bhive

View Brand PublisherHow BHIVE survived the pandemic with the launch of its fintech investment platform bhive.fund

HNI (High Networth Individuals) form 58 percent of India’s GDP, with close to 30 percent based out of Mumbai and Delhi alone. Today, the top 5 percent of HNIs own 70 percent of India's assets. From residential property to bank deposits and equity investments, they’ve tried their hand at it all, and want to go beyond traditional investments.

They're looking for a competitive platform that allows them to invest in international real estate, commercial real estate, schools, hospitals and the likes. While Ultra-high-net-worth individuals (UHNI) ― people with investable assets of at least $30 million ― are already into this, others in the market don’t have access to institutional-quality investment opportunities.

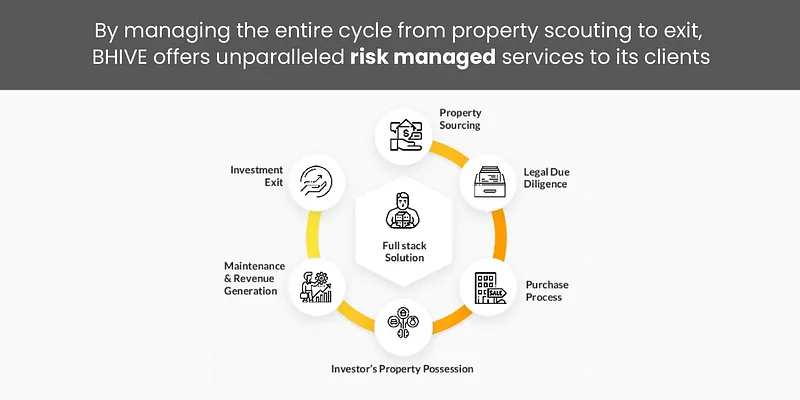

This is where BHIVE's fintech investment platform bhive.fund comes in as a comprehensive platform for all types of investments.

Where the idea for alternative investments stemmed from

In 2020, when uncertainty loomed and COVID-19 wreaked havoc across the globe, like most other coworking spaces, BHIVE pulled through with trust from its landlords, but the pandemic impacted its revenue collections. The coworking startup also had to put all its expansion plans on hold.

This gave the founders enough time to think of an alternative to continuing with their business. After much research, they found out that High Net Worth individuals aren't investing as much in Commercial Real Estate (CRE) and other alternative asset classes which gives much better returns compared to traditional investment options like residential real estate. This led them to launch the investment platform for alternative asset classes like CRE, international real estate, revenue-based financing (RBF) and asset reconstruction.

We are a fintech version of Blackstone. While the majority of our competitors are focusing on Fractional Real Estate, for us it's just one of the asset classes amongst what we offer. Our investors can invest in schools, hospitals, warehouses, data centres, storage facilities, international real estate, etc. When there are downturns like what we’re going through currently, we also have stressed asset as an investment category which opens a whole new avenue of asset class for the Top 5 percent to invest in,” says Shesh Rao Paplikar, Founder, BHIVE.

Bringing the coworking concept to India

The journey of BHIVE Workspace goes back to 2014 when Shesh moved back to India from New York. At the time, he was the CTO of a startup and was looking for a place for his team to operate from. In the process, he ended up setting up a coworking space of sorts himself. He realised that India was still not introduced to the coworking model. Tapping into this opportunity, Shesh started BHIVE Workspace, along with Monnappa Bayavanda and was later joined by Sandeep Gupta in 2020. Each of the founders bring varied experiences to the table.

Prior to BHIVE, Shesh worked in Wall Street, New York and started his first company while still at college. He started BHIVE with personal investment and then raised money through friends and family, before going through a professional funding round.

Monnappa has rich experience in the e-commerce and supply chain consulting domains. He joined BHIVE from Amazon India where he was involved in the launch of Amazon.in. Before that, he spent nearly nine years at supply chain major i2 technologies, consulting clients spread across Europe, Australia and the US.

A CIPM and CFA, Sandeep was the Head of MB Invest at Magicbricks (Fractional Real Estate division). With diverse experience across real estate functions and a corporate career spanning over two decades, Sandeep has worked as Head – Real Estate at Britannia Industries (Wadia Group) as well as in Bombay Burmah, New Chennai Township, Cinépolis and GMR.

Vibrant spaces that are growing by leaps

BHIVE is a full-fledged coworking space that is open 24x7 and is much like a vibrant campus that offers anything and everything a typical office-goer would need. This includes common areas, electricity, WiFi, unlimited tea and coffee, Plug and Play, lounge area, hi-tech meeting rooms, massage chairs and more. Moreover, the space offers competitive and flexible pricing with no admin or capital overheads involved.

BHIVE caters to over 100 clients which include renowned brands like Google, Paytm, Amazon, Vogo, NDTV, among others.

The founders were able to set up two spaces in 2014 which were run out of a villa, the third one in 2015 from a proper space and from then on, expansion was a no-brainer. In 2016, they opened the first large Grade A coworking centre of 30,000 sq feet. With competitors entering the market two years later, they kicked off the landlord franchise model. In 2019, they launched the investor franchise model and also opened the largest coworking space with a 1,000-seater capacity.

From personal funding to HNI funding

A year after they launched BHIVE Workspace, the founders received funding from Blume Ventures twice and other HNIs. Shesh's personal network, goodwill and the business network he developed over the years came in handy while funding. Since the startup was at a nascent stage, they used the funds to invest in branding and marketing, which helped them develop business models to sustain thus far.

"Coworking is a great business model to invest in and we were exploring how we could get HNIs to invest in it. We started with the Profit Share Model and then finally transitioned into RBF when we realised that it was a common concept in the west and was easier for HNIs to understand the revenue flows. Also, the implementation of GST has made revenue tracking more transparent and this gave HNI investors the confidence to invest in this model," says Shesh.

With a team size of 35 members, the BHIVE Workspace is on autopilot mode and all set to launch many more properties, as well as double its revenue by 2022.

Future roadmap for bhive.fund

As far as the bhive.fund is concerned, the founders are planning to launch a Rs 300 crore AIF fund and have started securing commitments towards sponsorships from HNIs.

Shesh says, “We envision bhive.fund to be the go-to place for HNIs to invest. We have already achieved product-market fit and instead of just CRE, we're focusing on alternative assets. Our process is that only if the top 5 percent of HNIs are convinced to take the deal and believe they will get good returns, do we bring it to the platform."

He adds, "We want to build a platform that will have millions of retail investors, who will pool in money and give us the bandwidth to negotiate on their behalf, manage their portfolio and get them great investment deals."