How can cloud accounting add to your small business’s bottom line?

Cloud accounting can be a wise investment, if you want your small business to work faster and smarter.

John owns a retail shop in Houston. One day, he started his laptop to post sales entries and he was taken aback. He couldn’t open any program and there were casino advertisements flashing all over the screen. It was clear that his system was infected by a virus and it was not detected by his anti-virus software. John had no other options but to format his system. Yes, all his data was lost just like that.

Sounds familiar? We feel that our system or home is the best place to store our important financial data. But this is just a fallacy. Most often we don’t take necessary measures to protect our data. And this is when a cloud comes into the picture.

What exactly is cloud accounting?

In simple words, cloud accounting is a way to access accounting software via the internet anytime and from anywhere, without actually installing it on your computer or server. Data is stored in the cloud – on a remote server, provided by third-party providers. The most common example of the cloud is internet banking. Whenever you’re logging into your account, making a payment or updating something, you’re using the cloud technology.

According to Intuit’s e-book, “The Appification of Small Business”, by 2020, 78% of SMBs will rely on cloud technology.

In a nutshell, cloud accounting is a convenient, secure and efficient solution and is ideal for small businesses.

Here are some of the benefits of cloud accounting for small businesses.

1. With cloud accounting, data entry is a cakewalk

In this age of technology, when all data is readily available in your banking system, why would you need to enter all the entries manually into the accounting software or poring over physical invoices, receipts? This is nothing but a waste of time and money.

Cloud accounting flips this tedious process on its head. It lets you automatically bring the transactions of your bank account into your accounting software, with no upload or download chore. Time consumed in data entry is drastically reduced. Cloud also eradicates the possibility of errors from manual data entry and speeds up the whole process.

When it comes to efficiency, cloud accounting has shown tremendous improvement in business processes, which are traditionally time-consuming. In a survey of US small businesses, 71% respondents agreed that they operate at least one-quarter of their operation on the cloud.

undefined

2. Cloud accounting offers mobility, flexibility and a better lifestyle

Enterprise mobility and flexibility are not just add-ons, but a must-have. These features are important for business growth, only if businesses have access to their files or data outside the office.

Cloud accounting allows SMBs to be more flexible – both in and outside the workplace. With the prevalence of web-enabled devices such as tablets, smartphones, laptops, and notebooks, employees are no longer tied to their office.

Cloud has made it possible for SMBs to harness the computing power which was earlier available to big companies only. Since most cloud providers offer multiple access across different platforms and mobile devices, it is easier for SMB owners to manage their business.

3. There is an improved collaboration on cloud

Collaborating accounting has been around for years, as various accounting transactions involve several parties. So, it makes sense to have a system which provides balances and checks in any process. One of the reasons this concept is getting popularity in the recent times is the proliferation of cloud accounting, making collaboration easier than ever.

With the cloud, businesses can connect with advisors and employees working with them to make sure that reconciliations are done, set up correctly and get all the reports needed. All these are done without sharing paper, without emails or without exchanging data back and forth.

4. Cloud accounting is more secure and reliable

Your data and files are only as safe as the weakest link in your security system and it’s wise to assume that the hacker will find that link. If you are concerned about your website, be cautious of giving administrative access to employees. If you are concerned about your computers, don’t leave doors unlocked. If you are concerned about your accounting, don’t leave it in office.

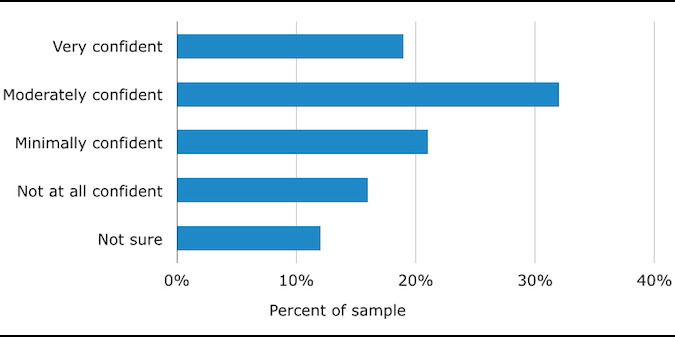

According to an online survey conducted by Software Advice, 51% respondents expressed moderate to high level of confidence in the security of cloud accounting.

undefined

Cloud is one of the safest options for your business to store your accounting data if you take necessary measures. Cloud-based accounting software, such as QuickBooks hosting, uses encryption to send and store data. Moreover, cloud providers will provide you with multiple backups, in different locations. Thus, your data is stored and saved with little or no effort from your side.

5. Automatic updates and real-time financial reporting

Budget is a key constraint for small businesses when upgrading to a new system. If there’s one thing accountants know about – it’s budget. And they know how to make one, save one and stretch one. As With cloud accounting, you SMBs don’t need big initial investments since there are no installation costs. Once the software is in the cloud, the system is automatically upgraded without additional cost.

Of course, the need for servers and hardware is greatly reduced. You can choose from different packages offered by cloud providers that suit your prevailing level of income and enjoy the benefits of in-house servers without incurring the cost.

Thus, a revolution in accounting sector has taken place: traditional accounting software has died a natural death and cloud has emerged as its rightful alternative. Accounting on the cloud is the unrivaled option for small businesses to stay on top.