How this insurtech startup is enabling large health cover at lower premium

Delhi-based insurtech startup Vital believes health insurance cover should go beyond hospitalisation charges. The digital platform has come up with an affordable, subscription-based product to deliver a more personalised cover for consumers.

Health insurance can be a tricky product where one may not find the need for it when they are healthy, but its importance is magnified when somebody is hospitalised.

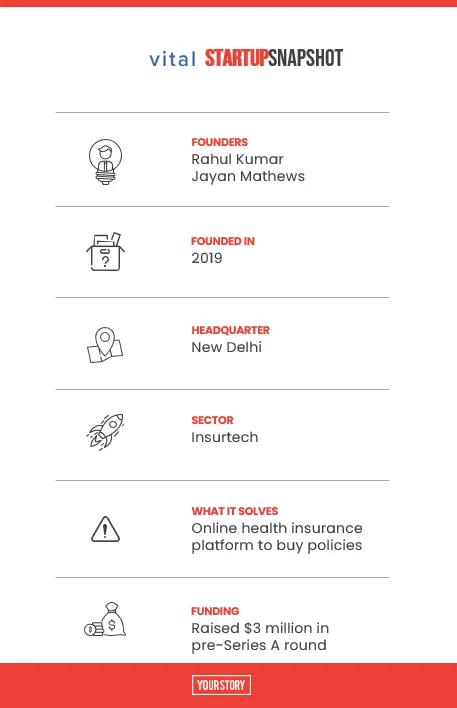

Delhi-based insurtech startup , founded in 2019, wants to bring about a change in how this entire model works, where the end consumer does not see this as an unnecessary expenditure while leading to a healthier lifestyle.

Founders Rahul Kumar and Jayan Mathews saw a few gaps in how the health insurance industry was operating in India and came out with a digital platform to deliver a more personalised cover for the consumers.

Rahul is a serial entrepreneur and has been a founding member of startups such as , , and Expedia, while Jayan is a health insurance industry veteran with more than 16 years experience.

“The biggest challenge of health insurance industry is that it takes a one-size-fits-all approach and this does not work as the needs of each individual is different,” says Jayan.

The problem it solves

According to Jayan, health insurance penetration is still very low in the country and this is due to several factors. Firstly, many consumers do not find the need to purchase a health insurance product when they are healthy. Secondly, most such covers take care of only hospitalisation charges while the majority of expenses come under the outpatient section like doctor’s visit, pharmacy, diagnostics, etc.

Also, the consumer does not see any financial return in paying a premium for the health insurance and it becomes important only when one is hospitalised.

On the other hand, health insurance companies have created policies that are related to specific illnesses which require hospitalisation, and do not cover expenses that are outside the purview of the hospital.

The product

In this scenario, Vital has taken a more holistic approach in providing health insurance to consumers, where the cover is larger in size than what the industry normally offers, while the premium is lower.

“We wanted to figure out how we can come out with a product that is just not a health insurance but more than that. I would like to use the term ‘health cover’, which provides a health plan that includes both critical hospitalisation as well as daily medical needs in a more efficient, cost-effective and valuable way,” says Jayan.

Vital also brings other elements into its product, where it both encourages and incentivises the consumer to adopt a more healthy lifestyle. The goal being that health cover takes into account three areas – hospitalisation, daily care needs, and benefits or services to live healthily.

“We wanted to make the product affordable to the customer and we were the first ones to actually work out a subscription-based health plan,” says Jayan.

Further, Vital has bought in a certain benefit structure in the plan so that the consumer can take the right amount of coverage at a lower cost. “It reduced the cost of premium by up to 60 percent,” says Jayan.

The co-founder of Vital claims that while the average cover offered by regular health insurance companies are in the Rs 3-5 lakh range, in their portfolio it is around Rs 15-20 lakh.

The startup has introduced other features in its product where the health insurance cover also takes care of regular health needs like diagnostics, medical checks, teleconsultation, discounts at pharmacies, etc.

Besides it has also introduced other benefits like nutrition counselling, fitness packs, mental health counselling, etc.

Partner-led approach

“We work with partners to give these benefits to customers and this entire pack is made into one subscription,” says Jayan.

Vital has tied up with numerous players to deliver these services like Care Health Insurance is for the primary product while others like , , , and provide the comprehensive health cover.

Today, Vital claims to be having over 7,000 customers, which is a combination of going directly to them or through the organisations where they are employed.

A digital platform with a mobile-first approach, Vital claims it is able to build personalised profiles of customers given the data it receives.

“We actually want to build a platform which is interactive and give an updated status of customers health and also tell them what they can do to improve their health. When the individual takes measures to become healthier there are rewards on premium and subscriptions,” says Jayan.

Vital raised $3 million in a pre-Series A round of funding in June last year from BLinC Invest, Venture Catalyst, Survam Partners, and angel investors.

The insurance segment has numerous other startups like Digit, Acko, Plum, and Turtlemint, and is a competitive field given the multi-billion dollar market size.

Jayan says, “We stand out in the market where our solution has both insurance and wellness component. We thought Vital should be taking this path where insurance and other benefits are balanced.”

As part of its future plans, Vital wants to tap into the SME segment as it believes it is an underserved market.

“SMEs have to buy health plans for their employees, which are designed for large corporates and it is not beneficial for them. Our platform will allow them to choose the benefits they want and can subscribe to it on a monthly basis,” says Jayan.

Edited by Megha Reddy