Limited Liability Partnership: The Amalgam Structure

Complete Guide on the concept of LLP

Limited Liability Partnership (LLP) is a newly established business format in India. This business format includes features of both a Partnership Firm and Company. Thus, the Limited Liability Partnership (LLP) is a partnership with the element of limited liability. Further, a Limited Liability Partnership (LLP) is regulated by the Limited Liability Partnership Act, 2008.

The model of Limited Liability Partnership is also considered as a hybrid or alternative corporate vehicle, as it unites the advantages of both a Partnership firm and Company. Moreover, this business model gets the best of both the business model. It is possible because the Limited Liability Partnership (LLP) grants flexibility regarding organizing internal management to its members like a partnership firm. A partnership firm is based on the concept of mutual understanding. Further, a Limited Liability Partnership (LLP) limits the liability of its members to the extent of their interest in the firm. Feature of limited liability is equivalent to the concept of a separate legal entity of a Company.

An organization that is closely-held by a few people or a joint family business can choose for the option of registration for Limited Liability Partnership in India.

Registration of a Limited Liability Partnership

In the year 2008, the concept of Limited Liability Partnership (LLP) got its recognition as a business format. Further, Limited Liability Partnership (LLP) as a business structure is opted by the micro, small and medium-sized business holders and professional service providers. An organization that is closely-held by a few people or a joint family business can choose for the option of registration for Limited Liability Partnership in India.

Registration of an LLP is the proper course of Incorporation of a Limited Liability Partnership as a form of business format. The designated partners of an LLP are required to submit some mandatory documents and details to the Ministry of Corporate Affairs (MCA) to acquire the Certificate of Incorporation.

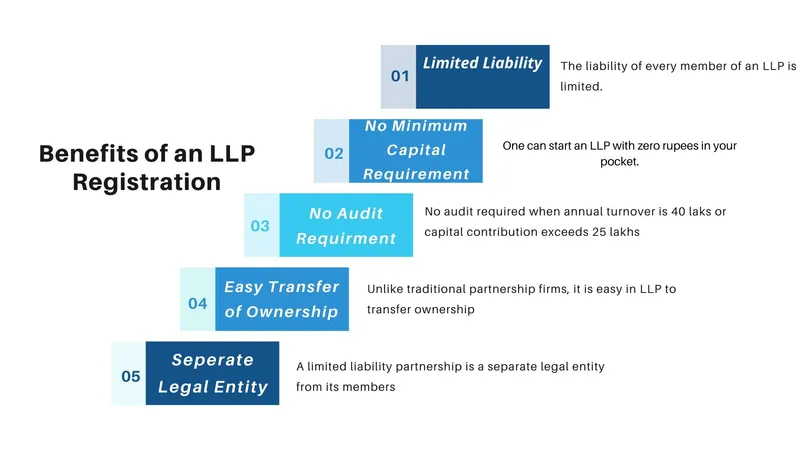

Benefits of an Limited Liability Partnership Registration

It is clear from the name itself that Limited Liability Partnership endows with the advantage of limited liability to its members. Besides this, there are several other advantages of Limited Liability Partnership (LLP) Registration which are as follows:

- Limited Liability - The expression “limited liability” means that the liability of the entire members in an LLP is limited. Further, this implies that if in case the company incurs any losses, then the personal assets of the partners will not be confiscated. Furthermore, they will not require paying for those losses. Hence, every partner is safeguarded from the consequences arising as a result of any wrong decision.

- No Minimum Capital Requirement - No minimum capital is required to start an LLP. Even an LLP can be started with zero rupees also.

- No audit Requirement – Normally, there is no need for an LLP to get the audit of its accounts. But, the requirement for getting an account audit arises in two conditions. Firstly, when the business annual turnover super passes the limit of rupees forty lakhs. Secondly, when the capital contribution of the business exceeds rupees twenty-five lakhs.

- Easy Transfer of Ownership - In a Limited Liability Partnership, It is easy to transfer the company’s ownership to others. Unlike, the traditional partnership format, where the addition of new partners affects the firm’s existence, but, in an LLP, things are purely reverse.

- Separate Legal Entity - An LLP is a separate legal entity distinct from its members. It means the addition of a new partner or exit of any existing member will not dissolve LLP’s existence. Apart from this, the firm assets are not owned by the partners.

Requirements for LLP Registration

- Minimum two Designated Partners – LLP needs a minimum of two designated partners, but no upper limit has been provided by the LLP Act, 2008 for the maximum number of Designated Partners.

- One Indian Partner – Out of all the Designated Partners, there should be at least one as an Indian Resident.

- Designated Partner Identification Number – DPIN (Designated Partner Identification Number) is mandatorily needed for all the designated partners.

- Digital Signature Certificates– DSC (Digital Signature Certificates) is compulsorily needed for all the designated partners.

- LLP's Registered Office – Partners of an LLP can choose any place or space to be its registered office, whether such a place is a residential or a commercial location. Further, partners of the LLP are required to file an address proof of the place opted for the Registered Office.

Documents Required for the Registration of an LLP

The following are the set of necessary documents for an LLP Registration –

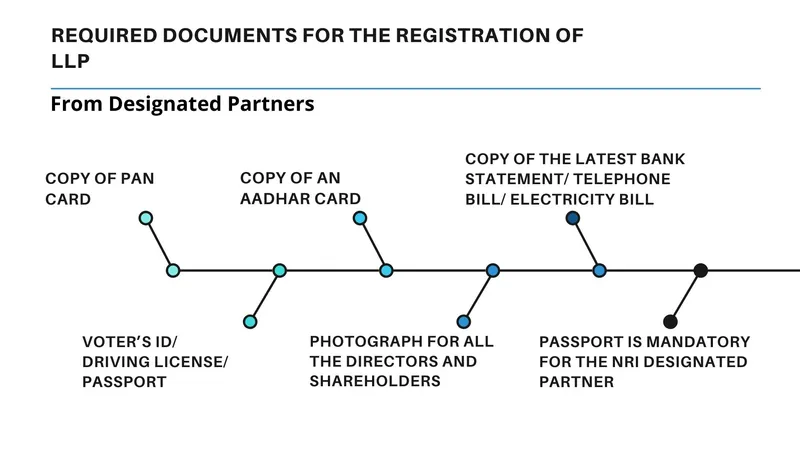

- From Designated Partners

- Copy of PAN Card

- Copy of an Aadhar Card

- Copy of the latest Bank Statement/ Telephone Bill/ Electricity Bill. Further, all the bills should be in the name of the Proposed Designated Partner.

- All the Partners are required to submit their Voter’s ID/ Driving License/ Passport.

- Passport-sized photograph for all the directors and shareholders.

- Passport is mandatory for the NRI designated partner.

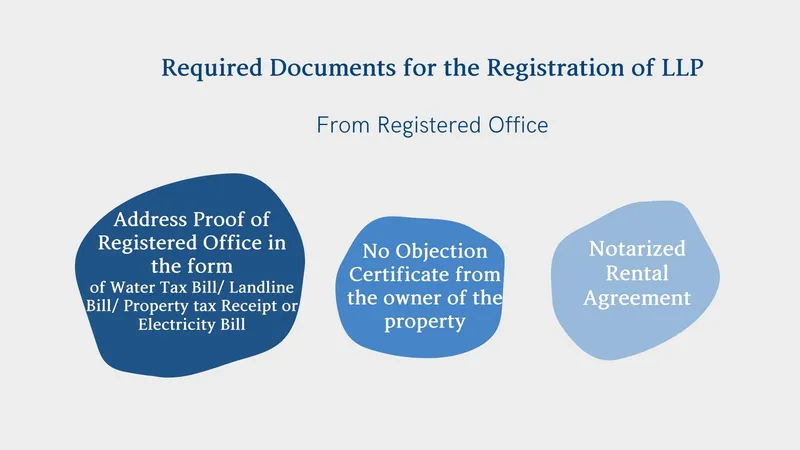

- From Registered Office

- Address Proof of Registered Office in the form of Water Tax Bill/ Landline Bill/ Property tax Receipt or Electricity Bill.

- No Objection Certificate from the owner of the property.

- Notarized Rental Agreement in case the space chosen for the registered office is on rent.

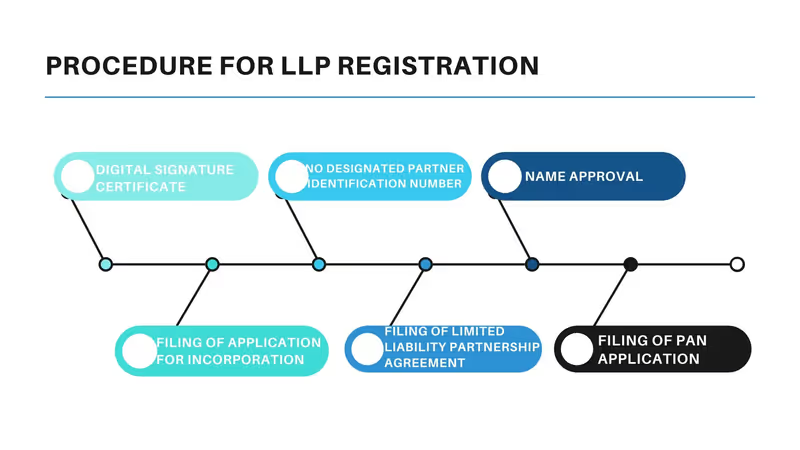

Procedure for an LLP Registration

- Digital Signature Certificate (DSC): - Procedure for LLP Registration initiates with the application to acquire a DSC (Digital Signature Certificate) for all the Proposed Designated Partners.

- No Designated Partner Identification Number (DPIN): - The requirement for obtaining DPIN by all the designated partners has been removed by way of the Limited Liability Partnership (2nd AMENDMENT) RULES, 2018. Currently, the DPIN is directly allotted along with the successful Registration of an LLP by Ministry of Corporate Affairs (MCA).

- Name Approval: - All the partners are required to file an online form for name approval to the Registrar of Company (ROC) through LLP RUN (Reserve Unique Name) service available on MCA Portal.

- Filing of Application for Incorporation: - The application can be filed through an E-form together with submitting the fees charged for an LLP Registration as declared on the Portal of MCA (Ministry of Corporate Affairs).

- Filing of LLP Agreement: - The next step is to file duly Notarized LLP Agreement according to Form-3 on the website of Ministry of Corporate Affairs (MCA). The Agreement is required to be submitted within thirty days from the completion of Limited Liability Partnership Registration together with the receipt of registration certificate from the MCA (Ministry of Corporate Affairs).

- Filing of PAN Application: - After, the completion of the LLP Registration process, partners are required to apply for PAN (Permanent Account Number) of the newly incorporated Limited Liability Partnership (LLP) together with all the particulars and required information.

Compliances to be followed after the Registration of an LLP

- Post- Incorporation Compliances

- Filing of Limited Liability Partnership (LLP) Agreement.

- Apply for LLP’s GSTIN and PAN

- Opening of a Bank Account for the registered LLP to commence the financial transaction.

- Annual Compliance Post Incorporation

After the conclusion of the Registration process, the partners are needed to conform to the LLP’s Annual Compliance Requirements. These requirements are obligatory to meet irrespective of the fact, whether they have initiated their business activities or not. Further, if the number of transactions after the Limited Liability Partnership registration is zero, then the concerned Limited Liability Partnership will file a NIL return.

- Statement of Account and Solvency - Partners are needed to file a statement of Account and Solvency in the Form-8. The concerned return is necessary to be submitted every year by October 30. Further, the report is needed to be certified either by the Practicing Charted Accountant, Company Secretary or the Cost Accountant.

- Annual Return: - Partners are required to file an Annual Return in the Form-11 to the Registrar of Company (ROC). Further, the due date for filing the said return is May 30 every year, i.e. within sixty days from the end of the financial year.

- Income Tax Return: - Another mandatory requirement is to file the Income Tax Return (ITR). After the completion of LLP registration, the partners are needed to file Income Tax Return every year by the September 30. Lastly, the return of the Limited Liability Partnership (LLP) is to be submitted in the prescribed format of ITR 5.

Closure of the Limited Liability Partnership

The LLP Act, 2008 also prescribes specific essential procedures for the closure of Limited Liability Partnership. Further, any Limited Liability Partnership (LLP) can shut down its business by implementing or adhering any of the following two ways:

- Declaring the Limited Liability Partnership as Defunct, or

- Winding up of an LLP

Declaring the LLP as Defunct

In case the Limited liability Partnership (LLP) desires to shut down its business or its business affairs, then the partners of the LLP needs to make an application the concerned Registrar of Company (ROC). This application is made to Registrar of Company (ROC) for declaring the LLP as defunct and also to eliminate LLP’s name from the concerned LLP register.

Further, filing of an E-form 24 with the Registrar of Companies (ROC) is mandatory for striking off the LLP’s name. In the same manner, the registrar is also authorized to strike off any defunct LLP, but only after being duly satisfied and has a real reason behind. Although in such cases, the ROC has to send a notice to the concerned Limited Liability Partnership (LLP). The notice sent much contains registrar’s intent along with a request to LLP to submit their representations within one month from the date of receipt of the notice.

Further, the Registrar of Companies (ROC) shall also publish such notice or the application made by the LLP on its website for one month. The main reason behind the publishing is to provide information to the general public. If in case the registrar does not receive any representation from the side of LLP, then the ROC may strike off LLP’s name from the concerned register.

Winding up of the LLP

The process of winding up means, wherein all the business assets are disposed off to meet the outstanding business liabilities. In case, any surplus remaining after disposing off the liabilities, the same will be distributed among the partners.

Further, there are two ways provided in the LLP Act, 2008 for the winding up of an LLP

- Voluntary Winding Up

- Compulsory Winding Up

Voluntary Winding Up

In this method, the partners of an LLP themselves choose to wound up the LLP’s operations.

Compulsory Winding Up

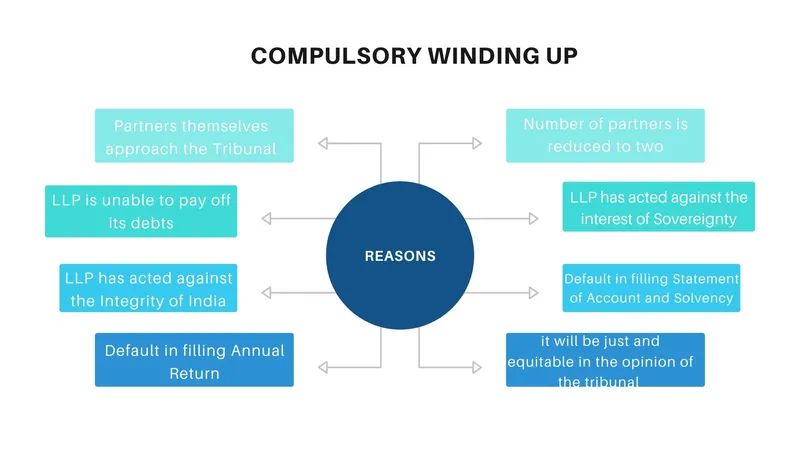

Compulsory Winding Up means when the Tribunal wounds up the LLP-

- If the partners choose to approach tribunal for winding up the LLP.

- If in case the number of partners is reduced to two for more than six months.

- If in case the LLP is unable to pay off its debts and liabilities.

- If the Limited Liability Partnership (LLP) has acted against the interest of the sovereignty and integrity of India, further, it has also acted against the public order or the security of the state.

- If the LLP has made a default in filling the required Statement of Account and Solvency or the Annual Return to the Registrar of Company, such default has been made for any of the five consecutive financial years.

- If the Tribunal is of the opinion that it will be just and equitable if the LLP is wound up.

Procedure for Winding Up

- Firstly, to file a Form-24 with the Registrar of Company along with the declaration from all the partners.

- Partners are required to submit an indemnity bond and an affidavit declaring that all the information is true to their knowledge. Such an indemnity bond and affidavit are to be filed with the main application.

- After approximately twenty working days, the ROC will publish the notice on its website, including the details of the application. Such publication will be for one month.

- After, the completion of one month, the Registrar of the Company (ROC) will strike off the LLP’s name from the register and will also publish a notice regarding the same in the Official Gazette. Such notice will declare that the concerned LLP is being dissolved,