It’s a shakeout — ATM growth down to two-decade low of 14pc

Banks weigh trade-off between digital and physical channels even as white-label ATM firms gasp for life breath.

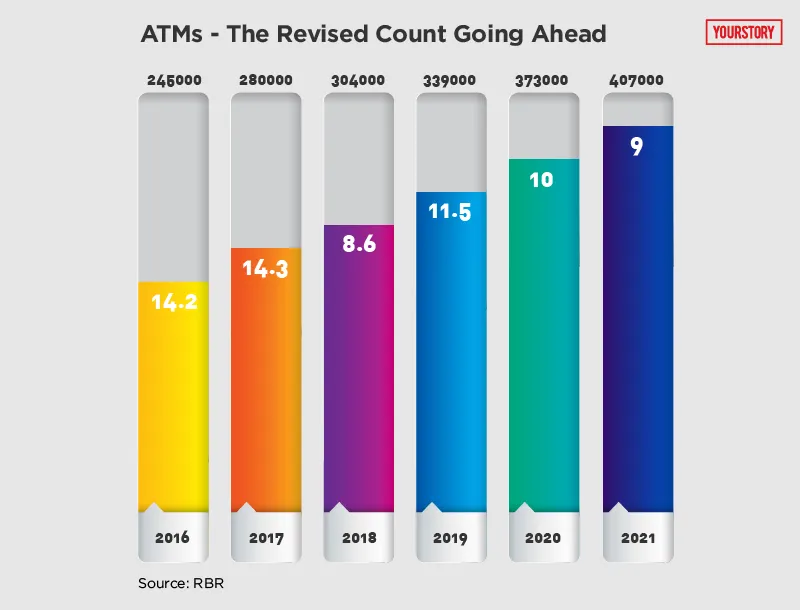

It’s the worst kept secret in our automated teller machine (ATM) mart — deployments in 2016 grew at 14 percent, the lowest since the first till-box was set up on our turf way back in 1987. Worse is in store, as revised estimates by the London-based RBR, whose reports are the gold-standard for the global ATM industry, show we will now cross the 4,00,000-mark in installations only in 2021, four years off the earlier projections made by RBR.

This disarray is due to banks taking a long, hard look at ATM deployments as cash-handling costs soar even as they weigh the channel’s trade-off with digital modes of servicing customers. The biggest casualty has been white-label ATM (WLATM) deployers, who now find that the business model just doesn’t pay for their bread and butter.

Few senior bankers or industry veterans wanted to go on record when YourStory reached out to them to elicit their views. Says a senior banker,

“All of this is linked to financial inclusion. We know the ATM business has gone off the plot. But why should I say in public what’s kept as a secret of sorts and get rapped on my knuckles.”

Banks — be they state-run, private (old and new), or foreign — now have to rework the math as other modes of engagement on the payments side is now on offer. The demonetisation drive by Prime Minister Narendra Modi’s government and the attendant stress placed on the digital has almost “hustled” bankers to look at operational costs on the retail payments side. The recent move by banks to either restore or hike transaction fees is reflective of the same. All of this is inter-connected; just that no bankers wants to spell it out or do plain-speak.

White-label ATM players, who were seen as the biggest drivers of deployment, have seen their business models go for a toss. If the grapevine is to be believed, some of them are on the block. We may well see a spate of acquisitions (read consolidation) in this space going ahead.

Humpty Dumpty’s great fall

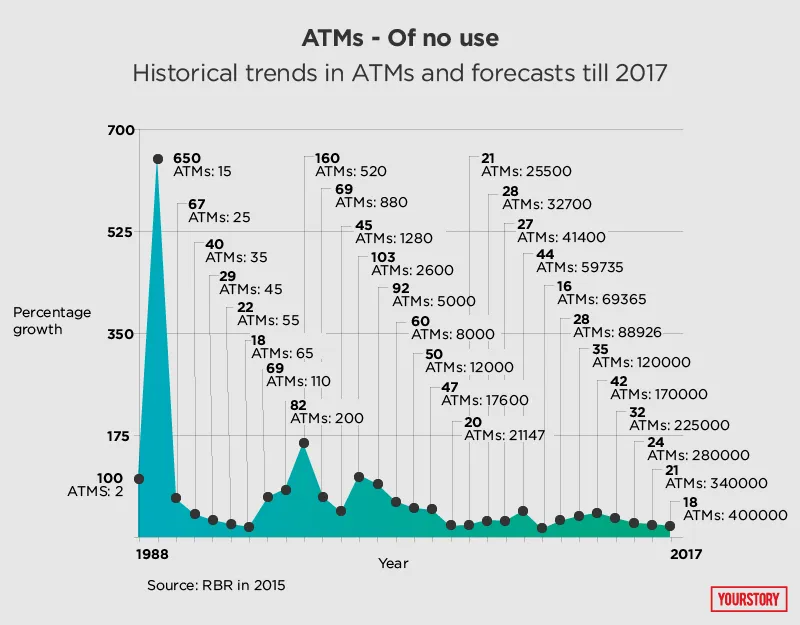

The bet that thousands of ATMs will sprout all over the country based on historical trends has gone completely awry.

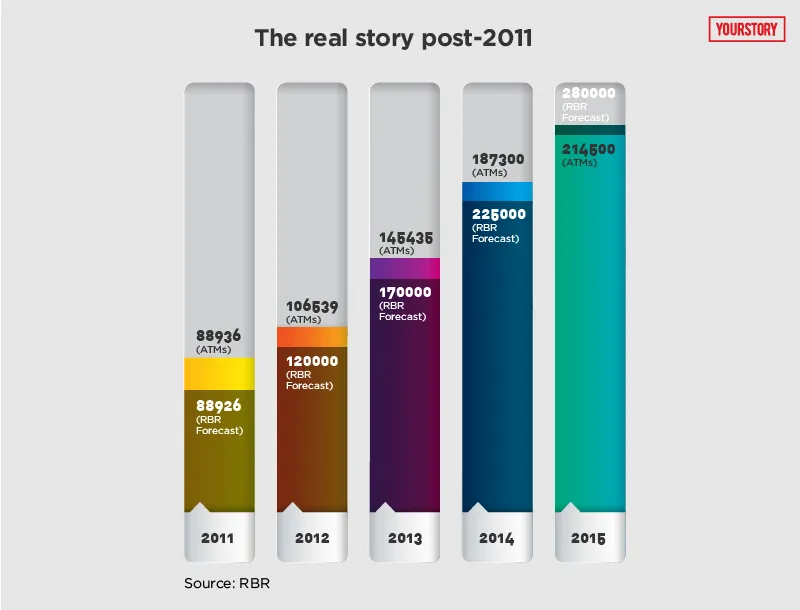

Just how wrong the banks (and ATM manufacturers’) were can be gauged if one looks at the actual deployments since 2011 till 2015 and compare it with RBR’s forecasts, which is based on the feedback it gets from banks and non-bank deployers, also called white-label ATM players by trade.

Fast lane, short life

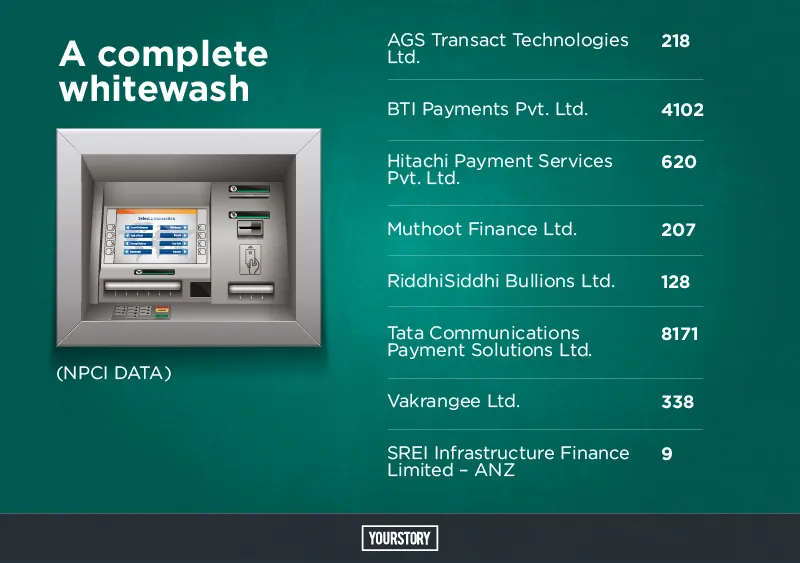

Deployers of WLATMs are seen as the biggest drivers of ATM deployment, but have little to gloat by way of performance. The eight worthies licensed by the Reserve Bank of India — AGS Transact Technologies, BTI Payments, Hitachi Payment Services, Muthoot Finance, RiddhiSiddhi Bullions, Tata Communications Payment Solutions, Vakrangee and SREI Infrastructure Finance — have collectively set up a mere 13,793 ATMs.

The poor show put up by WLATMs is due to both the low inter-change paid per transaction, and the aggressive manner in which they bid when licenses were up for grabs at Mint Road’s window in 2012. The WLATM policy was the first major ATM thrust after the mid-2000s, when non-banks were given the nod to set up ‘brown-label ATMs’ on behalf of banks whose signage appears on kiosks and terminals.

At the heart of the mess is the inter-change fee — at Rs 15 (down from Rs 18). It’s WLATMs only way to earn their bread and butter; their bellies fill up only when more and more plastic is swiped on their networks. For issuers, it’s an expense they have to bear on behalf of customers. It’s a different matter that after three free transactions in a metro (it’s five in the non-metros), the plastic issuer charges you anything between Rs 20 and Rs 30; and to that extent, covers up for the inter-change pay out. What’s important here is that it holds good only for your bank not for WLATMs which do not issue plastic.

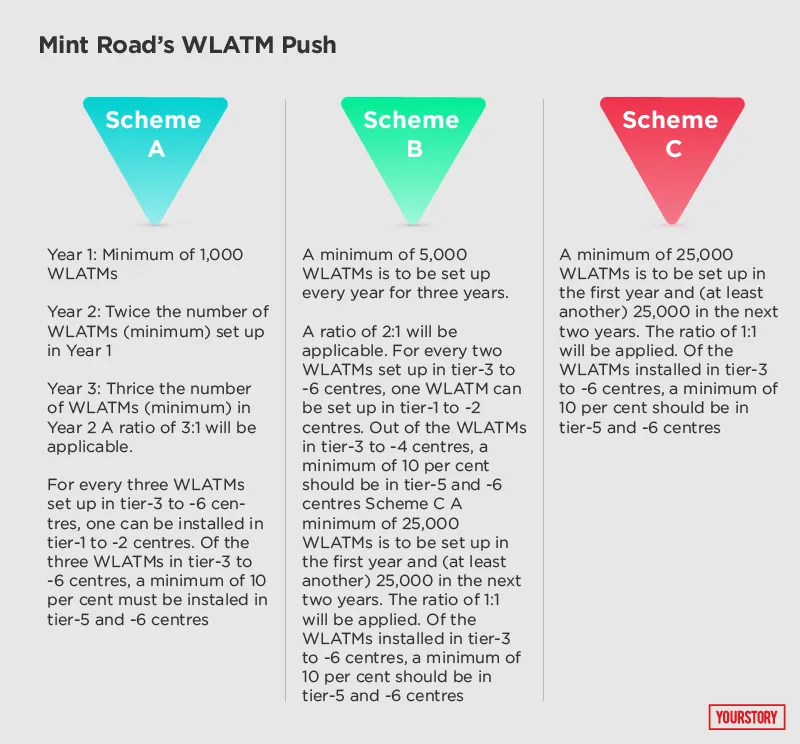

WLATMs have fallen way short of the targets set by Mint Road (See chart: Mint Road’s WLATM Push). In the very first year of operations (based on schemes that operators opted for), at least 1,000-25,000 ATMs were to be added. So if there were five operators, there would have been between 5,000 and 125,000 ATMs deployed in the debut year alone. But only 13,793 ATMs were deployed.

White-label ATM players want the RBI to give them a breather so that they can recalibrate their business models. But so far the banking regulator has not given any indication that they will lend a sympathetic ear.

The bottom line: there’s no money in the till-box, for those in the business that is.