Startups lead the way as kirana stores make digital push to boost margins

Paytm, SHOPX, Udaan, SnapBizz, Connect India, and Mobisy Technologies are among startups aggregating data from mom and pop stores. Cracking this market would build not just valuable Unicorns in India, but will enable the margins of the small store to increase.

As marketing gurus, and industry analysts cry themselves hoarse about ‘capturing’ the ‘next 500 million’ customers, startups are quietly targeting yet another demographic. These ‘customers’ have weathered many storms – from the entry of large format stores with their huge discounts, to ecommerce players offering even deeper discounts. And despite being written off many times, they have survived, keeping the economy running thanks to local consumption in Indian cities, towns, and villages.

Meet your neighbourhood kirana stores – they might not epitomise the glamour of the other formats, but are sure on everyone’s radar for the opportunities they offer. Still, net margins at these kirana stores are as low as two percent. And today, as the many local mom and pop stores eye higher margins, they're turning to technology and digitisation to scale their business – an opportunity that both retail giants and startups are not letting up on.

Why startups are after kiranas?

Most industry watchers believe the number of mom and pop stores using technology would not exceed half a million. And startups, they say, have reached just over 50,000 of them.

No surprises then, that this is an opportunity that even retail behemoths like Reliance, Amazon, Flipkart, and Walmart are going after. While Reliance has tapped 7 million such stores, digital payments major Paytm claims it has signed up over 7 million retailers across the country for its retail Point of Sale (PoS) system and customer engagement business.

That's still less than half of the 17 million kirana stores that is today in the country, according to logistics startup Connect India.

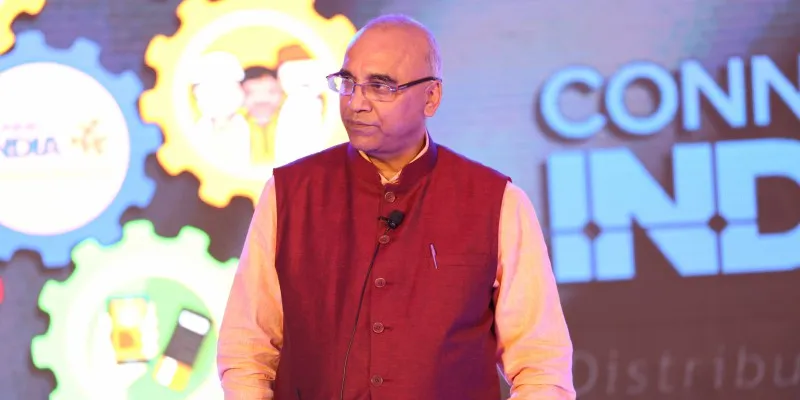

LR Sridhar, Founder, Connect India

“The numbers vary. But the opportunity is to use these mom and pop stores as networks to increase consumption. Today, most startups are just concerned with urban India. The opportunity lies with at least half a billion Indians waiting to use technology - in the form of smartphones - to increase consumption. When they do, these small stores will become the distribution hubs for larger businesses,” says L R Sridhar, founder of Connect India.

Founded in 2014, Connect India works with 6,000 small stores and 4,000 micro entrepreneurs to deliver goods to consumers across 4,000 pincodes in India. “We use small stores to deliver in rural regions, and also use our technology to help consumers book travel tickets and order online,” says Sridhar, who aims to create 35,000 mom and pop store entrepreneurs by the end of FY20.

Another startup SnapBizz, which makes point of sale (PoS) machines and billing solutions, offers an on-demand video platform for small stores about the offers available on various products. This, SnapBizz Founder PremKumar says, can increase margins by pushing up sales.

Most mom and pop store owners are reluctant to use technology, and would do so only when they are sure it will increase customer engagement and sales, PremKumar says.

“The small store owner will work with anyone who (can help) increase his margins. The margins are then part of his savings for the education of his children, their marriage and so on,” adds PremKumar.

SnapBizz offers an on-demand advertising video platform, which displays the offers available on various products. All the kirana store owner needs to invest in is a small TV which will act as the advertising platform.

Also read: In the race for retail market dominance, India’s kirana stores still hold sway

The role of technology

To be clear, mom and pop stores are keen to use technology if it increases their margins. With the large majority of kirana stores yet to fully embrace technology to change their business, startups believe this is a big business opportunity. In fact, several startups are already tapping this opportunity.

Take Lalit Bhise’s Mobisy Technologies for example. Mobisy’s products Distiman and Bizom have worked with over 10,000 kiranas and 300 brands. Mobisy has created a network of its own distributors or stockists, all of which are multi-brand, and a kirana store can get products of various brands from one stockist.

“Consumer goods retail ecosystem has the potential to streamline what is currently a very high-touch, inefficient system. This can mean better results for everyone in the ecosystem, from brands to distributors to retailers,” says Lalit.

The team at Mobisy Technologies tracks order management, distributor management, a retailer app, BI and analytics, field force management, claims management, van sales automation, and channel management.

One of Mobisy’s six stockists in Mysore, Tejas Sequeira, has converted a 1,000-sq ft house into a warehouse and spends his day making calls to kirana stores about their requirements. He then looks up his dashboard to see the orders coming in.

“Mobisy’s technology and their new distribution model are unique,” he says, adding it helps turn around his investments faster, and allows kirana stores to get products on the very same day.

Mobisy tracks order management, distributor management, a retailer app, BI and analytics, field force management, claims management, van sales automation, and channel management. It has worked with over 10,000 retailers and over 300 brands such as Nivea, Unibic and Emami.

Other startups like retail-tech firm Peel Works are also helping retailers adopt the technology they need to ramp up customer engagement.

“Indian shoppers continue to rely on brick-and-mortar stores for their monthly and daily grocery needs. Our retail management platform Taikee helps these retailers grow faster, retain their customers, and improve their profitability. The platform delivers this by helping the retailer right-size his assortment, buy it cheaper, and adopt technology that makes it convenient for shoppers to transact with him,” Sachin Chhabra, Founder and CEO, Peel-Works.

But working with mom and pop stores is not a smooth path to growth for these startups. Chennai-based GoFrugal knows this well and has witnessed three phases of growth before its annual recurring revenue could reach $10 million in 2019. This was thanks mainly to the right bet the company made by moving to the cloud and increase pricing.

Today, GoFrugal has 21,000 small retailers on the platform and 9,000 large customers.

Kumar Vembu of GoFrugal says the mom-and-pop store is here to stay

“The mom and pop store is here to stay. Look at India’s consumption patterns and the way its network is built around the locality. For big retailers to take over it is very difficult, even after two decades of organised retail and money being invested. Organised retailing is less than 10 percent of the total retail market,” says Kumar Vembu, founder of Chennai-based GoFrugal, which has 21,000 small retailers on its platform, as well as 9,000 large customers.

Another startup creating waves in this space is Udaan, India’s fastest unicorn, which is a marketplace for small businesses to buy from. It allows small retailers to buy everything, from fashion products to computers, and brings traders, wholesalers, retailers and manufacturers onto a single platform. Udaan wants its users to leverage the power of technology to scale their business.

Other startups like Smerkato, Peel Works, and Shop Kirana are trying to change the way small retailers use technology to connect with consumers and increase their margins

ShopX, which has raised funding from Infosys co-founder Nandan Nilekani, believes that in India, the small store is closer to the customer because of the structure of Indian cities and there is no concept of stacking up on food for a month. Most of the food is consumed fresh, and processed food pack sizes are small, and consumption is at most stacked up for a few days or a week.

Amit Sharma of ShopX says merchant-enabled commerce is the future of India

ShopX is a retail operating system that connects brands, retailers, and consumers. It is currently experimenting with over 55,000 retailers to give them a single view of the data on what sells, and what does not.

“Only one thing matters. They want data to show them the products that make them the most money. Merchant-enabled commerce is the future in India,” says Amit Sharma, co-founder of ShopX.

While the size of the Indian retail industry is well over $600 billion in India, organised retail accounts for just 10 percent of that, according to KPMG and E&Y. This translates to a huge opportunity for startups or anyone that can help improve sales and margins for kirana stores.

Also watch: Arvind Mediratta, CEO of Metro Cash and Carry, in conversation with YourStory's Shradha Sharma