The Merge: Indian exchanges prepare for the most significant upgrade in Ethereum’s history

With a vast potential to transform the future of ETH as an asset, the Ethereum Merge event is being carefully watched by all stakeholders in crypto, especially exchanges—which are the primary gateway into crypto assets like ETH.

The Merge is coming!

On September 15, 2022, the Ethereum blockchain will transition from a Proof of Work (PoW) system to a Proof-of-Stake (PoS) network. (Read more about PoW and PoS here.)

In other words, mining nodes (which validate the format of new transactions) won’t have to compete for block rewards on Ethereum. Instead, node operators will need to stake 32 Ether (ETH) to become network validators and earn rewards.

The Ethereum Foundation believes that after the successful completion of the Merge, Ethereum's carbon footprint will be reduced by over 99%.

The move is also expected to make the Ethereum blockchain faster, more scalable, and much more energy efficient, and pave the way for scalability upgrades.

Since it has vast potential to transform the future of ETH as an asset, developments prior to and during the Merge are being carefully watched by all stakeholders in crypto, especially exchanges which are the primary gateway into crypto assets like ETH.

A green future for Ethereum?

In India, the larger exchanges remain largely bullish about the future prices of ETH as well as the adoption of greener Ethereum infrastructure in building a decentralised web.

“Ethereum today has the highest adoption among developers and DeFi projects—it is the primary infrastructure layer of Web3. But for greater adoption of blockchain among enterprises, energy consumption needs to be drastically reduced as businesses are striving for carbon neutrality. This is precisely what the Merge will achieve,” says Ashish Singhal, Co-founder and CEO, , in a conversation with The Decrypting Story.

Rajagopal Menon, Vice President, is also looking forward to carbon emission reduction following the Merge.

He says, “The transition to PoS brings down a lot of arguments about Ethereum, DeFi, and NFTs “killing the planet”. As a byproduct, it also makes Ethereum ESG-compliant, which can be good for more regulatory-driven institutions that may want to start exploring the Ethereum ecosystem. This will also make Ethereum more friendly to gamers and NFT artists concerned about the environmental impact of crypto.”

ETH and ERC-20 token trading

In a statement, CoinSwitch said that investments, trades or holdings of ETH won’t be impacted, and users may continue to buy and sell on CoinSwitch as usual.

“In the event of a hard fork, where a new token is introduced, the forked token will undergo the same rigorous review process as any other coin listed on CoinSwitch. We will share more details if and when that happens,” the exchange said.

is another leading Indian exchange whose operations “will continue as normal”, with no impact on ETH and ERC-20 (the technical standard for fungible tokens) token trading.

“Post the hard fork event, users will get a 1:1 distribution of the ETH PoW if that chain continues and the token exists. Investors will have an option to buy the other ETH if CoinDCX decides to list it. In the hard fork case event, staked ETH will continue to remain staked and the listing of the forked token for trading will go through CoinDCX's 7M listing process—a standard compliance practice followed by the company for any new listing,” says Minal Thukral, EVP, Growth and Strategy, CoinDCX.

WazirX has paused deposits and withdrawals for ETH and ERC-20 tokens as a precautionary measure till the Merge is complete. “Once our systems reflect the same [the competition of the Merge], we will resume the process normally,” says Rajagopal.

Other exchanges, including , and , are also suspending ETH and ERC-20 token deposits and withdrawals till the event is complete, but will keep spot trading running.

The Merge is also expected to help “crypto payments make sense again”, according to Ethereum co-founder Vitalik Buterin, who believes transaction costs will reduce in the longer term after the event.

The Ethereum Foundation believes gas fees on Ethereum will not immediately reduce post-Merge.

"Gas fees are a product of network demand, relative to the capacity of the network. The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput,” the foundation said earlier.

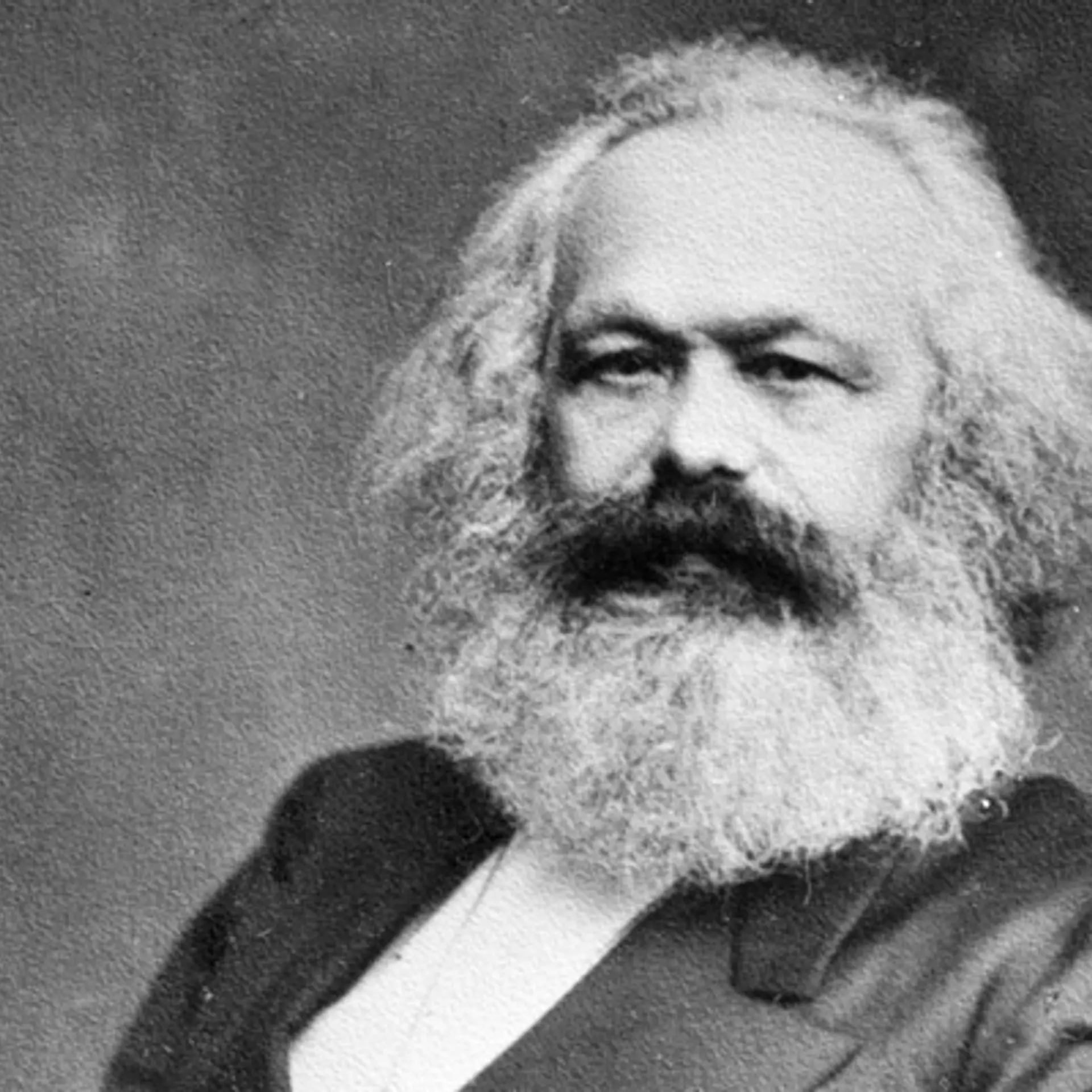

Ethereum Co-Founder Vitalik Buterin

Impact on ETH price

While the transition from PoW to PoS has large-scale implications on the efficiency of Ethereum adoption and scaling, the Merge is also likely to impact Ether (ETH) token prices and its attractiveness as an asset. Importantly, ETH also becomes a more deflationary asset than it was pre-Merge.

It may not be possible to predict market movements of ETH prices to an accurate degree, but the rising total value staked on the Ethereum PoS chain could paint a positive picture for ETH prices.

As per a Chainalysis report, users have already staked over $30 billion worth of ETH on its new PoS chain, making it the largest PoS chain by value even before officially merging with the primary Ethereum chain.

Further, since early 2021, the number of wallets staking over $1 million or more worth of ETH has been rising steadily.

Source: Chainalysis

Impact on Layer-2s

Source: Polygon

The Merge’s impact is not just limited to crypto exchanges—which stand to benefit from Ethereum’s low carbon emissions. Layer-2 (L2) solutions built on Ethereum—which leverage the primary chain’s infrastructure and security—are also set to potentially become more energy efficient.

Polygon, Optimism, Arbitrum, Loopring, and Boba Network are a few examples of L2s built on Ethereum.

In fact, Polygon claimed the Merge event will cancel out a whopping 99.91% of its network’s carbon emissions.

In a recent blog, the firm said its annual carbon emissions through July 2022 stood at 60,953.26 tonnes of carbon dioxide equivalent (tCO2e), while its post-Merge emissions are estimated to be around 6.09 tCO2e over a similar period in the future.

The environmental benefits of a PoS system could set the stage for mainstream adoption of Web3 via L2s, and yield a competitive advantage over L1s.

Polygon added in its blog post that its reduced, post-Merge carbon footprint is a “fraction of its closest competitors”, and that “it will make the chain one of the greenest in Web3.”

Edited by Kanishk Singh