[Product Roadmap] How fintech startup Zaggle digitises spending for organisations and rewards employees

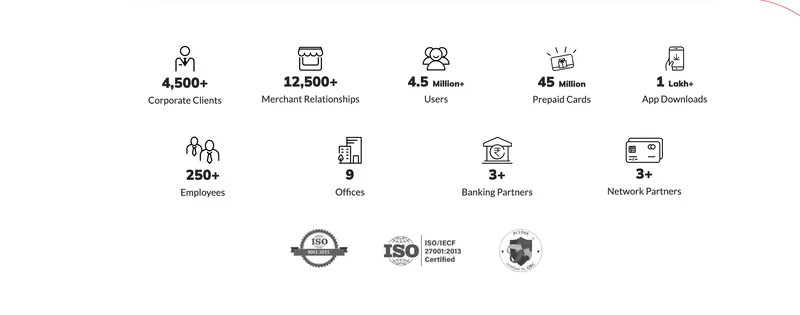

In this week’s Product Roadmap, we feature fintech startup Zaggle, which helps companies achieve scale by winning over and retaining customers.

Software as a Service (SaaS) fintech firm , founded by serial entrepreneur Raj N in 2011, provides expense management systems and employee rewards and recognition programme services to companies.

The Mumbai-based B2B company operates in three verticals — digital payments, cashback, and analytics, and serves startups, SMEs, and corporates.

According to the founder, he started up in the space as he believed there were tremendous opportunities in digitising and automating workflows.

Raj says, Zaggle offers companies a complete solution. “Right from conceptualising and identifying incentives, RnR programmes, and data collection, to rewards calculation, onboarding, disbursement, and fulfilment.”

He explains that earlier, the entire process was non-transparent, there was no user data validation, no visibility with regard to achievement versus targets, leakages, delayed disbursements, etc. This would lead to ineffective programmes being deployed by companies.

“Zaggle’s Propel platform addresses the above issues, and companies see direct benefits on deploying the programmes. Interactions over time with corporate CHROs, CFOs, and business teams saw other adjacencies opening in the employee flexi benefits space and expense,” says Raj.

“We also came up with a few innovative steps for users to have a seamless experience by doing OCR for automating expense creation or deduplication check for expense bills or automating card loading of thousands of employees on each wallet, etc,” says Raj.

The other interesting innovation was on the infrastructure side. The team was able to identify high TPS components and move that to serverless infrastructure, which can scale infinitely, and this has come as a great value add and removed human dependency on scaling some core product flow.

Developing tech infrastructure and growth

Raj explains technology is at the core of everything at Zaggle, and therefore the team has always taken utmost care in building a robust and state-of-the-art technological infrastructure.

“We work very closely with companies across the spectrum and are size and sector agnostic. This is because our systems and platforms are designed in a way that offers usage across organisations. We act as enablers and supporters of digitisation through the use and adoption of adequate technology,” says Raj.

Zaggle’s growth in the past few years is due to a combination of multiple factors. In the last two years, the team has seen over 7X growth in revenue, and its profits have jumped to about 20X. Zaggle has had a phenomenal growth journey, starting from a gross transaction value (GTV) of just Rs 4 crore in 2012, to a GTV of about Rs 15,000 crore per annum at present.

“On one hand, Zaggle has benefitted immensely from demonetisation, GST implementation, and the digitisation wave brought about by COVID-19. On the other hand, its deep understanding of the market, innovative products, deep engineering, and design capability have allowed us to create a state-of-the-art SaaS fintech platform for our customers,” adds Raj.

Building the product

Zaggle product offerings include Zaggle EMS, Zaggle Save, Zaggle Propel, and Zaggle Edge.

The first product built by the company was the Channel Incentivisation and Employee RnR platform. Points would be issued to users by the companies, and the users could redeem these points later with gift vouchers.

Built by its internal tech team, it took around three months to build the prototype — Zaggle Propel. The platform enables channel incentives and employee rewards and recognition. Along with a SaaS-based redemption platform, clients can manage multiple business workflows and uses cases — from computing incentives through a matrix-based configurator to automating the disbursal of incentives.

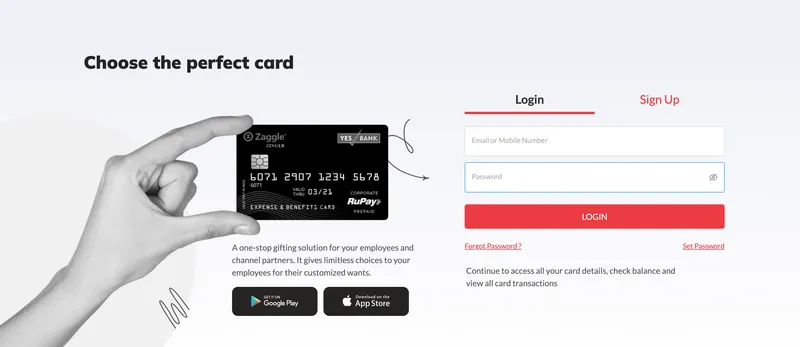

Employees can also use the mobile and web apps to view reward points and redeem for Zaggle Cards as well as vouchers from Amazon, Flipkart, etc. Through mobile and web interfaces, channel partners can also participate in incentive schemes by uploading their invoices and submitting claims. This goes through a fully configurable approval flow and the approved amount is deposited into the Zaggle Card, which can then be used at all Visa/RuPay enabled merchant outlets.

Through the Zaggle Save platform, employee travel and entertainment expenses and flexi-benefit programmes such as meal, fuel, travel etc., are enabled.

The roadmap for products and platforms at Zaggle follows a detailed product management process — starting from requirement consolidation across multiple drivers — markets, customers, competition, innovation, technology, and regulation to name a few and basis this the backlog is groomed.

Zaggle’s matrix-based configurator helps companies set up the KRAs, KPI attributes, qualification criteria, weightages, and special conditions to arrive at a reward score. A customised redemption catalogue is provided for users to redeem across a range of 250+ branded vouchers and Zaggle network cards.

Zaggle Save - Employee Flexi Benefits

For employee tax benefits, Zaggle launched a single multi-wallet card, which covers meals, fuel, travel, telephone, gift, etc., in one card.

The Save platform allows companies to load the cards by themselves and allows them to manage all employee tax benefits and perks on a single interface.

For perks such as gym membership, uniform allowance, work-from-home allowance, etc., employees can submit the bills through the app, and the bills are verified and reimbursements are done into the Zaggle card.

The Zaggle multi wallet card has been very useful for customers across Metros, Tier I, and Tier II cities unlike other closed-loop cards in the market.

According to the founder, Zaggle is a hundred percent tax compliant as each tax benefit component can be used only at the corresponding merchant categories. For example, the meal wallet only works at meal outlets, and the multi-wallet card can be configured with up to 99 wallets. This provides great flexibility in customising solutions for corporates as per their requirements.

The platform issues cards on its rails, and hence is easily integratable with customer platforms. Customers can then set up wallet issuance and loading to their users through their platform.

Zaggle also provides the choice of multiple banks across RuPay/Visa networks to choose from. The KYC process is completely digitised, providing a seamless journey through the Zaggle Mobile app to the user.

“The product underwent continuous enhancements and upgrades and was used for five years. It has been well accepted and used by our customers,” says Raj.

Building the product further

“With our experience and interaction with various business groups, we realised that businesses face a lot of problems in managing their financial requirements and expense management. We figured out that payments and accounting in conventional ways is a bit broken, inefficient, and sluggish,” explains Raj.

Some of the challenges faced by businesses include complex and tedious workflow, using cash for payments, no real-time control or visibility over business spends, manual accounting, and risk of fraud and duplication.

Raj says, the team spent months understanding and researching these pain points and wanted to come up with an innovative financial revolution. They directed all their efforts and worked towards building the products and services that could solve the financial needs of the businesses.

“We landed up by completely reinventing the business financial flow and expense management. Our major focus has been committed to assisting corporates in creating a productive and efficient organisation,” says Raj.

Understanding the base architecture

When the team launched the product, they started building basic features in the organisational layer, then started configuring clients in the configuration layer on top of it, and then integrated with third-party tools like HRMS, ERP, etc.

“In the integration layer for user and data on-boarding for efficiency and informed decision making, we are using the implementation layer for client-specific requirements and customisation. Automating workflows helps onboard the user through existing HRMS tools without any manual interventions from the admin. Customers integrate to Zaggle workflows and enable Zaggle offerings to their users,” explains Raj.

He adds that during the pandemic, it was just not possible to print cards, pin mailers, courier physical cards to customers, and so on. Fortunately, Zaggle had just moved a majority of its channel incentivisation and employee RnR programmes to virtual cards, and Zaggle could not just sustain its business but actually grow during the pandemic.

Future roadmap

“Today, we manage employee spending and sales/marketing spending through our Save and Propel product offerings. By getting onto business spend management, Zaggle would be the single source of truth for all things expense in the business that we serve,” says Raj.

One example is Zoyer, an integrated financial platform for business spends started in February 2022. The team has completed the business architecture and the UJs for five key personas who would be using the platform.

The March sprint has commenced on I2P (Invoice to Pay) and Supplier Management (SM), and the first release covering these two areas of the S2P (Source to Pay) value chain would be launched along with corporate credit cards as Beta in Q1 of our oncoming fiscal.

The wireframes, partnership, and technology stack are running in parallel as well. Zoyer would be designed as a data-driven platform with an emphasis on the Why (Diagnostic) and What (Descriptive) of the spending that is happening.

“We are simplifying the app experience for the millions of users that we have today and we expect to scale in the coming year. The user experience, personalisation, and intuitive design is the focus here and would be highly impactful to increase engagement and our users’ wallet share through our platform,” says Raj.

Edited by Megha Reddy

![[Product Roadmap] How fintech startup Zaggle digitises spending for organisations and rewards employees](https://images.yourstory.com/cs/2/0911f29093a911ec98ee9fbd8fa414a8/ImageTaggingPooja16-1651031406290.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[Product Roadmap] How this wellness startup is bringing AI, sensor technology to your yoga mat](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/imagepr-1649845251544.jpeg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Product Roadmap] With user feedback loop and data insights, how Apna reached 20 million job interviews per month in two years](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/ApnaProductRoadmap-1650365129978.jpeg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Product Roadmap] How Lokal went from a WhatsApp group to a top hyperlocal content and social media app](https://images.yourstory.com/cs/2/a09f22505c6411ea9c48a10bad99c62f/Imagepow4-1646762167239.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)