The subscription economy: how to focus your business model on subscribers, not just products

With case studies from startups and large enterprises, this new book charts the rise of the subscription model, and how you can use it to transform your business.

Product and service models of businesses are converging into the subscription model, as documented in the book, Subscribed: Why the Subscription Model Will Be Your Company's Future - and What to Do About It by Tien Tzuo and Gabe Weisert.

Tien Tzuo is the CEO and co-founder of subscription SaaS provider Zuora. He was formerly CMO and Chief Strategy Officer at SalesForce.com. Gabe Weisert is the managing editor of Zuora's Subscribed magazine.

The 15 chapters are spread across 246 pages. Here are my key takeaways from the book. Also, see my reviews of the related books, The Inevitable, The Seven Principles of Complete Co-creation, and Master Growth Hacking.

I. The subscription model

The old linear model of product-channel-customer is being replaced by the circular model of subscriber-experience-service-channel. “Companies that survive over a long period of time follow their customers, and they do not expect customers to follow them,” the authors explain.

Old business models were “product first, customer second” – they were based on mass-based production and marketing of individual units. Success depended on finding magical hits and then pushing them out to customers via channels. Business logic was based on inventory, shelving, and cost-plus pricing, and the focus was on efficiency through standardisation.

Business structure was full of silos, with little coordinated vision. The consumer base was relatively passive, and mass media advertising was a key success factor. In the tech sector, this led to “needlessly complicated products, mercenary sales forces, and a parasitic systems integration industry,” according to the authors. “There is nothing more dangerous than profitable mediocrity,” they caution.

The subscription model turns customers into subscribers for recurring revenue. Digital consumers are much more informed, and are increasingly favouring access over ownership. The business focus is on gathering insights based on usage data, finding out what customers want, and then delivering it as an intuitive service.

Such companies go beyond customer segments to individual customers. Assumptions and persuasion are replaced by accurate insights into actual behaviour. Cash flow becomes less “bumpy” or dependent on make-or-break holiday sales.

Customers should be treated as partners in an ongoing, mutually beneficial relationship, the authors advise. In a good subscription model, it should even be easy for customers to leave when they want, rather than tricking and tripping them up.

II. Companies using the subscription model

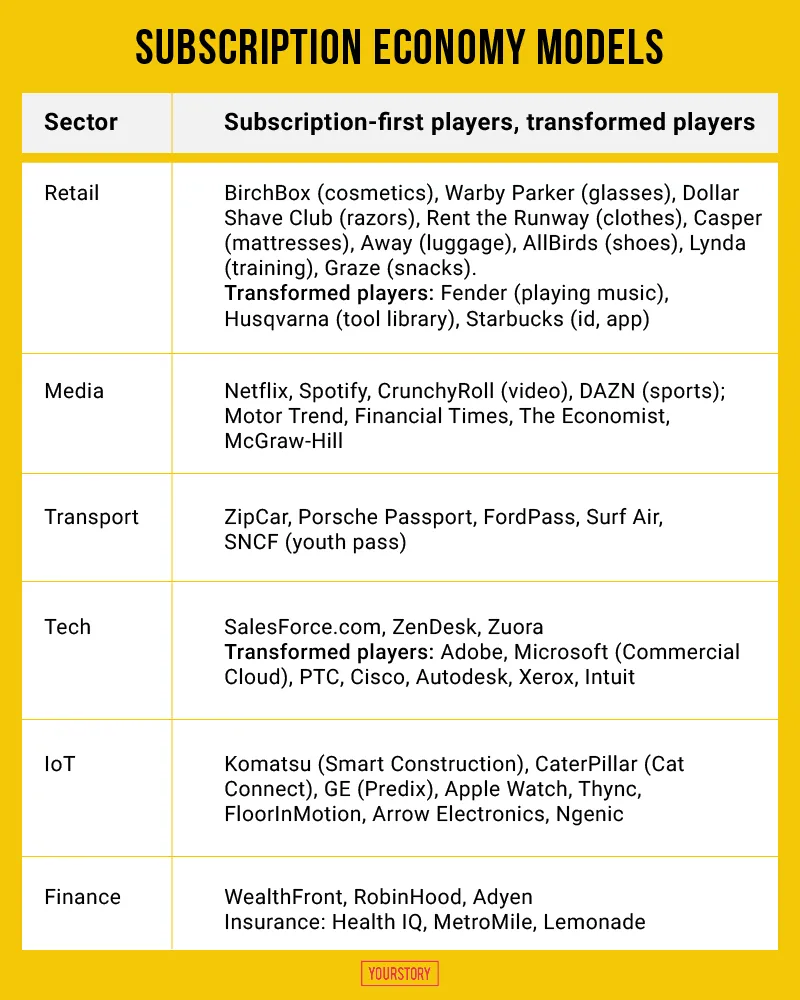

Part II of the book shows how the subscription model is being used across sectors. I have summarised these categories and examples in Table 1 below. Digitally-enabled startups have the advantage of building direct online relationships with their customers from day one, but incumbents are also transforming themselves.

In the retail sector, the battle is not between offline and online, but between product-first and customer-first. It is about starting with the digital experience, then building the physical store. Zombie business models with customer neglect and ignorance are out; omni-channel, experiential and flexible models are in. The new winners are using their physical stores as extensions of customers’ online experience, not the other way round, the authors explain.

For example, Fender observed that 90 percent of its customers quit playing the guitar within a year; it launched the Fender Tune app and Play service to gather data on how customers are using the instrument. The company’s new model is based on helping customers become guitar players and music lovers for life.

Streaming companies like Netflix and Amazon Prime can avoid relying on risky sink-or-swim blockbuster experiments of earlier companies, and take calculated risks on smaller, edgier projects. Success comes from driving down subscriber acquisition costs and increasing lifetime value. Companies like Apple could even offer “Apple as a Service,” with guaranteed phone upgrade and access to content for a monthly subscription fee.

Uber, Lyft, BlaBlaCar and others have transformed the ride business. The automobile industry is fragmented into dealers and repair shops, and automakers are reimagining themselves as providers of “mobility as a service.” The FordPass app helps drivers find parking and schedule service appointments.

In the news industry, reliance on advertisement is on the decline due to reasons like ad blocking software, dominance by Google and Facebook, and distortions by clickbait factories. Instead of shifting from print copies to only page views, a better and more stable model would be subscription. The amount of time spent on a site can be more valuable as a metric than CPMs.

Digital models also allow for flexibility in packaging, bundling and pricing. Common models in the news and tech industry include freemium. The digital medium also opens up the global market for content industries such as language-specific content. If the information and consumption experience is unique and of high-quality, people will be willing to pay for it.

The Financial Times made its site free during the Brexit referendum weekend, and saw a 600 percent surge in weekend subscriptions. Its reader metrics include recency, frequency, and volume of articles read. The New York Times has paid apps for crosswords and cooking, and looks more like a SaaS company than a newspaper, the authors observe.

Cloud and SaaS models are transforming the tech industry, but the big transitional challenge is in absorbing the increased costs of new capabilities and structures as well as dip in revenues and share price from the old product model, until the next high is reached. It is not easy for incumbents to move from annual to monthly (even daily) updates, billing systems for larger volumes of subscribers, and new sales commission structures.

Companies like Adobe were trailblazers, with clear communication of transition objectives and transparent financial reporting. Cisco now sells not just routers but security services and Catalyst hardware with embedded machine learning and analytics.

IoT and “digital twins” open up new possibilities of service-level agreement behind products in the manufacturing sector. “The physical world is starting to ‘wake up,’” the authors explain. Such transformation can even help deliver “dirt removal as a service” instead of selling earthmovers, the authors joke.

Komatsu uses drones and sensors to map out construction projects, and feeds this data into a fleet of semi-autonomous excavators, bulldozers and robots. Caterpillar’s Cat Connect shares equipment data with site managers to help predict servicing and schedule maintenance. French flooring manufacturer Tarkett has an offering called FloorInMotion; its “connected floors” monitor human traffic flow to enable better navigation and energy usage.

The key is to pitch outcomes powered by data insights, and not just products. “Every manufacturing environment on the planet is turning into a data-driven testbed,” the authors explain. AI is “cognitising” what was formerly electrified, and “green intelligence” can also transform the agriculture sector.

IoT lets you rediscover your customers and have better conversations with your business partners, the authors enthuse. “The only true competitive advantage is your relationship with and knowledge of your customers,” they insist. Competitors can’t beat this via reverse-engineering your products, because only you own your customer data.

The subscription model is also emerging in the solar panel industry (SolarCity), healthcare (One Medical, Magellan Health), real estate (WeWork), and even pet care (BarkBox, My Royal Canin). Open data and subscription services can also spur “civic creativity” in government services.

III. Transforming companies into the subscription model

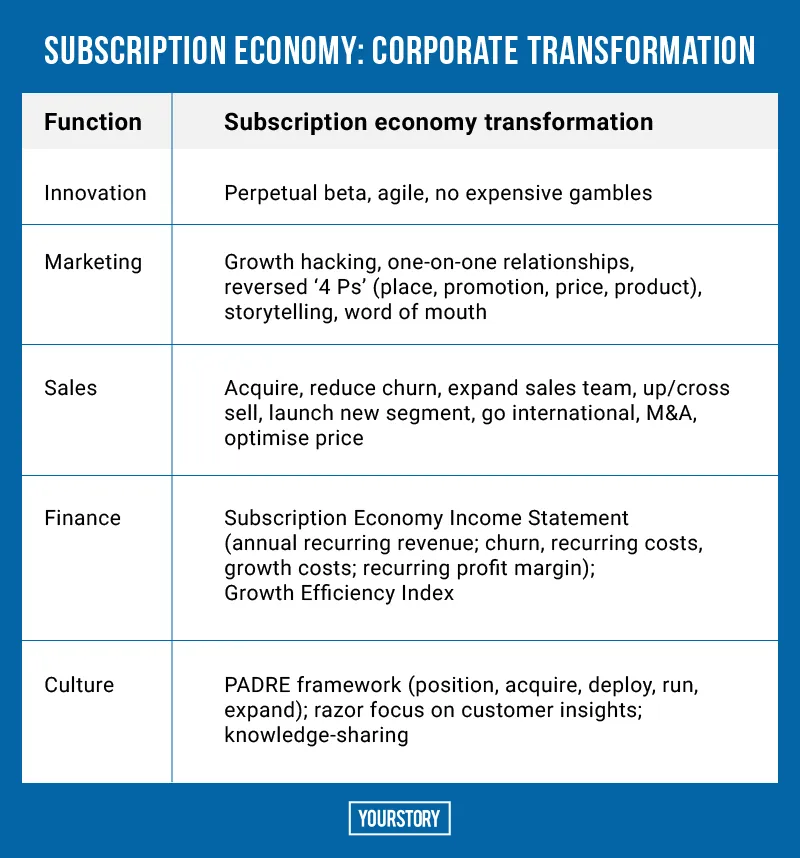

In the subscription economy model, companies have to become cohesive, recurring, responsive, scalable, and relentlessly focused on the customer. However, this transition from the old asset-transfer product model to a long-term and deep customer relationship is not easy, and covers a wide range of functions and activities (see my summary in Table 2 below).

The subscription model creates the “never-ending product,” with customers as innovation partners all the time. Productivity and inspiration are now continuous, and not marked by unhealthy peaks and troughs.

Market research is baked into a subscription service, and gives direct line of sight to the customers. It does not need focus groups, phone surveys or “hoping and praying” for getting a hit product. For example, the “giant brain” of Netflix effectively harnesses user ratings, content properties, geo-location data, viewing times, device choices, and social media feedback.

The subscription model opens up direct data sources that used to be earlier owned by third-party channels. Storytelling for marketing taps this data to come up with context, value and product pitch.

“You can create intuitive subscriber journeys that take customers from good to better to best, with relevant incentives and tipping points along the way,” the authors explain, with respect to choosing tiered pricing models and levels.

Growth is of two types: consumption driven (eg. DropBox storage) and capability driven (eg. higher-level features). Coming up with prices, campaigns and the right narratives in real-time converts the marketing department into a “giant test laboratory,” and sales into an acquire-retain-grow flow. The role of IT is to help set up these test beds for experiments in services and experiences.

DocuSign offers three levels of its electronic signature services – personal, standard and business. Self-service options are for individuals, and guided selling is for enterprise customers.

SalesForce has Customer Success Managers to ensure that customers are getting the best out of their service. New Relic connects directly to developers for its digital intelligence solution. SurveyMonkey pushed into the enterprise market by acquiring a range of companies: Precision Polling (phone polls), Wufoo (building forms), Renzu (app insights), and TechValidate (content generation).

The subscription model calls for agility in the billing cycles and steps as well, as customers continuously upgrade, downgrade, suspend or adjust their services. Giving them so much flexibility meets their needs as well as yields deeper business insights into their behaviour.

The book ends with industry insights from Zuora’s subscription management customers. In the long run, success in the subscription model calls for more cross-functional cooperation and knowledge-sharing. “You want three things out of your subscribers: retention, growth and advocacy,” the authors explain.

“Subscriptions are the only business model that is entirely based on the happiness of your customers,” the authors sign off.