OYO lands in new controversy, says never acquired Zo Rooms

Softbank-backed OYO on Friday (Oct 27) stated that they have called off all discussions around the acquisition of budget hotel room aggregator, Zo Rooms.

In a statement to the media today, OYO stated,

“In late-2015, OYO explored a potential acquisition of Zo Rooms. The non-binding term sheet for this deal already stands terminated in September 2016. Following this, we tried to identify potential value in their business but could not reach an outcome. We can now confirm that OYO has ended all discussions on the matter.”

In February last year, it was rumoured that OYO was in the final stages to acquire rival Zo Rooms. Sources close to Zo Rooms had confirmed the news to YourStory then and said that the deal was expected to close in two weeks.

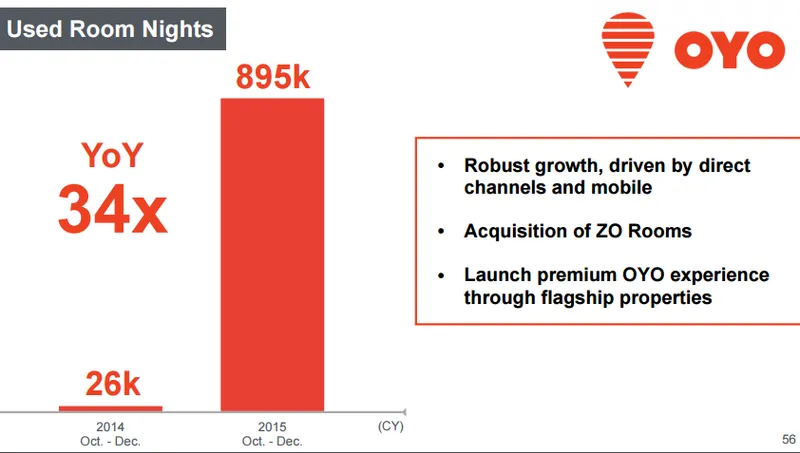

This news of the acquisition first surfaced when Softbank mentioned it in its earnings report (for year ending December 21, 2015), which highlighted a point on ‘Acquisition of ZO Rooms’, attached below:

The deal was expected to be an all-stock deal, according to multiple sources, close to the matter.

According to media reports, ZO Rooms has accused OYO of resiling from the contractual terms. A spokesperson was quoted as saying in Economic Times,

"As a matter of clarification, ZO states that OYO is resiling from the contractual terms after acquiring the entire ZO Rooms business by March 2016. This is not an act in good faith and ZO takes a very serious view of the matter and will take all steps to protect its interests and enforce its rights."

However, there has been no clarification or details given on how ZO Rooms intends to enforce these rights.

Multiple media reports have suggested that ZO was at a disadvantage in its battle with its rich rival OYO, and was losing money. Reportedly, the talks of acquisition had begun in November 2015.

Just last month, OYO had announced raising its Series D funding of $250 million led by SoftBank through SoftBank Vision Fund. Existing investors Lightspeed Ventures, Greenoaks Capital, and Sequoia India had also participated in this round, with Hero Enterprise joining this round as an investor.

With this funding round, OYO’s valuation is pegged to be $850–900 million, which is a significant push from $460 million last August. According to Crunchbase, the company has usurped a total of $450 million in funding till now.

Battling OYO is budget hotel chain Treebo which also raised close to $34 million in Series C funding led by Ward Ferry and Karst Peak. Existing investors SAIF Partners, Bertelsmann India Investments, and Matrix Partners also participated in the round.

With this controversy breaking out now, it is clear that the conclusion to this saga is far from over.