Find out how startups are taking a bite out of the $39 billion precious jewellery sector

Advertising professional Anila, 28, was sceptical of shopping for jewellery online. But a few months ago, while browsing, she came across a beautiful pair of gold studs. “I thought I would just look at it. Clicking on the ad, I went to BlueStone. Though wary, I got those studs, and opted for a COD option. Worst case, I don't get the studs, but my money is safe. However, they arrived right on time and are looking absolutely perfect,” she recounts. Anila then realised that shopping online for jewellery is no cause for worry; the real hurdle is the mindset.

It was only recently that India’s e-commerce sector — which constitutes less than two percent of total retail in the country — woke up to the precious jewellery segment, but it didn’t take horizontal marketplaces and vertical players long to zero in on tech-savvy and fashion-conscious females between 25 and 40 as their preferred audience.

Although Anila’s mindset was the norm for most of that customer base, these players have managed to power through with strategies cleverly devised to meet the new generation’s tastes, the focus being on daily wear more than occasional jewellery - rings, earrings, pendants –including diamonds.

India’s constantly evolving e-commerce sector seems to be taking precious jewellery along for the ride, and YourStory finds out how.

Inventory vs marketplace model

Horizontal marketplaces like Amazon and Flipkart tie-up with offline jewellers like Tanishq, TBZ, and Kalyan — getting more sales for both. However, private labels have their own advantages too. Sourav Lodha, Founder and CEO of KuberBox says, “We are a single brand, so it gives more control over quality. We can retain customers with suitable price points and discount.”

Nevertheless, Angshuman Bhattacharya, Consumer Lead, Managing Director with Alvarez and Marsal, says that while large multi-category marketplaces could successfully establish a vendor network for jewellery, the opportunity could be limited to fashion and lower value products. “For customised higher value jewellery, specialised vertical jewellery online players would be in a better position to provide design depth and service. Carrying high value inventory against unpredictable SKU level demand is not a financially feasible option for either model, hence back-end vendor tie-ups are prevalent,” he adds.

A prime example is Mumbai-based Velvetcase. Initially selling customised jewellery, it moved to a marketplace model last July, has onboarded 300 sellers, and is planning to expand offline presence by collaborating with other brands. Kapil Hetamsaria, CEO and co-founder, believes that omni-channel is inevitable. “Customers do research online, buying offline, and vice versa. For a high value purchase, customers want to interact with us. So our customer care team has trained jewellery designers. We introduced 3D pieces before confirming orders worth Rs 50,000 and more.”

According to Kapil, marketplace gives better value due to lack of inventory. They provide delivery in five to seven days. He adds that their consumers, especially brides-to-be, are very particular about designs. “Some customers provide images of their own designs too. Ability to customise empowers the customer,” he says.

But CaratLane and BlueStone, the top players in the game, are both private labels, although the former has an omni-channel model, with 13 stores across eight cities. They keep ready-to-sell inventory like any other offline store, while some are ready to ship in 48 hours. Atul Sinha, Senior Vice President, CaratLane, says: “We make our own designs. So we have to build up trust on the brand, and meet expectations in quality, delivery, and payment.” They focus on everyday wear, although wedding rings are available too.

Jaipur-based KuberBox has no inventory; it takes seven days to manufacture after getting the order and a token. “First we give a 3D printed model and get the customer’s approval. When the mould is ready, we cast the design using gold,” says Sourav.

Festive season sales

Diwali and Akshaya Tritiya are key jewellery-buying occasions where retailers’ daily sales jump to as high as 15–30x the daily average. For online retailers, Valentine’s Day, Mothers’ Day, and even Raksha Bandhan see more interest from customers — something not applicable for traditional offline stores.

KuberBox gets a 2x spike from October to November. For CaratLane, 17–20 percent of annual sales happen during Akshaya Tritiya, Dussehra, and Diwali. For the rest of the year, peak sales happen from March to May, while June to August is dull.

This festive season, BlueStone is offering over 2,000 diamond jewellery designs with up to 25 percent off and no making charges, along with four new collections. They also have an exchange offer under which company representatives visit customers’ houses with a caratage machine (used to measure the purity of gold) and exchange jewellery. Also, Velvetcase is offering up to 20 percent off on precious jewels made of gold, diamond, and platinum, with up to 40 percent off and interest-free EMI.

Beyond the metro cities

Jewellery as a category is highly penetrated in India through the physical retail channel. With an increasing base of online shoppers, though, there is a high likelihood of consumers switching to the online channel for purchase of jewellery. In fact, it provides big opportunities for small towns to access good designs, because big retail stores often don’t venture there.

It is a long process, though. Atul believes that first-time online buyers tend to buy books. “If nothing goes wrong, they go for clothes and shoes. These are still brands, so their quality is trusted. Jewellery is the last phase of adoption in e-commerce. It will be another three to four years before small-town customers start looking at jewellery in a big way.” About 90 percent of orders for CaratLane come from metro cities, with about 65–70 percent from six tier one cities. About 70 percent of BlueStone’s customer base is from metro cities, as well as Jaipur, Ahmedabad, Surat, etc.

But KuberBox is particular about getting customers from tier 3 cities and beyond.

The KuberBox Privilege Partner programme enables housewives in rural areas to take orders with KuberBox’s catalogues and exclusive items which are not available online.

“Thus the rural customers also get bigger selection and lower prices. One of our partners is a 45-year-old housewife in an Odisha village with no railway connection, who earns Rs1,70,000 commission annually,” says Sourav. In a year, they got 20 such agents across India, who contribute to 30 percent of KuberBox’s monthly orders. Otherwise, online ordering from tier 2 and 3 cities is less than 10 percent.

Challenges galore

Selling high ticket items — right from sourcing, manufacturing, and delivering to return logistics — is a pain, especially in a market where 90 percent of the customer base is wary of buying online. According to Rishi Vasudev, VP, Flipkart Fashion, the key challenges the online jewellery sector faces are primarily differentiated by design and the ability to portray the item as close to the actual product as possible in the product catalogue. “Fraud prevention has become a major challenge as well, given the high value of the product and driving awareness around buying jewellery online. Getting the right fit for certain products has also become difficult of late,” he says.

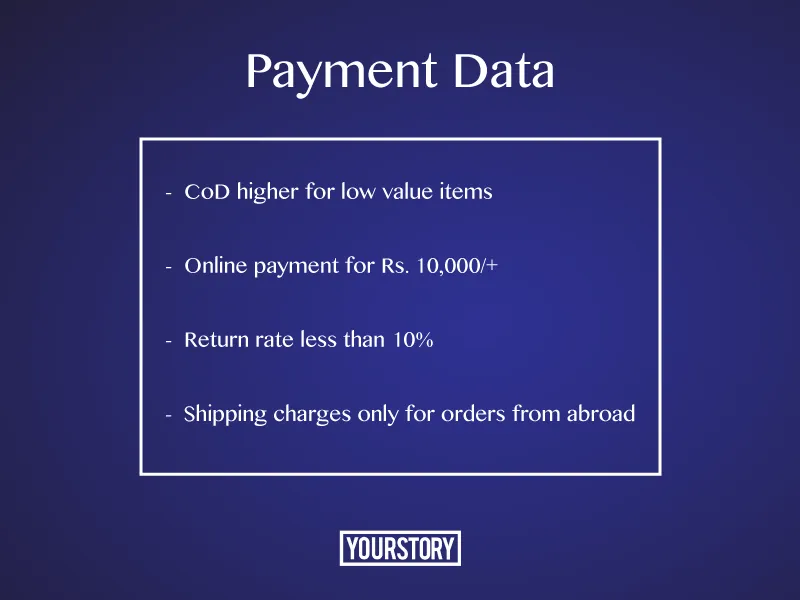

Of course, there are specialised logistics service providers for the jewellery sector, who are adept at issues of handling, security, and insurance of high value, low volume products. Without a strong system, sale of items which cost tens of thousands of rupees and have high resale value brings extreme risks. Warehouses have security cameras to avoid any corruption, and delivery boys have to go through thorough background checks. Returns, however, are lesser than the e-commerce industry average of 25 percent, and happen mostly on gifts which did not suit recipients’ tastes or when there are size issues, which mostly end up with replacements.

Gaurav Kushwaha, Founder and CEO of BlueStone, feels gaining trust is difficult. “Whatever works on trust has to have a network on which that trust lies — people are more comfortable when their social circle buys it,” he says.

When Velvetcase began in 2012, they did not do digital marketing or hoardings. “Instead we worked with companies and bridal planners. Four years since our launch, we have had high value purchases at Rs1.62 crore,” Kapil says.

Profitability

Vertical online jewellery players compete not just with each other, but with horizontal marketplaces and offline sellers. It is not a sector with room for many players, and is still evolving. Unlike B2B companies, B2C product brands take time to build. However, association with big names in the offline sector will help them.

Angshuman says, “Offline players view online platforms as an additional channel to address customers. Some of these large jewellery players are in the process of strengthening their online capabilities. Others have chosen a route of acquiring online brands and platforms through acquisition. The business model becomes increasingly stronger when online capabilities are supported by back-end sourcing, design, and making capabilities.”

CaratLane, in which the Titan Group has bought a 62 percent stake, claims it will become profitable in two years. “We are now at the growth stage, so still investing in branding, marketing, infrastructure etc. But profitability boils down to what you are selling,” Atul says, adding that the inventory model is advantageous in that respect. “In the marketplace model, you are selling other brands at discounts. Customers buying the brand will go to whatever website gives bigger discounts. They have to keep giving discounts for competition.”

Since precious jewellery is considered a lifetime investment, quality and design, and not discounts, matter the most. However, discounts of up to 10 percent help access new customers, at least for the first few transactions.

In fact, KuberBox takes it a step ahead. “If an ornament is stated to weigh 2gram, and once it is manufactured turns out to weigh lesser, the remaining amount is returned to the customer. In case it becomes more than 2gram, we do not take the extra amount from the customer,” Sourav says. They have seen annual growth of 60 percent in revenue, and 150 SKUs every month. Angshuman says that the being high value, the margins are healthy and therefore scale and efficiencies should be able to steer companies towards profitability. With a margin of 25–30 percent, KuberBox is profitable and hoping to scale by 5x.

What next

The online jewellery sector is just beginning to see innovations. Since jewellery is a not a frequently purchased category, consumers are reluctant to download apps. However, companies are working towards increasing the usage of apps to allow for better customer engagement and loyalty. The CaratLane app, launched a year ago, now brings 25 percent traction with one lakh downloads. “Customers tend to browse more on the app; but the number of transactions is smaller,” says Atul. CaratLane’s ‘Try At Home’ service and virtual tryouts [only for earrings] have reduced customer’s anxiety on misfits. They have a no-questions-asked 30-day return policy.

However, for Flipkart, the number of orders received on the app is much higher compared to the website. Comparing its web and mobile sites, Flipkart sees lower order volumes for the latter, which has a 10-day return policy.

The next stage in innovations will be on customisation of ornaments by online software, and predicting customer needs accordingly will be the next breakthrough, says Sourav. According to Gaurav, proliferation of technology will give VR and AR of better quality soon. “Viewing is not a rich experience right now, but it helps marketing,” he adds. According to him, movement from gold to diamond and from local to branded stores is already happening. “We focus on designer and diamond jewellery; about 60–70 percent is diamond for us — which is different from the Indian market made up of 80 percent gold,” he says.

With technological advances backing the sector, e-commerce might just be the next step for a population which views jewellery as a lifestyle and investment at the same time. And the winner of the race undoubtedly will be the one who brings quality and quantity to designs.