Konnichiwa from Japan: HR firm Mynavi is building an ecosystem in India with strategic investments

Hidekazu Ito, Managing Director of Mynavi Solutions India, discusses the Japanese parent company’s strategy to address critical HR and education challenges in India, including cultural differences and skills gaps, and its ambitious targets for the country.

About six years ago, when —one of Japan’s largest human resources (HR) firms—set its sights on India, it planned to bring its well-established job portal to the world’s most populous country.

But it quickly became clear to the company that the work cultures in India and Japan were poles apart, and the demands of the Indian market were starkly different from what the Japanese market wanted.

Mynavi is a leading HR firm based in Tokyo, specialising in recruitment and talent solutions. It connects job seekers with employers through job matching, career counselling, and recruitment support. It also offers HR consulting, outplacement services, and technology solutions, leveraging its extensive network and deep expertise in the Japanese job market.

As it studied the Indian market, the Japanese firm soon realised that a simple ‘expansion’ strategy—all on its own—would not work.

If it had to seize the opportunity in the HR and education space in India, it had to bridge the cultural gaps and meet the needs of the local market. Recognising the need for a distinct approach, Mynavi got down to business with strategic investments and acquisitions to get a foothold into the local market.

However, it is work-in-progress as the company tackles the challenges of upskilling and demand-supply disparity.

“Indian people need to upskill to meet job market demands. There is also a huge mismatch due to the population and demand-supply imbalance, which we aim to resolve,” Hidekazu Ito, Managing Director of Mynavi Solutions India Pvt Ltd, tells YourStory, in an exclusive interaction.

“It is almost impossible for one company to resolve India’s critical issues. That’s why I am building a strong ecosystem under Mynavi India Group to address the challenges in India,” he adds.

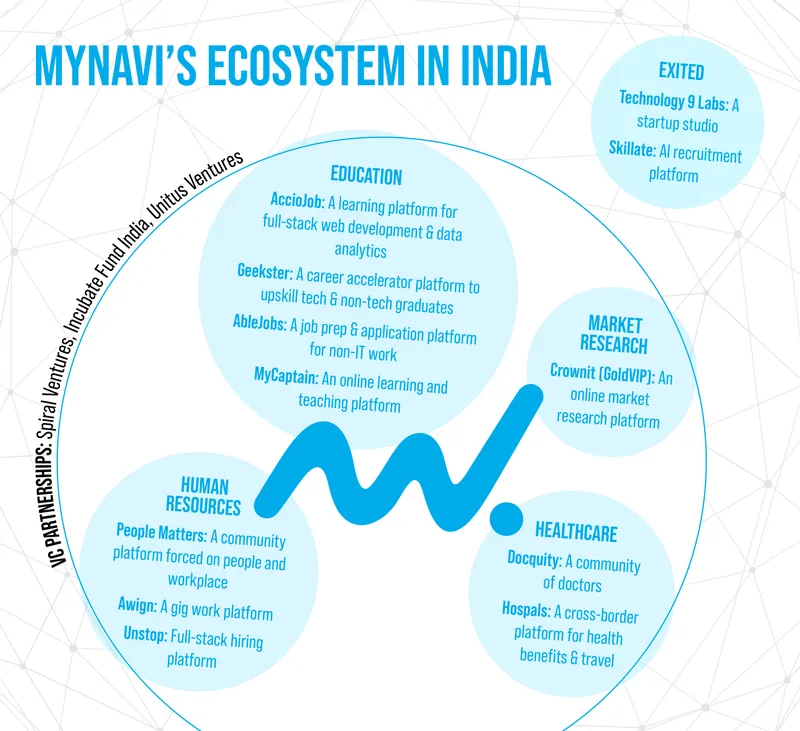

This ecosystem that Mynavi is building includes partnerships and subsidiary companies in the HR and education sectors.

Ito believes that India is more familiar with the work cultures of the United States, United Kingdom, and some European countries, compared to the work cultures of the Asian markets, particularly Japan.

India’s work culture is a blend of local practices and Western influences, primarily shaped by the country’s historical ties with Britain. Many urban businesses in India have adopted Western corporate practices. The same is true with the education system in India, particularly at the higher level, which mirrors Western models, especially the British approach.

On the other hand, the Japanese work culture prioritises group harmony, teamwork and consensus, unlike the West’s focus on individual achievement. Hierarchy and values such as silence and modesty are in contrast to the Western emphasis on self-promotion.

Given the differences in work cultures, Ito understands that Manavi has to work with local founders and management so that it can integrate its system and culture slowly into the local environment and not impose itself on the Indian ethos.

Challenges in HR and education

Comparing the Japanese and Indian job markets, Ito notes that Japan faces a high demand for labour due to its declining population, while India has a large, young labour force.

Despite its educated workforce, Japan’s demographic challenges are leading to a labour shortage across sectors, including healthcare, elderly care, manufacturing, construction, agriculture, and hospitality.

On the other hand, while there is surplus unskilled labour in India, there is a shortage of skilled workers, especially in technology and services. The quality and skill-sets of many workers do not align with the specific needs of industries.

From an education standpoint, Ito notes that Japan invests heavily in high-quality education, through both private and public schools, and substantial support comes from the government. On the contrary, due to its large population, even with government investment, the education system in India will take time to improve, he points out.

While India boasts a vast and diverse talent pool, many companies struggle to attract the right candidates with the right kind of skill-sets and education. Through its portfolio in India, Mynavi seeks to address the challenges in talent acquisition and skill development.

In India, Mynavi does not offer its own products directly to consumers; its offerings are through the companies it has acquired. Through these affiliate firms, Mynavi offers recruitment solutions, including job matching and career counselling. It also provides skilling programmes, workshops, and resources to help individuals and organisations close the skill gap.

Infographic design: Nihar Apte; Source: Mynavi India

Strategic investments

With over 50 years of experience, the Japanese firm established its Indian subsidiary in 2018 as part of a strategic global expansion plan.

Mynavi’s approach in India involves focusing on investments in promising startups and companies rather than building services from scratch. This strategy leverages the knowledge of the local market and cultural nuances, local expertise, and the established networks of these companies. By investing in existing HR and education platforms, Mynavi taps into the existing user base, course offerings, and technology.

This enables rapid adaptation and scalability, says Ito.

In the HR space, the company is looking beyond the white-collar space, where players like Naukri and foundit dominate, and is eyeing the segment of gig workers.

On the education front, Mynavi offers higher education and upskilling courses, as they are more closely aligned with job readiness. Ito states that the company plans to expand further in the upskilling education segment in the near future and is open to collaborating with the government and large enterprises to address the skills gap in the country.

In India, Mynavi holds minority investments in some companies and has entered into venture capital partnerships with a few. It has also fully acquired two companies and exited successfully from two.The Japanese corporation’s investments in India include learning and skilling platforms AccioJob, Geekster, AbleJobs and MyCaptain.

While Mynavi hasn’t acquired any large company, it has bought or funded small and medium-sized businesses, including startups at Series A, Series B, and Series C stages.

“We start with minority investments and then work to support the company for one or two years. If I feel a strong sense of sympathy, solidarity, and connection, then I propose an acquisition,” Ito remarks.

This is what happened with People Matters, a community platform focused on people and the workplace, and Awign, a platform for jobs in gig work, where it first made minority investments and then acquired them after a few years.

What is Ito’s assessment of Indian entrepreneurs with whom he has been working for over six years?

Indian founders often lack a concrete vision and tend to rely heavily on Plan A, which can be problematic when faced with challenges like funding, he remarks.

“In Japanese culture, we do extensive research, create concrete plans, and then take action.”

However, Indian entrepreneurs make up for their lack of planning and vision with their optimism, he says, adding that this speeds up their decision-making, unlike their Japanese counterparts who weigh in on multiple options, thus slowing down the decision-making process.

Steady and structured approach

Under Ito’s stewardship, Mynavi is gradually integrating its system and culture into People Matters and Awign, working closely with the founders and ensuring a smooth transition.

Last month, People Matters announced a leadership transition following its acquisition by Mynavi. Pushkaraj Bidwai, a founding member and the former chief business officer of People Matters, was appointed as the new chief executive officer and a member of the board of directors.

“The management members are smart, kind, and understanding. They have embraced and accepted what we need to do because we are not imposing Japanese styles or systems,” Ito remarks.

Mynavi’s approach brings a thoughtful, well-researched method to the company’s operations, says Bidwai, adding, “It is a balanced approach: we retain our agility and responsiveness, but now with the strategic foresight and rigour that Mynavi is known for in Japan.”

Mynavi believes its affiliate companies should be run by local people, while it infuses capital, systems, and mindsets into the ventures.

“On the ground, day-to-day management is handled by the existing promoters and Indian team members. We acquire strong teams and great companies, then support and empower them to build successful businesses,” he highlights.

Ito, who is responsible for investments, M&A, and expansion negotiations, believes his role goes beyond these aspects.

“I’m getting great people, strong teams, and motivated promoters to make a huge impact in the Indian market,” he says.

When it comes to unearthing information on startups for potential acquisitions, Ito conducts his own diligent research, without appointing investment banks. He also relies on VC partners and his connections with former VC members, which he has built over the years.

Apart from India, Mynavi also operates in Vietnam, Singapore, the Philippines, Indonesia, Taiwan, and Thailand. Ito notes that the Indian market is much more advanced compared to the other Asian markets and is Mynavi’s biggest focus for business expansion.

In addition to Asia, the corporation is also present in the United States and Europe.

Looking ahead

The corporation’s group-level global revenue for the financial year ending September 2023 was 186.2 billion yen (about $1.2 billion). According to Ito, 80-90% of this revenue comes from the HR segment.

Ito has both short-term and long-term targets for India: he is aiming for a revenue of $100 million in the next three years and $500 million over five to ten years.

As it looks to expand its India portfolio, Mynavi is actively scouting the market to acquire a couple of companies in the near future—in line with its goal to strengthen the local ecosystem.

Edited by Swetha Kannan