sense because all the right inputs do not necessarily mean what you’ll expect it. But you will have to keep in mind that it is something amorphous you are creating and it is that amorphous thing that becomes your differentiator.

Gopalan: As Peter Drucker said,

“By themselves, character and integrity do not accomplish anything. But their absence faults everything else.”

SS: You talk about strategy, about a continuum of strategy at different stages of the entrepreneurial journey. One question that came to my mind was that when do you decide that now I am at this stage and this is the strategy I need to follow?

AS: Perhaps, with that also an unspoken thought is that is there an inflection point in which you move from one stage to the other? We’ve talked about startup strategy, scale-up strategy, there’s acquisition strategy, there’s risk minimising strategy, and there’s also pivoting strategy. So there are multiple types of strategies.

In the startup stage, you need to see what you are doing to validate the idea. In the scale-up stage, you’ve got to look around and say how’s competition responding to your venture, so how do you take actions against that. Risk minimisation is something you do all through your journey.

People often get macho about entrepreneurship; that 'I am a risk-taker'. Risk is inevitable in any business, but in my mind, the entrepreneur is one who is working towards minimising risk.

On the acquisition front, we’ve laid down a few guidelines: we don’t think that you should do acquisitions too early, that you’ve got to build your own culture. Certainly, you should not go around picking up organisations which are losing money.

I think the interesting thing in pivoting, which can happen at almost any step, is when you find that your original value proposition is not working out. Then how do you decide what is the right time to pivot. And here again, we’ve laid out a few guidelines: The most important one is that you’ve got to see earlier there’s one coming.

We are not in favour of what they call 'fail fast'. We think that’s a dreadful strategy.

But at the same time, you give it your best before you run out of money because pivoting is itself going to be a new strategy with money. We’ve spelt out multiple ways in which you can do that.

SS: You’ve talked about how pricing is not a strategy, yet if you look many players have captured a market share on pricing strategy alone. How do you explain that?

AS: In our view, there are two principles here. One is that a low price is justified when you have a razor and bleed approach. That means you are going to sell a follow-on offering in large quantities over a period of time so you can make the initial loss lead a product sell at a virtually low price. Another justification for a low price is when your costs are low. Obviously, you are passing on a benefit of that to gain a competitive advantage.

But if your cost structure is somewhat similar and assume you are coming in the market that has a large player, their cost will be lower, and if at that stage you go and give a discount, you will end up with low margins and you are never going to build up a decent balance sheet.

Only in a certain extent in e-commerce companies, discounting strategy is justified. You see they had to create a new habit, but here again, their costs were lower. They did not have the physical infrastructure cost of large retailers and to that extent, they could have still been very competitive rather than saying we are gaining market share at the cost of each other by offering a low price. That’s why we use the phrase: Pricing is a monk’s game.

SS: You talk about the ability to bargain for a better deal. I think everyone will agree with me that no one will say 'no' to you. [Laughter] But how do people like us bargain a deal?

AS: You have not done so badly yourself.

I’ll say experience helps, there’s no question about it, but look around, there are large sums raised by e-commerce companies and many of them (entrepreneurs) are quite young.

You know dealing with VCs is not only about getting valuations and money, when you get to your term sheets and clauses, that’s where you need experience and seasoned people.

This is when you turn to your advisors.

SS: You say in the book that startups don’t think about governance, and they only do so when they are thinking about an IPO. Do you think the lack of long-term thinking results in unnecessary challenges? Do you think we are myopic in our dealings?

AS: The framework for governance includes fundamental issues like ethics. You never know when they will come and hit you. There are bound to be difficult times and if you haven’t laid down a structure you could end up finding that there’s a temptation to take a shortcut. And that is the shortest way to go down.

You cannot begin your IPO just two months before you intend to do so. IPO preparation begins a good 18 months prior to the actual date. I wish more companies look at going public than looking for a resale.

During a Q&A session with the audience, to a question on starting late, Ashok said,

“It is a myth that entrepreneurs have to be young. But the early-stage entrepreneurs often don’t know what they don’t know so they go on to change the world.”