3 key ways in which 1200 developers across the globe generate revenue from their apps

App Annie, the app analytics and app market data platform, recently shared the results and key insights behind how app publishers monetise in the ever-evolving app economy. To that end, App Annie surveyed 1,200 app professionals, from over a dozen industries and across the globe.

Changing landscape of app economy where one size doesn’t fit all

The app economy is booming in every respect. App Annie noted that downloads and consumer spend hit record levels in Q3 2017, with no signs of slowing down. Apps dominate the amount of time people spend on their smartphones while mobile retail continues to skyrocket, which is just one of many signs of how the app economy continues to mature. App Annie noted,

Apps now play an important role in almost every industry, with each taking a different approach to apps.

The app economy continues to become more diverse with publishers from a variety of industries achieving success in many different ways. App Annie stated that this is particularly true for monetisation where there are many approaches available, but one size does not fit all. As the overall landscape becomes increasingly complex and competitive, it is more important than ever that app publishers leverage data and insights to develop their strategies and make decisions.

Here are some of the key highlights from the report titled, App Economy Survey Part 2: Monetisation Insights from App Professionals.

1) Monetisation methods vary across categories and industries

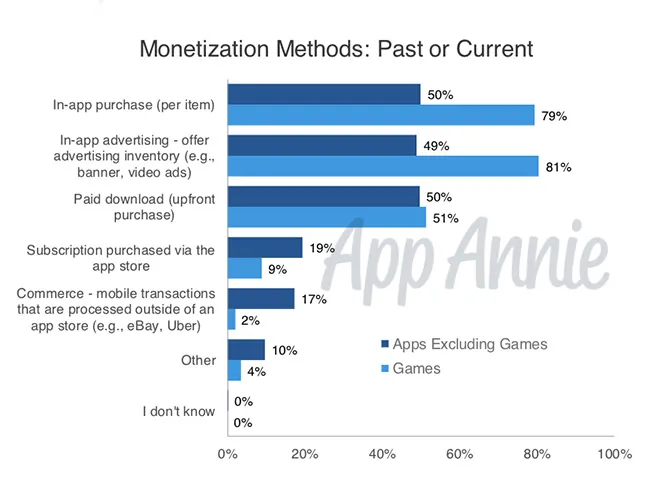

In-app purchases (IAP) and in-app advertising were selected as the two most popular methods of monetisation overall. Each method was selected by 59 percent of respondents. Next up were paid downloads.

But when App Annie drilled down into the differences between gaming and non-gaming companies, they found some stark differences.

Gaming companies were much more inclined to rely on IAP and in-app advertising (to the tune of around 80 percent for each), while subscriptions and commerce models were much more popular among non-gaming publishers.

That said, when App Annie asked companies how they might alter their monetisation strategies, it was clear that change is in the air: subscription and commerce models were projected to become more popular, while upfront paid downloads were expected to become less popular.

2) Video ads aren’t necessarily the be-all and end-all

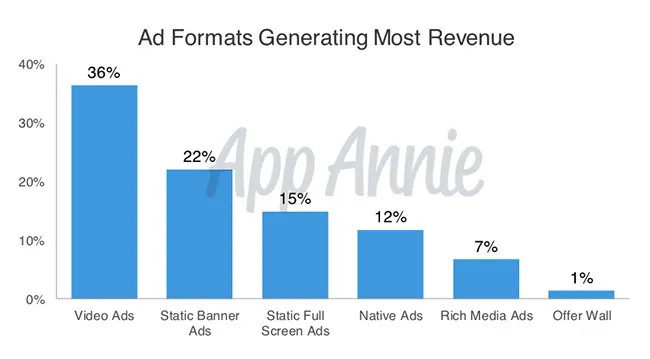

‘Rewarded video’, where mainly gaming apps encourage users to view short ads within their app and then reward them through virtual currency or in-game upgrades, has been a popular and effective revenue model for freemium apps. Indian app developers that YourStory has spoken to commented that rewarded video has taken off since the arrival of Reliance Jio in the Indian market.

App Annie observed that in gaming, 57 percent of respondents indicated that video ads or rewarded video were the top revenue generator among ad formats, while for non-gaming, static banner ads ranked first, with 35 percent of respondents saying that they generated the most revenue.

There’s also the fact that video ads and static fullscreen ads are perceived as being the most likely to negatively impact user experience. So App Annie adds this caveat,

However, given that retention is a key goal for many app marketers, publishers should carefully monitor and test how different ad formats affect user engagement, and for any type of ad that renders an app temporarily unusable while shown, make it clear to users how and when they can dismiss the ad.

These are just a few highlights of what we learned from the app professionals that we surveyed. Read the complete report and you’ll also learn about the variety of freemium techniques that app publishers use, companies’ overall goals for their mobile apps (it’s not just about direct monetisation) and much more.

3) Functionality beats user experience

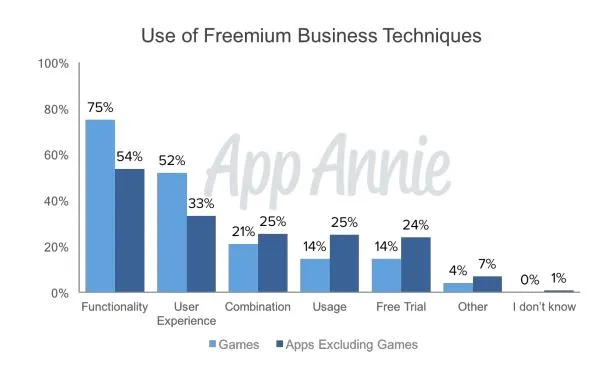

Among the various freemium techniques that publishers can use, 61 percent of respondents indicated that they use functionality, followed by user experience with 40 percent. App Annie though observed that there are significant differences among verticals in which freemium techniques are most popular, especially among gaming and non-gaming companies.

Gaming publishers are more likely to use functionality with 75 percent of respondents selecting that option while only 54 percent of non-gaming companies went for it. In addition, gaming companies are also more likely to utilise the user experience option. On the other hand, usage, free trial and combination models were more commonly selected by non-gaming verticals. In particular, free trials tended to score highly in the Media, Entertainment, and Fitness categories.

Conclusions

To summarise, App Annie shared the following:

1) App publishers need to craft their monetisation strategies to fit their vertical.

2) The functionality freemium technique is popular with games, but is not a good fit with banking, for example.

3) Given that some freemium models still see very low numbers of paying users, publishers seeking to monetise should use other options, including advertising, to generate revenue in addition to in-app purchases (IAP), and many developers already combine IAP with ads.

4) Advertising continues to carry user experience risks, and developers need to consider the formats and frequency of these ads carefully to ensure the right mix of engagement and monetisation.

5) The expansion of subscription models across categories and the lower long-term revenue cuts from Google Play store and Apple’s AppStore should prompt more developers to consider using them.

You can access the full report here.

MobileSparks 2017 is back with a focus on The New Billion - the people, who represent the next wave of mobile adoption and will explore mobile-first solutions. Get the early bird tickets with the code MS17EB, limited tickets left! Click here to book now!