[YS Exclusive] Travis Kalanick’s cloud kitchen business makes a silent exit from India

The Uber co-founder’s KitchenPlus failed to build a lucrative premium business despite critical demand for cloud kitchens in the country. It shuttered operations in December, abruptly laying off its entire staff over a video call.

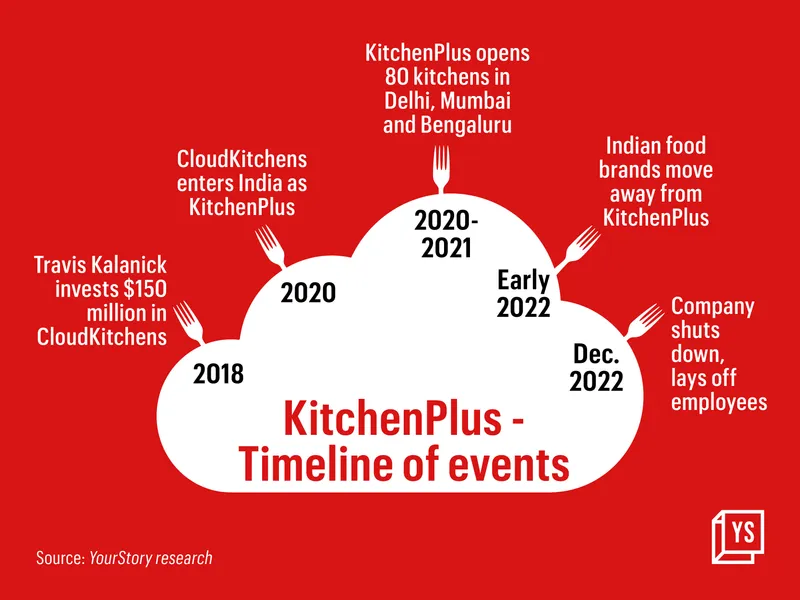

Travis Kalanick’s second startup following his ouster from , CloudKitchens, has shut its India business after failing to generate sustainable revenue over a period of three years, according to three people familiar with the development.

Los Angeles-based CloudKitchens shut its India operations, branded KitchenPlus and positioned as a premium service, in the final week of December, laying off the entire staff of about 40 members, said two of these people, both former employees.

KitchenPlus provided kitchen infrastructure and services to both physical and online-only restaurants, including marquee brands Theobroma, Mamagoto, Burgerama, Fat Lulu’s, and Smoor.

“The management informed us over a video call in December and terminated our employment contracts effective immediately,” one of the former employees said.

A phone number listed on KitchenPlus’s website was not operational. KitchenPlus and CloudKitchens did not respond to YourStory’s emailed queries. Rahul Wadhwani, the former India head of KitchenPlus, declined to comment on the development.

Kalanick invested $150 million in CloudKitchens in 2018 shortly after he was forced out from Uber, aiming to build a WeWork for kitchens. He bought properties, including abandoned garages and empty rooms, around the globe and leased out refurbished spaces with kitchen equipment and infrastructure to restaurants, largely to cater to their online food-delivery orders.

CloudKitchens entered India in early 2020, at a time when foodtech unicorns and had already ventured into the segment. But Southeast Asia as a market worked differently–it made better sense to lease, rather than buy, properties given the exorbitant prices.

KitchenPlus had established about 80 cloud kitchens, also known as dark or ghost kitchens, across three cities over the years it was operational in India.

City Storage Systems, which runs CloudKitchens globally, has raised close to $1.25 billion so far from prominent investors including and .

The company is said to have suffered several senior-level exits globally over the last two years owing to a toxic work culture, according to a Financial Times report, reminiscent of the allegations Kalanick faced at Uber.

Tough business

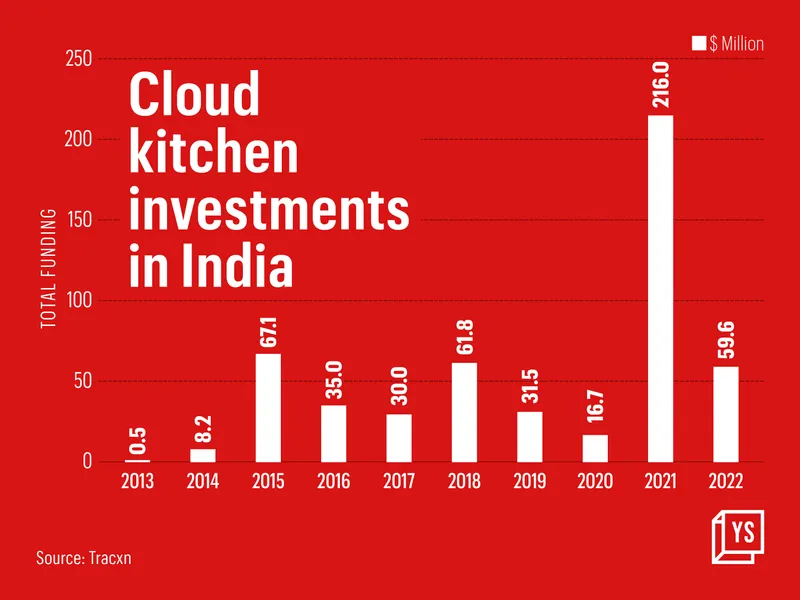

Over the years, with real estate prices booming, several food brands in India are opting for the cloud-kitchen route to be able to expand quickly with lower operating costs. Investors saw value, leading them to pour in more than $500 million into the industry over the last 10 years, per Tracxn data.

KitchenPlus, through its six centres in Delhi-NCR, Mumbai and Bengaluru, offered fully furnished kitchen infrastructure to more than 20 food brands. Right from a gas connection to electronic tablets to track orders, the properties aimed to provide restaurateurs a premium experience without having to spend extra bucks on purchasing real estate.

But premium comes at a cost.

Rentals plus the cost of utilities such as electricity and water supply were 50-70% higher than the industry average, according to two restaurant partners who had engaged with KitchenPlus.

“Rent for a small kitchen sized 250 sq.ft. would cost as much as Rs 50,000 per month. Depending on the city, it could go up to Rs 1.5 lakh per month,” one of the restaurateurs said.

For several restaurant logging average order values of Rs 250-300, the economics proved hard to pull off. Many brands chose to move away from KitchenPlus within a month or two of partnering with the business citing pricey deals, according to the restaurateur quoted above.

For KitchenPlus, just a few vacant kitchen slots were enough to eat into its margins, making the business unsustainable.

More than 30 of KitchenPlus’s 80 kitchens have been taken over by Delhi-based commercial shared-kitchen firm Speed Kitchen, Founder Paurav Rastogi confirmed. The company has nearly 120 kitchens across cities, including Mumbai, Bengaluru, Delhi, Pune, and Jaipur.

The remaining 50 kitchens are also up for grabs, with some potential buyers in advanced talks to purchase the properties.

A sector in crisis

The infra-as-a-service model is capex-heavy and unaffordable for food brands in India in the long term, said Ashwani Basantani, Founder of Cloud Kitchen Exchange, a Delhi-based kitchens-as-a-service platform.

“Irrespective of the quality of infrastructure, the heavy overhead cost does not leave any margins for the food brand. In the case of KitchenPlus, brands realised and started to look for cheaper alternatives,” Basantani said. “KitchenPlus’s model is better suited to more developed geographies such as the US, where average order values are six times higher than in India.”

KitchenPlus is hardly the first kitchen infrastructure company to struggle to build a lucrative business.

Top competitor Kitchens Centre has run into a cash crunch situation in the last two months, resulting in non-payment of dues including rent and share of revenues to restaurant partners, according to two people familiar with the development.

The company, which is backed by venture capital firm Village Global, was in talks with -backed Kitchens@ for a merger in March last year, but the deal fell through subsequently, one of the two people said.

Email queries sent to Kitchens Centre Founder Lakshay Jain bounced. Jain could not be reached over LinkedIn as well.

Prosus-backed , too, is divesting its cloud-kitchen business, Swiggy Access, according to a report in The Economic Times. Zomato has scaled down its kitchen infrastructure over the past few years.

Cloud Kitchen Exchange’s Basantani, however, remains hopeful for the sector.

“KitchenPlus’s failure is not indicative of degrowth in the cloud kitchens industry, which is still growing by leaps and bounds,” he said.

“As of last year, only 9% of (internet users in) India were ordering food online, compared to China where it is multiple times this number. That opportunity alone makes the cloud kitchen industry a lucrative one in the long run.”

(Infographics and featured image by Chetan Singh)

Edited by Feroze Jamal

![[YS Exclusive] Travis Kalanick’s cloud kitchen business makes a silent exit from India](https://images.yourstory.com/cs/2/f3638ff0dcc111ec93bca187955479ef/Cloudkitchencopy-1676439526255.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)